Gilbane, the family owned construction and real estate development firm, is predicting stronger spending on nonresidential building this year, even if the number of projects started doesn’t appreciate significantly.

“Even if new starts growth were to turn flat for the rest of 2015 (which is not expected), those starts already recorded over the past 12 months indicate spending for nonresidential buildings in 2015 will increase 15% over 2014, the best growth since 2007,” writes the company in its “Building For the Future” Spring report on Construction Economics and Market Conditions.

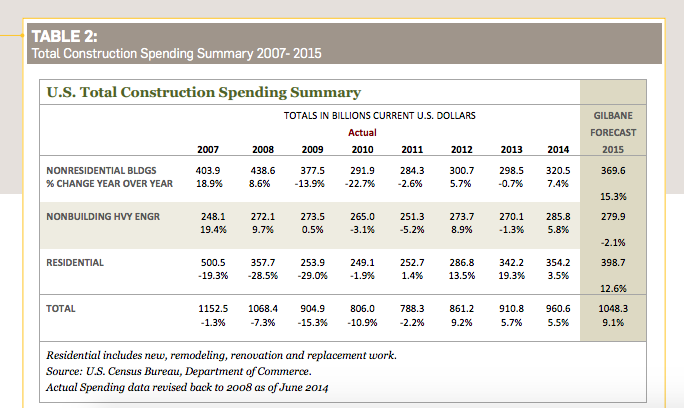

Gilbane estimates that total spending for nonresidential building construction will reach $370 billion this year, a 15.3% increase. The company expects nonresidential starts to slow in 2015 but still hit 218,052 units, 7.4% ahead of the previous year.

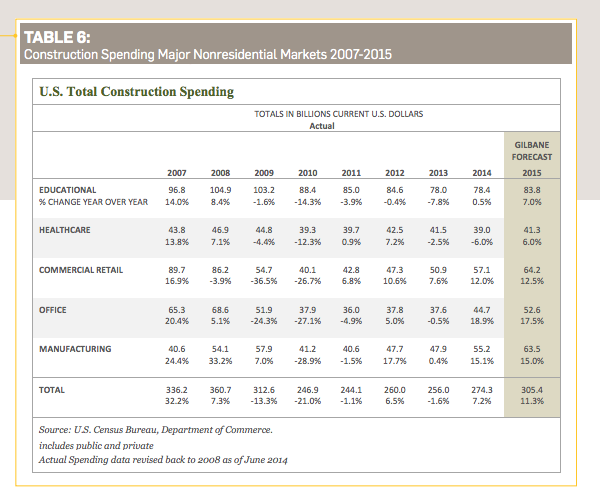

Educational building is expected to account for 22.7% of total nonresidential construction spending in 2015, down from its 24.4% market share in 2014 and 30.3% in 2010. Still, Gilbane foresees spending on educational building to be up 7% this year, to $83.8 billion, the first substantial increase since 2008.

The manufacturing sector, whose market share of total nonresidential construction spending is projected to be flat at 17.2% this year, should see its spending amounts increase by 15% to $63.5 billion, which would be on top of a 15% gain in 2014. Spending on office construction is expected to grow 17.5% to $52.6 billion. And construction spending on commercial retail will be up 12.5% to $64.2 billion.

Gilbane projects that nonresidential construction revenue will increase by 9.1%. However, using historical benchmarks as its guide, the company believes that at least half of that gain could be attributable to “rapidly increasing inflation,” which had grown by 11% in the previous three years.

As other industry watchers have noted, Gilbane isn’t seeing much inflation on the materials side, with some exceptions like gypsum and precast concrete. Gilbane is more concerned, though, about construction hiring trends.

As of March 2015, there were 6.344 million construction employees, according to Bureau of Labor Statistics’ data. The unemployment rate in construction is now at 9.5% after hitting a low of 6.4% in October 2014. Total hiring in the construction industry was up by an estimated 15% in the first quarter of this year.

Gilbane believes that companies aren’t always using the right metrics to determine their hiring levels.

It notes that since 2012, the number of workers to complete $1 billion of constant volume has increased from about 5.65 million to 6.1 million. That would imply an 8% loss in productivity in three years. But Gilbane insists this “loss” has more to do with overall cost reductions than with projects being over-staffed.

“Workload volume should be used for planning the size of the workforce,” Gilbane states. “As an example, at the 2008 peak of construction cost, a building cost $12 million and took 100 men per year to build. In 2010, that same building potentially cost as little as $10 million to build, 20% less. Did it take 20% fewer men per year to build it? No, certainly not. That would be the fallacy of trying to determine jobs needed based on unadjusted revenue.”

To bolster its argument, Gilbane notes that historical averages (adjusted for inflation) since year 2000 show the number of direct construction jobs supported by $1 billion in construction spending varies +/- from 6,000 jobs. That calculates to one job for every $165,000 (in 2014 dollars) spent on construction, or 6.0 to 7.0 jobs per $1,000,000 spent.

Related Stories

| Aug 11, 2010

Webcor, Hunt Construction lead the way in mixed-use construction, according to BD+C's Giants 300 report

A ranking of the Top 30 Mixed-Use Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Clark Group, Hensel Phelps among nation's largest federal government contractors, according to BD+C's Giants 300 report

A ranking of the Top 40 Federal Government Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Report: Fraud levels fall for construction industry, but companies still losing $6.4 million on average

The global construction, engineering and infrastructure industry saw a significant decline in fraud activity with companies losing an average of $6.4 million over the last three years, according to the latest edition of the Kroll Annual Global Fraud Report, released today at the Association of Corporate Counsel’s 2009 Annual Meeting in Boston. This new figure represents less than half of last year’s amount of $14.2 million.

| Aug 11, 2010

Peter Marchetto joins Tishman as president of Construction Operations

Tishman Construction Corporation Chairman, Daniel R. Tishman, today announced that Peter Marchetto joined the company as President of Construction Operations.

| Aug 11, 2010

Whiting-Turner, EMJ Corp. top BD+C's ranking of the nation's 40 largest retail contractors

A ranking of the Top 40 Retail Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants