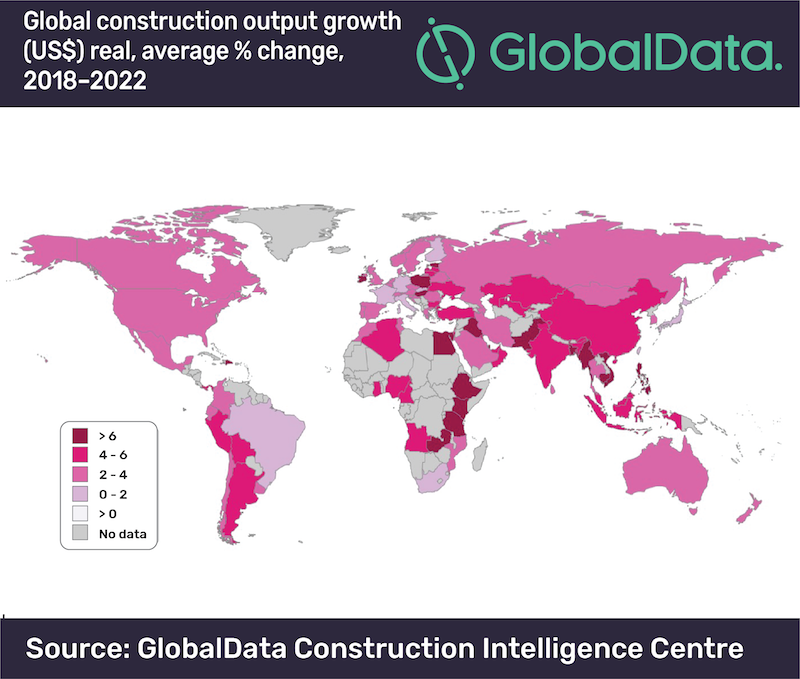

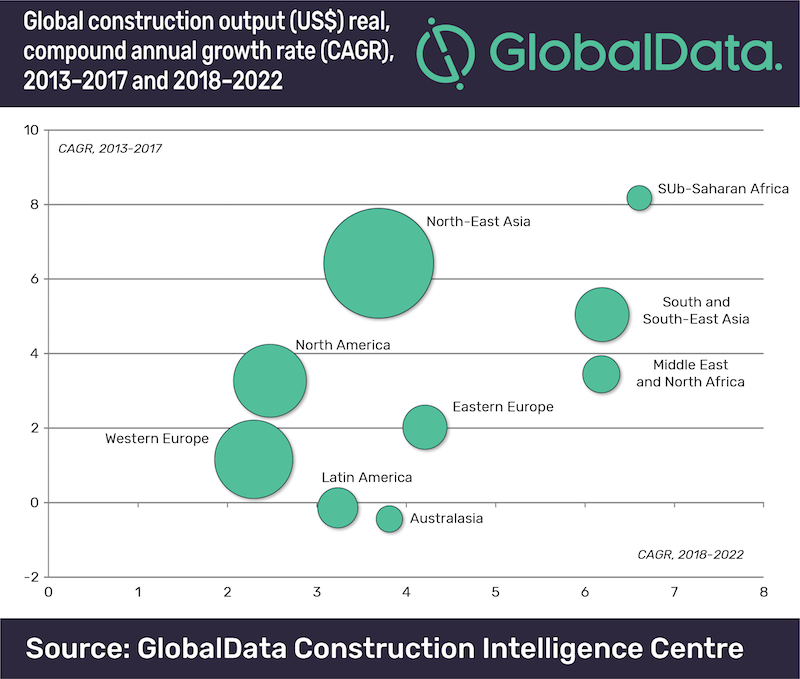

The global construction industry is expected to grow by an average of 3.6% a year over the forecast period 2018 to 2022, according to GlobalData, a data and analytics company.

The company’s latest report, ‘Global Construction Outlook to 2022: Q3 2018 Update’ reveals that in real value terms*, global construction output is forecast to rise to $12.9 trillion by 2022, up from $10.8 trillion in 2017.

Danny Richards, Construction Lead Analyist at GlobalData, says, ‘‘We forecast that global construction output growth will accelerate to +3.6% in 2018, up from 3.1% in 2017, reflecting the recovery in the US as well as general improvements across emerging markets. In South and South-East Asia, for example, construction in India has regained growth momentum, while the pick-up in oil prices has supported the recovery in the Middle East and Africa.’’

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020, before easing back in the latter part of the forecast period, reflecting trends in some of the largest markets.

The Asia-Pacific region will continue to account for the largest share of the global construction industry, however the pace of growth will slow given the projected slowdown in China’s construction industry to an average of +4.2% between 2018 and 2022, offset by an acceleration in construction growth in India.

Construction activity is gathering momentum across Western Europe with the region’s output set to expand by 2.4% a year on average from 2018 to 2022. However, expansion in the UK is subject to major downside risks in the face of uncertainty over Brexit.

The Middle East and Africa region as a whole will be the fastest with an annual average growth of 6.4% from 2018 to 2022. Countries in the Gulf Cooperation Council (GCC) have suffered from the weakness in oil prices in recent years, greatly reducing government revenues. As oil prices pick up, however, large-scale investment in infrastructure projects - mostly related to transport - will be a key driving force behind the construction growth in the region.

Richards says, “Whilst there are intensifying downside risks for global construction related to global economic growth, notably stemming from the erupting trade war between the US and China, the global economy will continue to expand in the range of 2.5% to 3% a year from 2018 to 2022 which will support continued construction growth in key markets.’’

* ‘real value terms’ is measured from constant 2017 prices and US$ exchange rates

Related Stories

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

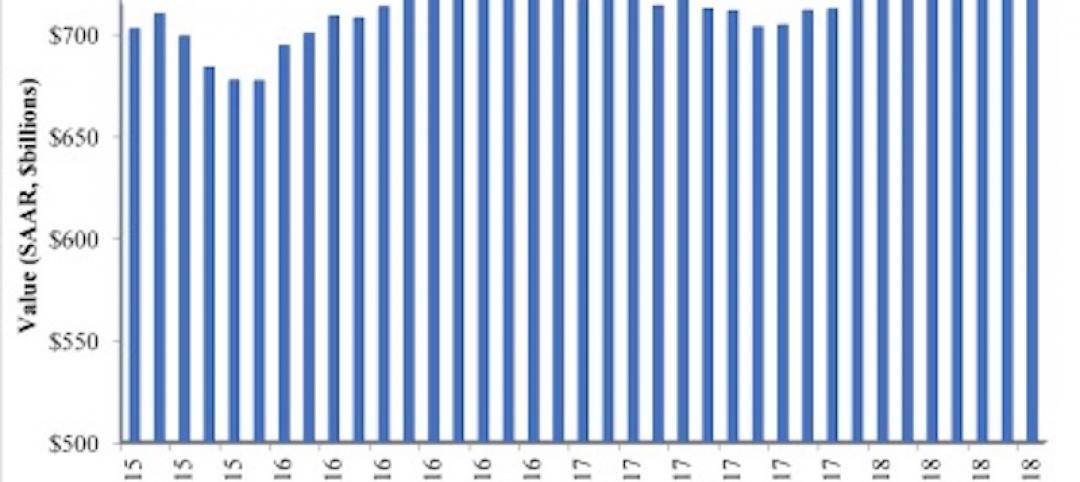

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.