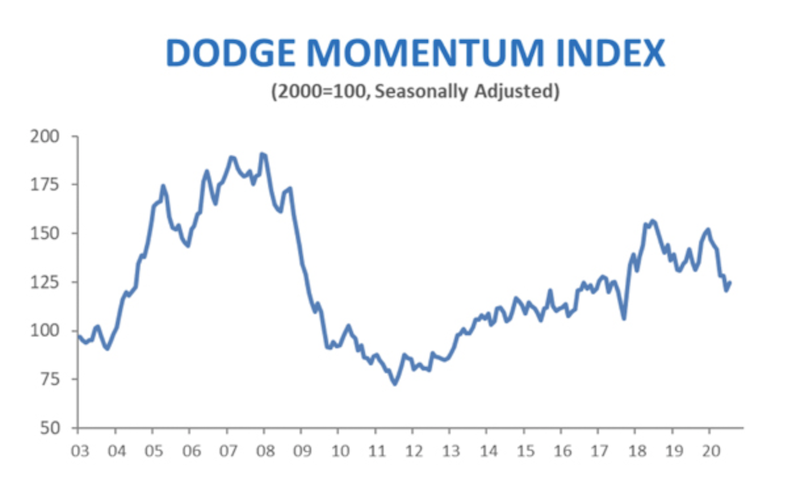

The Dodge Momentum Index moved 3.4% higher in July to 124.7 (2000=1000) from the revised June reading of 120.5. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. During the month, the commercial component increased 5.3% while the institutional component was unchanged.

This month’s increase in the Dodge Momentum Index was the first in all of 2020. Since December 2019, the Momentum Index has lost 18% with most of the decline coming in April when the COVID-19 pandemic led to numerous business shutdowns across the country. The pullback has largely come from institutional planning, rather than commercial plans. State and local government revenues have been squeezed as declines in economic activity have led to a drop in tax revenue just as costs related to the pandemic have skyrocketed. The institutional component is currently 28% below its December 2019 peak and 21% lower than its year ago level. Commercial planning is down 13% from its January 2020 peak, but is actually 1% higher than its year-ago level.

In July, 13 projects each with a value of $100 million or more entered planning. The leading commercial projects were the first two phases of the Centene Healthcare headquarters in Charlotte NC, with each phase valued at $500 million. The leading institutional projects were the $320 million Dignity Health Hospital in Elk Grove CA and the $155 million first phase of the West Henderson Hospital in Henderson NV.

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.