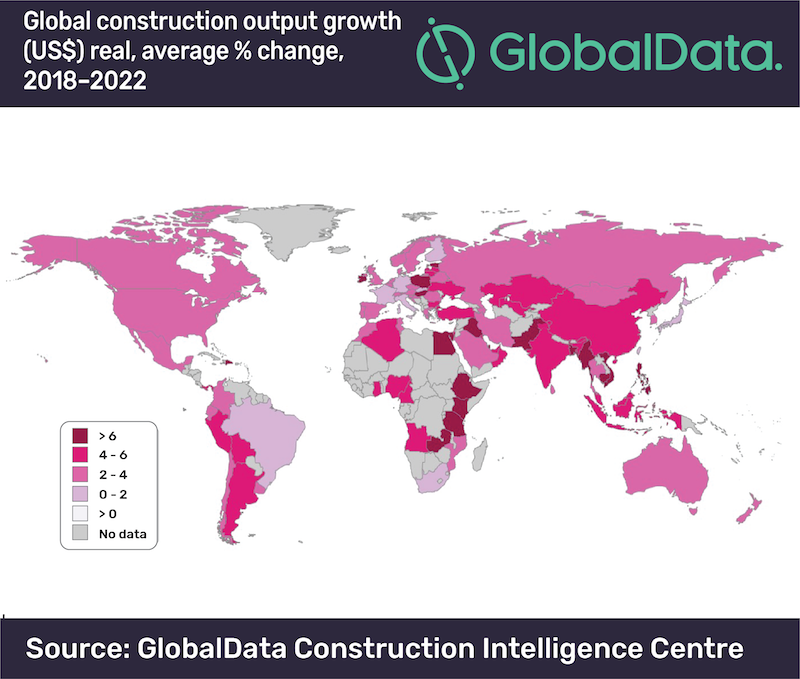

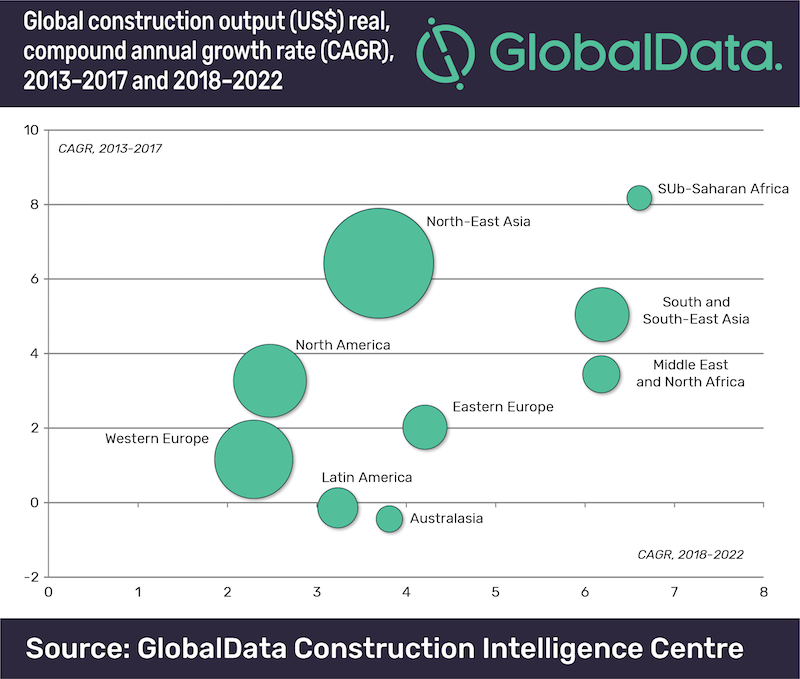

The global construction industry is expected to grow by an average of 3.6% a year over the forecast period 2018 to 2022, according to GlobalData, a data and analytics company.

The company’s latest report, ‘Global Construction Outlook to 2022: Q3 2018 Update’ reveals that in real value terms*, global construction output is forecast to rise to $12.9 trillion by 2022, up from $10.8 trillion in 2017.

Danny Richards, Construction Lead Analyist at GlobalData, says, ‘‘We forecast that global construction output growth will accelerate to +3.6% in 2018, up from 3.1% in 2017, reflecting the recovery in the US as well as general improvements across emerging markets. In South and South-East Asia, for example, construction in India has regained growth momentum, while the pick-up in oil prices has supported the recovery in the Middle East and Africa.’’

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020, before easing back in the latter part of the forecast period, reflecting trends in some of the largest markets.

The Asia-Pacific region will continue to account for the largest share of the global construction industry, however the pace of growth will slow given the projected slowdown in China’s construction industry to an average of +4.2% between 2018 and 2022, offset by an acceleration in construction growth in India.

Construction activity is gathering momentum across Western Europe with the region’s output set to expand by 2.4% a year on average from 2018 to 2022. However, expansion in the UK is subject to major downside risks in the face of uncertainty over Brexit.

The Middle East and Africa region as a whole will be the fastest with an annual average growth of 6.4% from 2018 to 2022. Countries in the Gulf Cooperation Council (GCC) have suffered from the weakness in oil prices in recent years, greatly reducing government revenues. As oil prices pick up, however, large-scale investment in infrastructure projects - mostly related to transport - will be a key driving force behind the construction growth in the region.

Richards says, “Whilst there are intensifying downside risks for global construction related to global economic growth, notably stemming from the erupting trade war between the US and China, the global economy will continue to expand in the range of 2.5% to 3% a year from 2018 to 2022 which will support continued construction growth in key markets.’’

* ‘real value terms’ is measured from constant 2017 prices and US$ exchange rates

Related Stories

Market Data | Apr 4, 2018

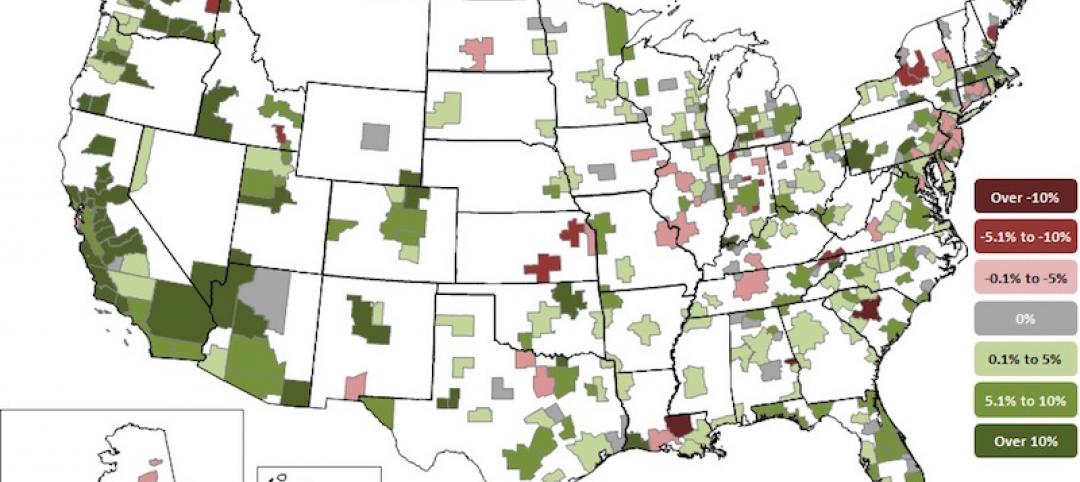

Construction employment increases in 257 metro areas between February 2017 & 2018 as construction firms continue to expand amid strong demand

Riverside-San Bernardino-Ontario, Calif. and Merced, Calif. experience largest year-over-year gains; Baton Rouge, La. and Auburn-Opelika, Ala. have biggest annual declines in construction employment.

Market Data | Apr 2, 2018

Construction spending in February inches up from January

Association officials urge federal, state and local officials to work quickly to put recently enacted funding increases to work to improve aging and over-burdened infrastructure, offset public-sector spending drops.

Market Data | Mar 29, 2018

AIA and the University of Minnesota partner to develop Guides for Equitable Practice

The Guides for Equitable Practice will be developed and implemented in three phase.

Market Data | Mar 22, 2018

Architecture billings continue to hold positive in 2018

Billings particularly strong at firms in the West and Midwest regions.

Market Data | Mar 21, 2018

Construction employment increases in 248 metro areas as new metal tariffs threaten future sector job gains

Riverside-San Bernardino-Ontario, Calif., and Merced, Calif., experience largest year-over-year gains; Baton Rouge, La., and Auburn-Opelika, Ala., have biggest annual declines in construction employment.

Market Data | Mar 19, 2018

ABC's Construction Backlog Indicator hits a new high: 2018 poised to be a very strong year for construction spending

CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.

Market Data | Mar 15, 2018

ABC: Construction materials prices continue to expand briskly in February

Compared to February 2017, prices are up 5.2%.

Market Data | Mar 14, 2018

AGC: Tariff increases threaten to make many project unaffordable

Construction costs escalated in February, driven by price increases for a wide range of building materials, including steel and aluminum.

Market Data | Mar 12, 2018

Construction employers add 61,000 jobs in February and 254,000 over the year

Hourly earnings rise 3.3% as sector strives to draw in new workers.

Steel Buildings | Mar 9, 2018

New steel and aluminum tariffs will hurt construction firms by raising materials costs; potential trade war will dampen demand, says AGC of America

Independent studies suggest the construction industry could lose nearly 30,000 jobs as a result of administration's new tariffs as many firms will be forced to absorb increased costs.