Despite rising demand, the construction industry is expected to see a serious falloff in building starts, according Jones Lang Lasalle’s Construction Trends and Midyear Update, which JLL released this morning.

The report takes a fresh look at the industry’s overall health, the current availability and pricing for labor and materials, and the direction that total construction costs may be headed.

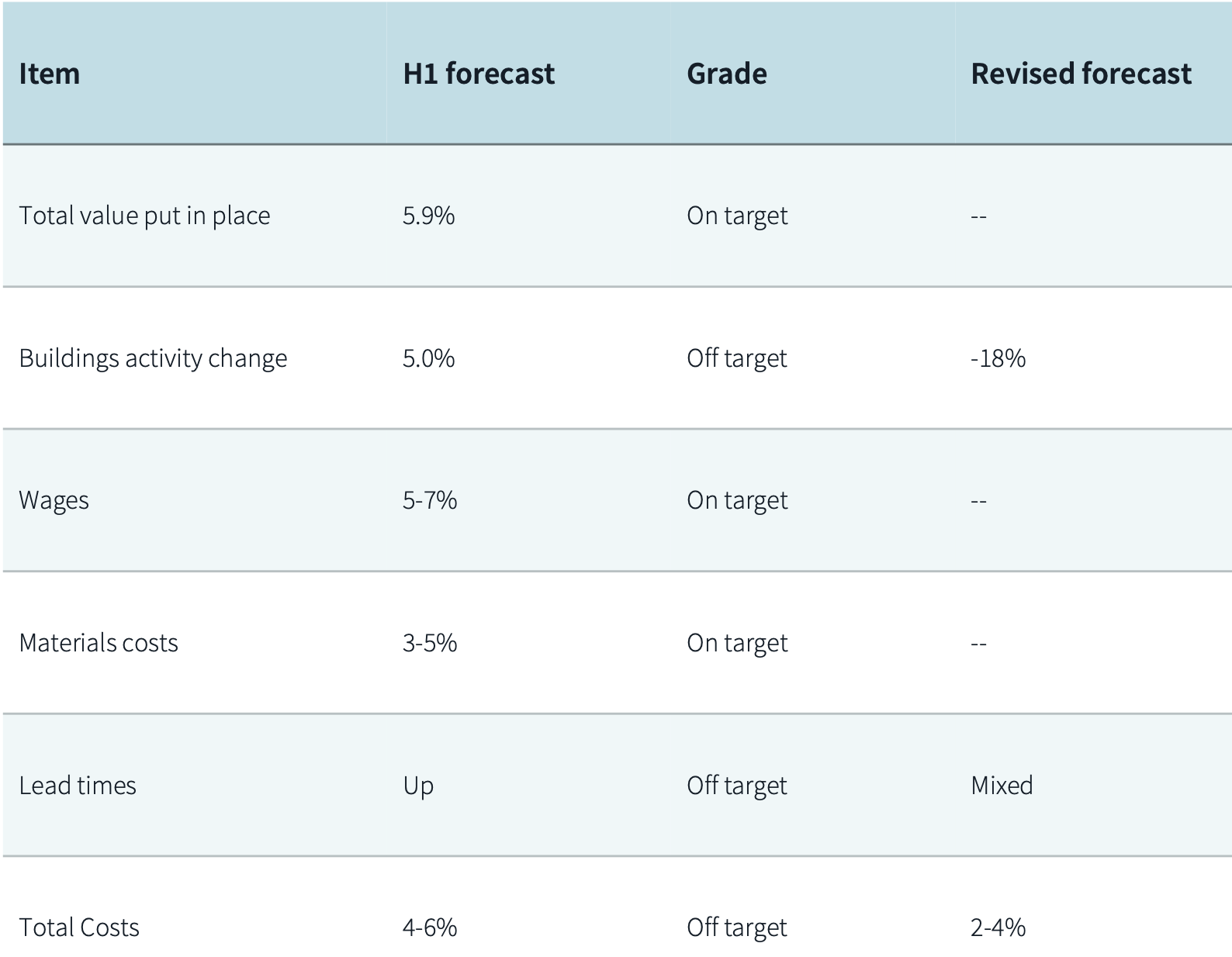

JLL still sees the construction sector in “uncharted economic territory,” as global threats remain unrealized “but full of disruptive potential” even as construction continues at breakneck speed to address post-pandemic built-environment needs. Consequently, JLL updated its projections for three of the seven barometers it tracks (see chart).

The outlook’s four key takeaways are:

•Industry Health: Financing constraints have driven a rapid decline in construction starts over the last quarter;

•Labor: Firms are prioritizng talent retention strategies;

•Materials: Supply chain issues have largely stabilized, and future cost increases should be manageable;

•Total Costs: Firms' responses to the impending slowdown have led to a drop in total costs during the third quarter, prompting JLL to revise its total cost growth forecast down to 2-4%, from 4-6% in the first half of the year.

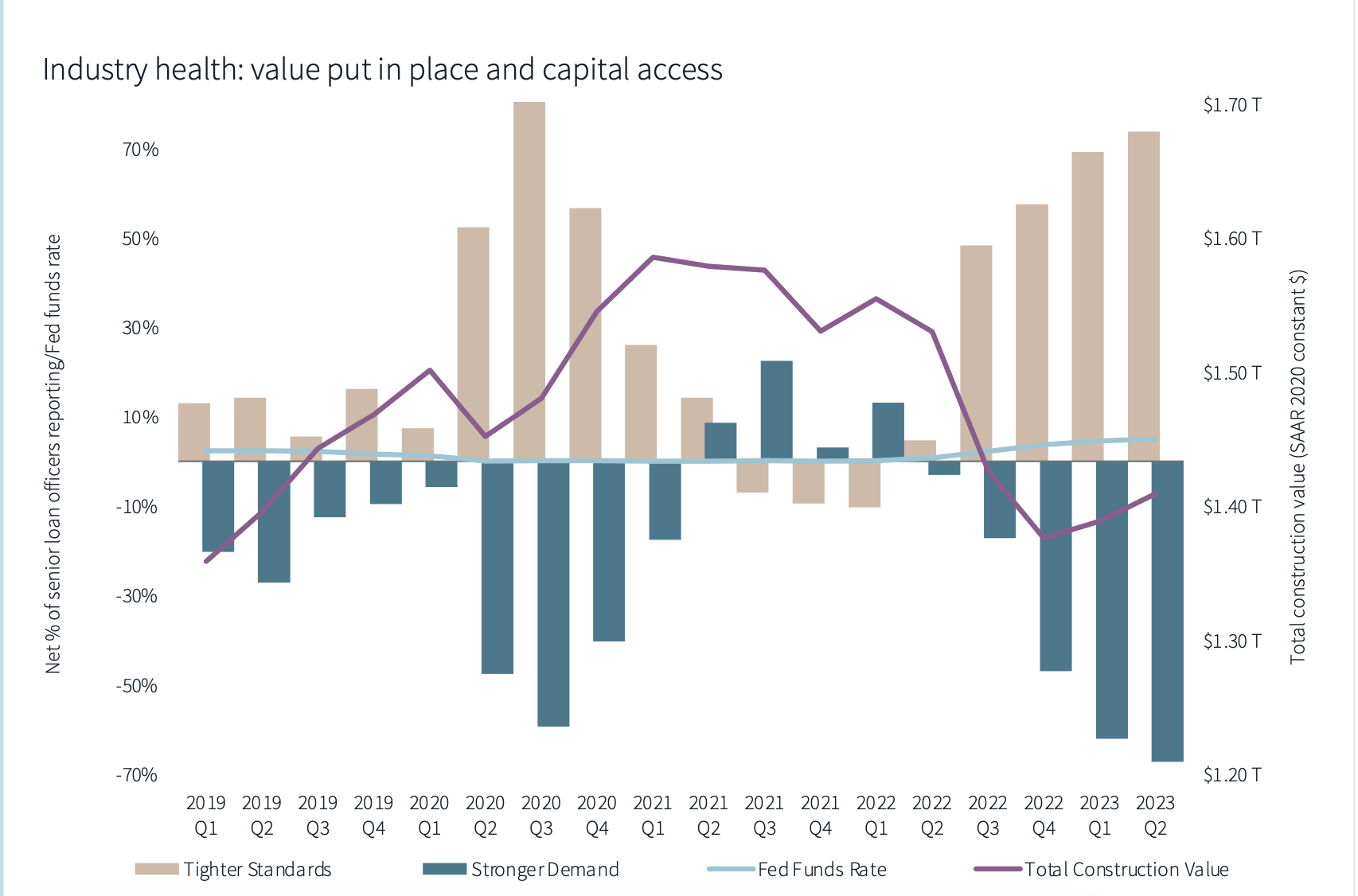

Interest rates are curtailing building starts

Based on midyear data, JLL’s forecast for construction value put in place aligns with its previous expectations. Overall, industry sentiment is strong, but construction is expected to cool depending on resolution or escalation of threats ranging from inflation to geopolitical turmoil. JLL’s revised forecast anticipates an 18% decline in building activity, compared with its 5% growth forecast for the first half of the year.

Rising interest rates are slowing construction starts. But demand for infrastructure and other non-building projects remains strong. JLL predicts interest rates will peak near the end of this year, and construction activity should rev up, “with specialization and complexity management playing vital roles.“

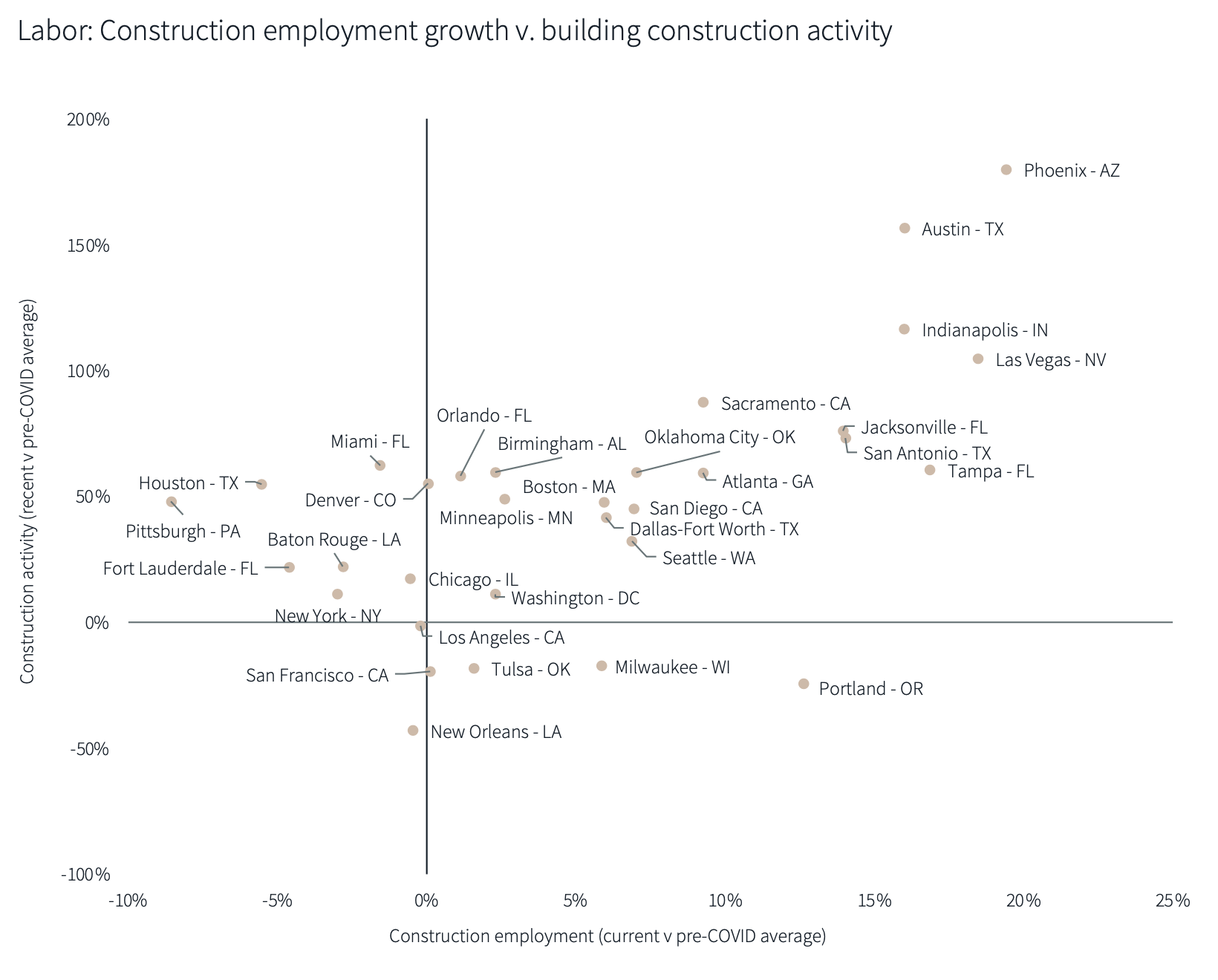

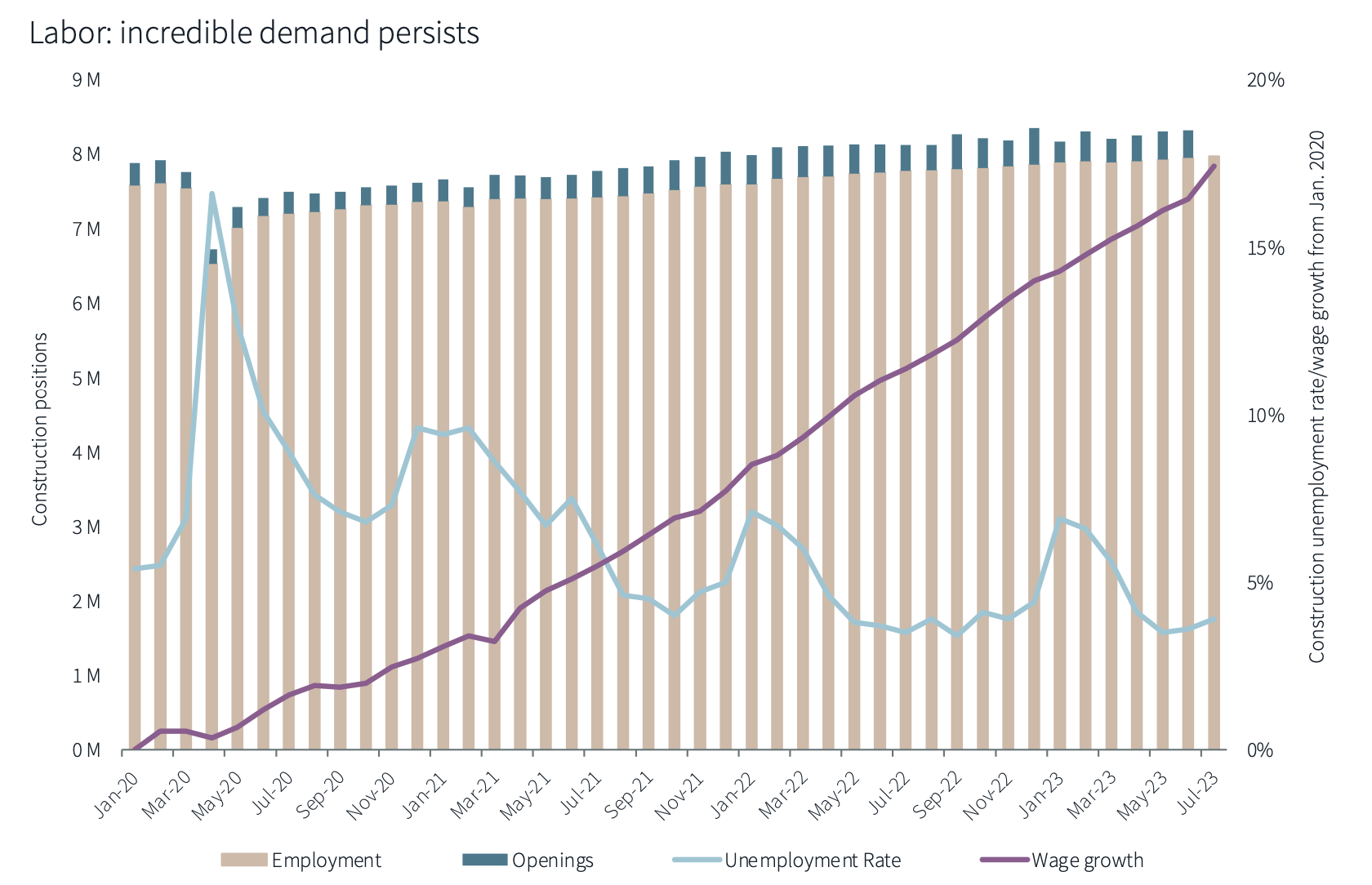

JLL continues to stand by its forecast of 5-7% growth in labor costs. Job openings remain high, and unemployment is unusually low. There is “persistent” wage competition for skilled workers. However, contractors remain confident about their ability to weather the expected downturn. JLL foresees minimal disruption in sectors buoyed by public sector spending; other sectors could see more of a dropoff, though. Construction activity per employee will remain above pre-pandemic levels for the foreseeable future.

Total costs are stabilizing

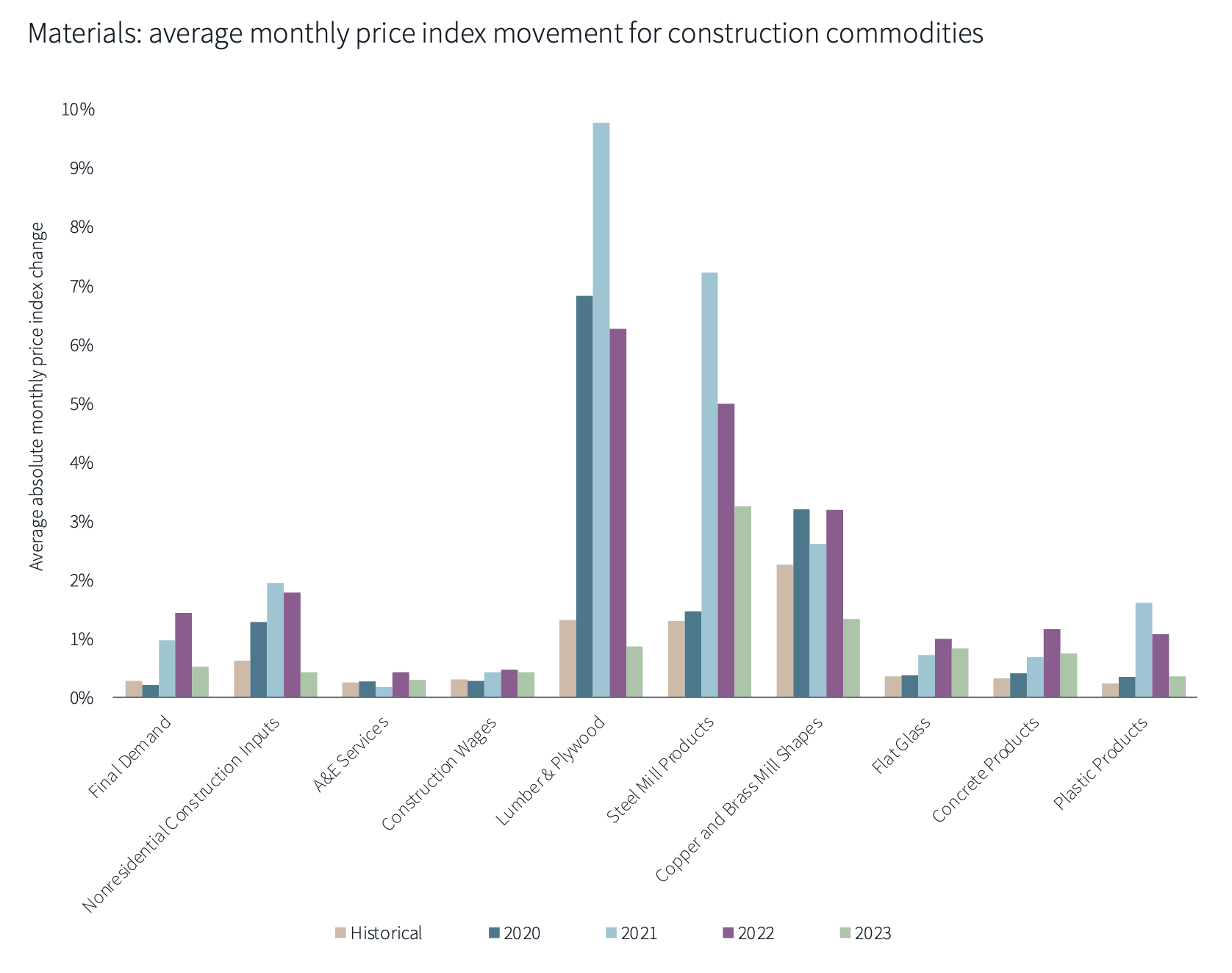

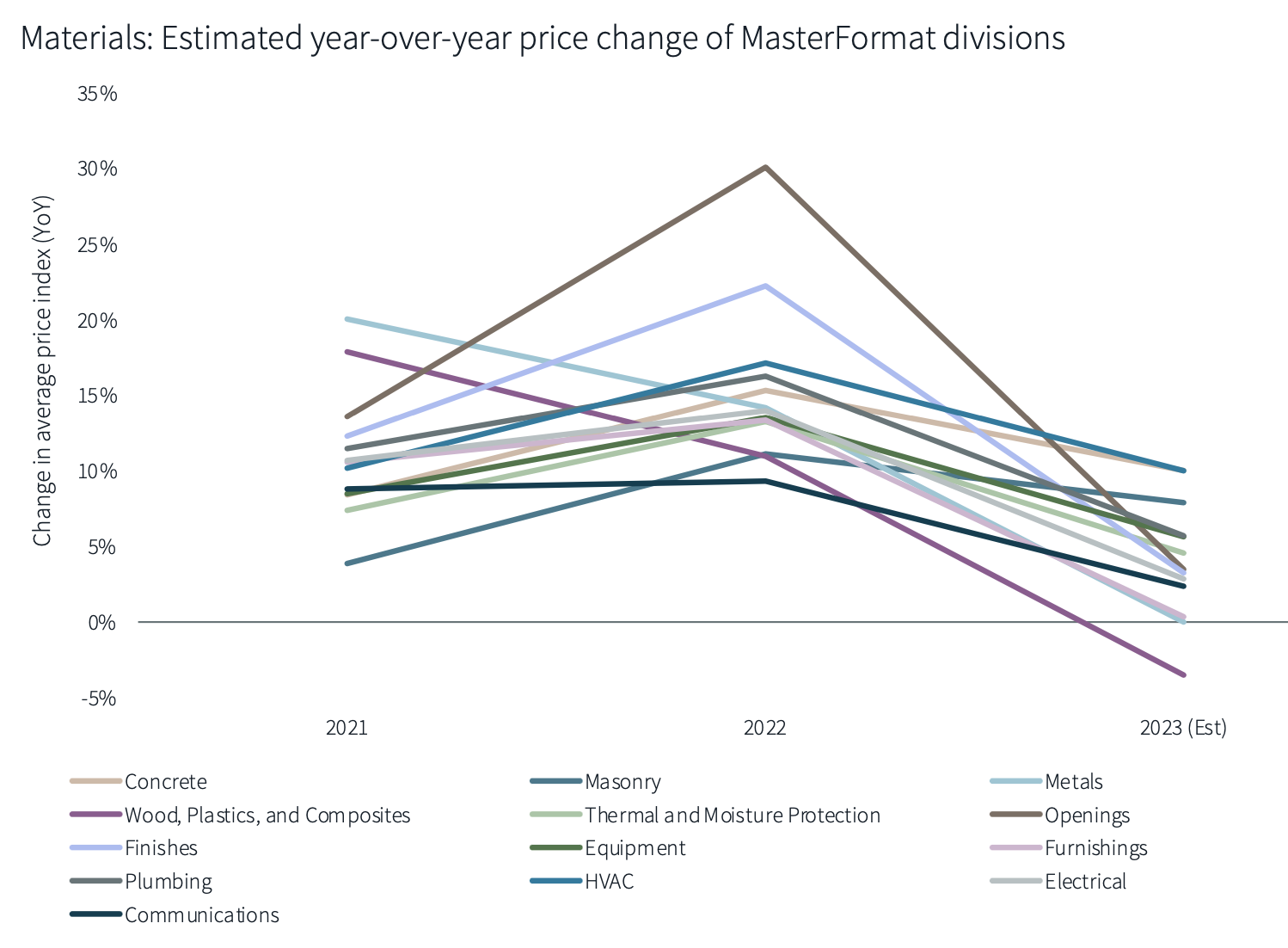

JLL also believes that its prediction of a 3-5% increase in materials costs remains on target. Commodities are exhibiting varying price fluctuations. Lead times were high in the first half of 2023, especially for MEP goods, making it harder for contractors to keep up with electrification and data center demand. Steel, concrete, glass, and plastic products’ price movements are also above historic levels. JLL expects materials costs to continue to rise at their current modest (single-digit) pace, having less impact on demand. But summer wildfires are likely to impact the supply of Canadian softwood.

Mixing these factors, JLL concludes that total construction costs have stabilized, having recorded the slowest period of growth (and the first declines) since the immediate aftermath of COVID-19 being declared a global emergency. Firms are navigating wage hikes, and expect sales and profit to grow modestly and stabilize, respectively. Labor retention is a priority to hold the line on costs. JLL adjusts its projection for total cost growth down to between 2-4%, from 4-6% in the first half.

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.