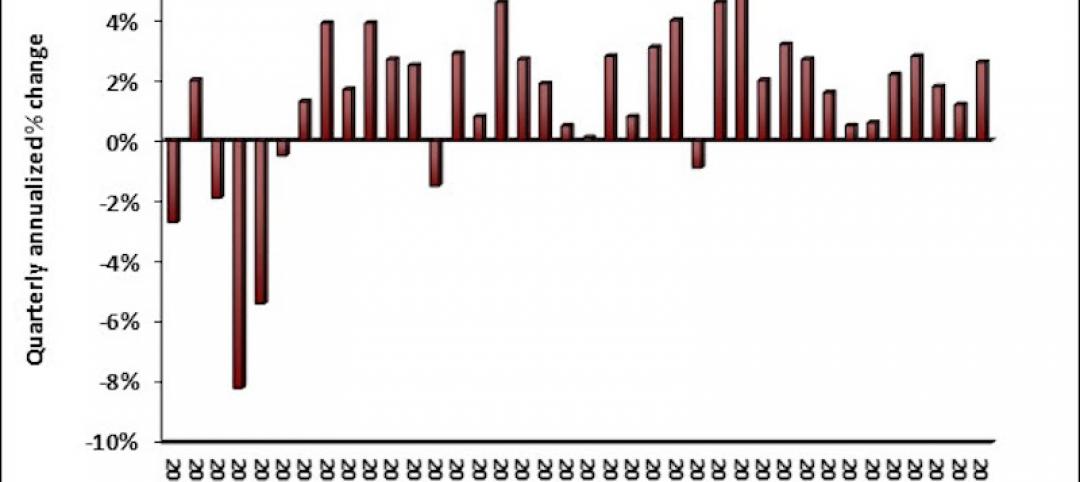

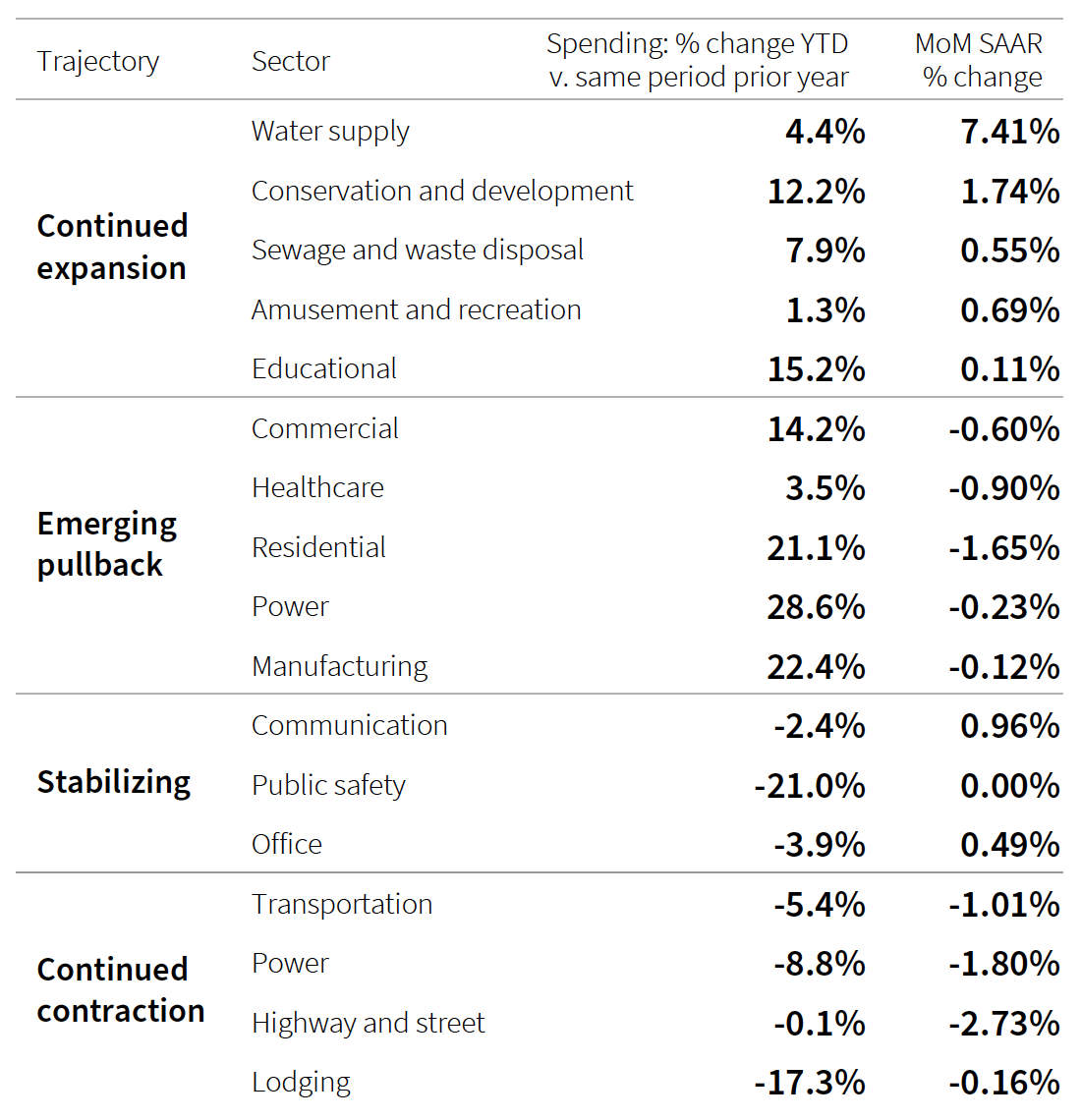

Through the first half of 2022, nonresidential construction spending returned to “nomimal growth.” But JLL, in its Construction Outlook for the second half of the year, foresees nonresidential spending being flat, on an inflation-adjusted basis, and year-over-year growth returning to historical levels in 2024, “as disruptions are likely to persist into 2023.”

Those disruptions include supply-chain issues that contributed to construction materials costs increasing by 42.5 percent from prepandemic levels. Labor costs related to workforce shortages were 10.5 percent higher than they were in March 2020.

“Labor availability remains a deep-set structural challenge for the industry and will be a larger issue as construction demand persists and shifts focus,” JLL observes. “Estimates of future need based on these upcoming expenditures show the gap will only widen, with a particular need for nonbuilding and public workers.”

Too much work, too few workers

Job openings for construction labor have been consistently elevated, even as hiring expanded above prepandemic rates and separations fell to extremely low levels. In June 2022, unemployment fell to 3.7 percent, just 0.1 percent above the national average and job openings finally pulled back, dropping by 109,000 openings to 330,000. As such, the pullback is likely to continue, as firms stabilize backlogs and plan for difficult times.

Wage growth in the first half of 2022 was modest as well, significantly outpaced by inflation. Workers in the construction industry have actually experienced real wage losses of roughly 1.9 percent since the start of the pandemic. That gap widened in the first half of 2022 for construction employees.

“It is unlikely that the pullback will result in significantly lower demand side pressure in the construction labor market, as the current volume and array of work are sufficient to keep demand high for the next several years,” states JLL, especially once spending from the Infrastructure Investment and Jobs Act (IIJA) is in full swing.

The industry’s dilemma, however, is that it doesn’t have the capacity to fill every construction job that’s expected to be added in the next few years. At current forecasts of incoming IIJA funds bumping public spending by 10 percent or more annually from 2024 on, the increased need for construction employment equates to roughly 350,000 jobs from that spending alone —well above capacity identified in the historical record.

The largest impacts could be continued wage pressure and potential delays in projects. JLL predicts that the favorable situation for labor is expected to accelerate wage growth in the second half of the year, continuing to pressure margins. Though outright cancellations have remained limited, delays due to labor shortages are a nearly universal experience “with no relief in sight.”

Uneven price stability

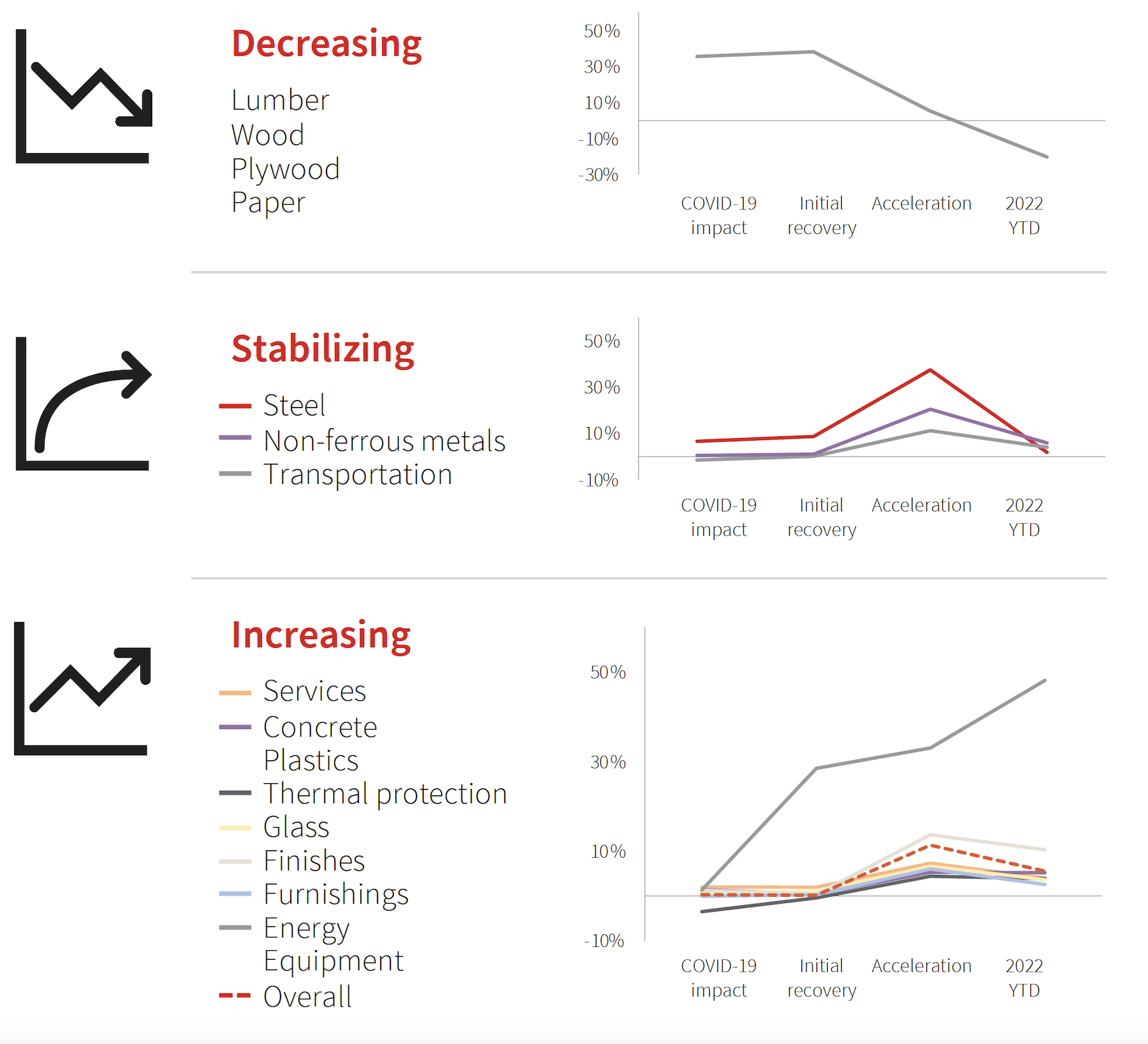

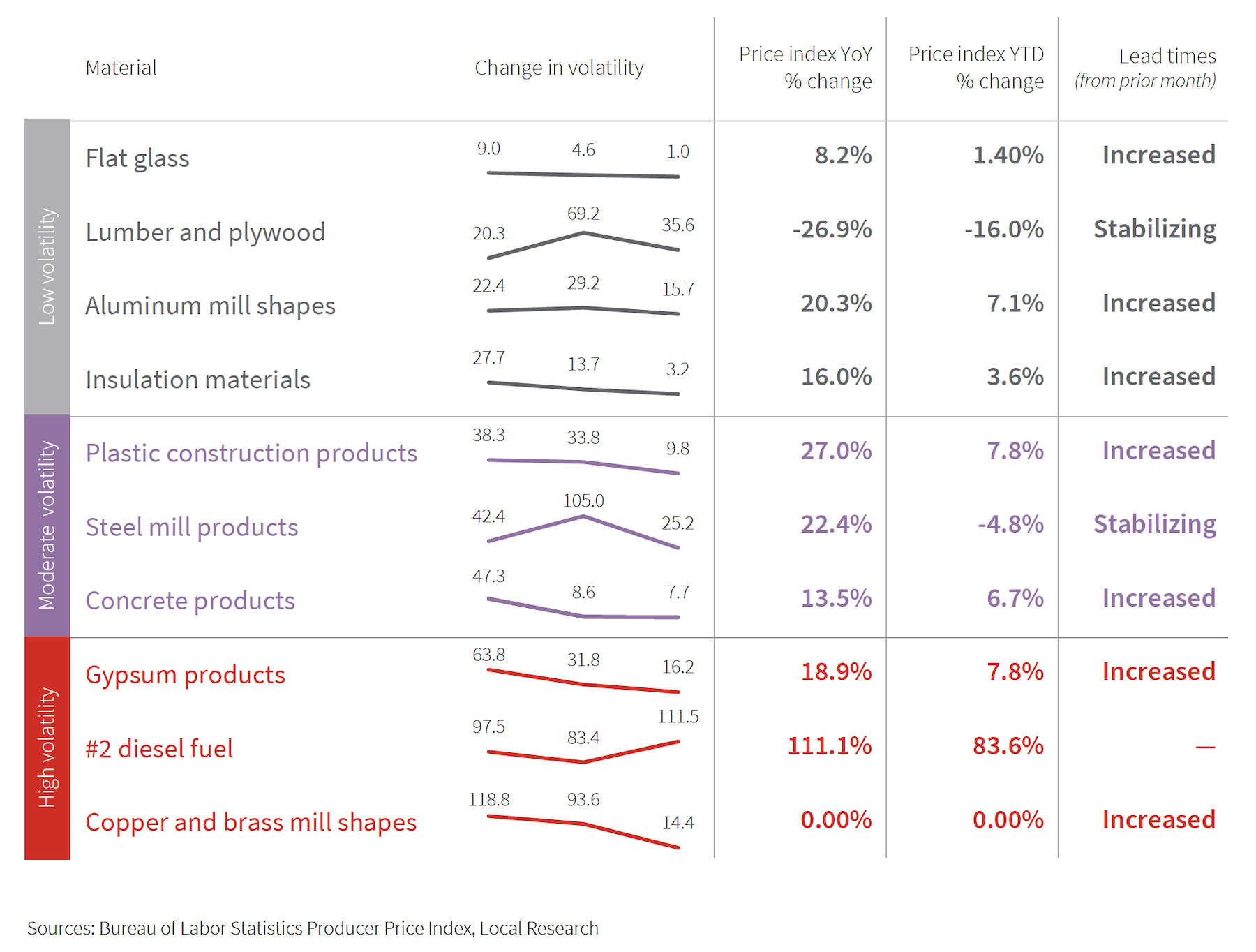

JLL’s Outlook is mixed about construction materials availability and costs. Steel and lumber, once the poster children for price inflation, have stabilized, thanks in part to domestic steel construction that’s 30 percent higher than prepandemic levels. However, “volatility has not gone down uniformly” across the spectrum of construction products.

That is particularly true of energy related materials that have been affected by Russia’s invasion of Ukraine, whose damages to its built environment are estimated at $750 billion and rising. Cement, glass manufacture, and semiconductors for equipment and machinery “are among some of the larger price increases,” with concrete and glass disproportionately reliant on few producers with extremely high energy usage for production. Plus, the 10 percent increase in domestic cement and concrete production hasn’t stabilized prices yet.

Consequently, JLL has revised its previous outlook and now projects that materials prices will be up between 12 and 18 percent this year. “Uncertainty is still widespread and, as demonstrated by the current changing patterns of costs, novel issues are likely to emerge and disrupt supply chains and pricing in the near term.”

An active industry

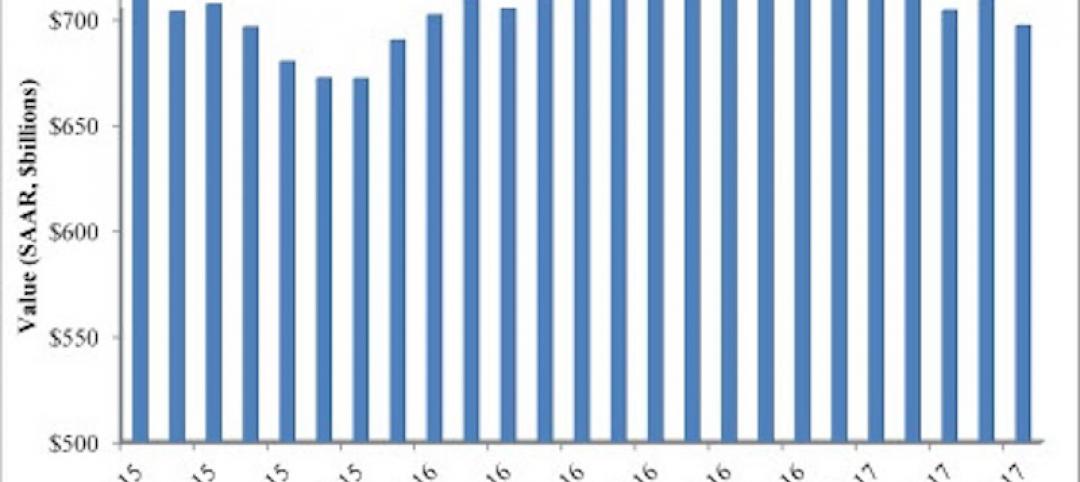

From January to May 2022, the seasonally adjusted annual rate of total construction spending expanded at a monthly rate of 0.63 percent, above the growth rate observed in 2021. June, though, was down a percentage point, and any increases through the first half of the year were attributable to inflation.

On the bright side, JLL expects construction activity to remain healthy, global economic concerns notwithstanding. In the U.S., the Northeast has faltered with numerous months of contraction in the first half of 2022, while the West has picked up the pace of billing and backlog increases in recent months. The South and Midwest have maintained billings growth that is beginning to decelerate but will nevertheless create an appreciable pipeline of construction activity in the regions.

Related Stories

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 20, 2017

Some suburban office markets are holding their own against corporate exodus to cities

An analysis of mortgage-backed loans suggests that demand remains relatively steady.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.