Entering the second quarter of 2022, FMI expects construction spending to end 2022 up 7% compared to up 8% in 2021. But that growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays and economic turmoil caused by international events such as the Russia-Ukraine war, according to FMI's 2022 North American Engineering and Construction Outlook Second Quarter Edition.

Key highlights of the report include:

- Strong investment in residential and manufacturing will drive industry spending through 2022.

- Due to expected increases in infrastructure funding later this year, several nonbuilding segments, including highway and street, sewage and waste disposal and water supply, are all anticipated to realize growth rates of more than 5% in 2022.

- Year-end 2022 growth will be tempered by ongoing spending declines across various nonresidential building segments, including lodging, office, educational, religious, public safety and amusement and recreation.

- Commercial, health care, communication, power and conservation and development are all expected to end the year with low growth, roughly in line with the historical rate of inflation, between 0% and 4%, and are therefore considered stable.

Download the free PDF report (short registration required).

Related Stories

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.

Market Data | Aug 2, 2018

Nonresidential construction spending dips in June

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu.

Market Data | Aug 1, 2018

U.S. hotel construction pipeline continues moderate growth year-over-year

The hotel construction pipeline has been growing moderately and incrementally each quarter.

Market Data | Jul 30, 2018

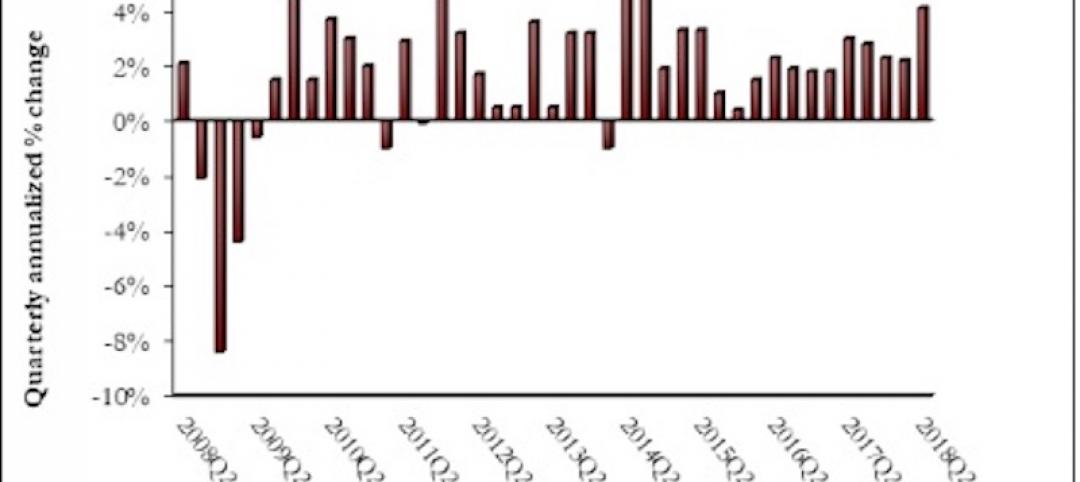

Nonresidential fixed investment surges in second quarter

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate.

Market Data | Jul 11, 2018

Construction material prices increase steadily in June

June represents the latest month associated with rapidly rising construction input prices.

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.