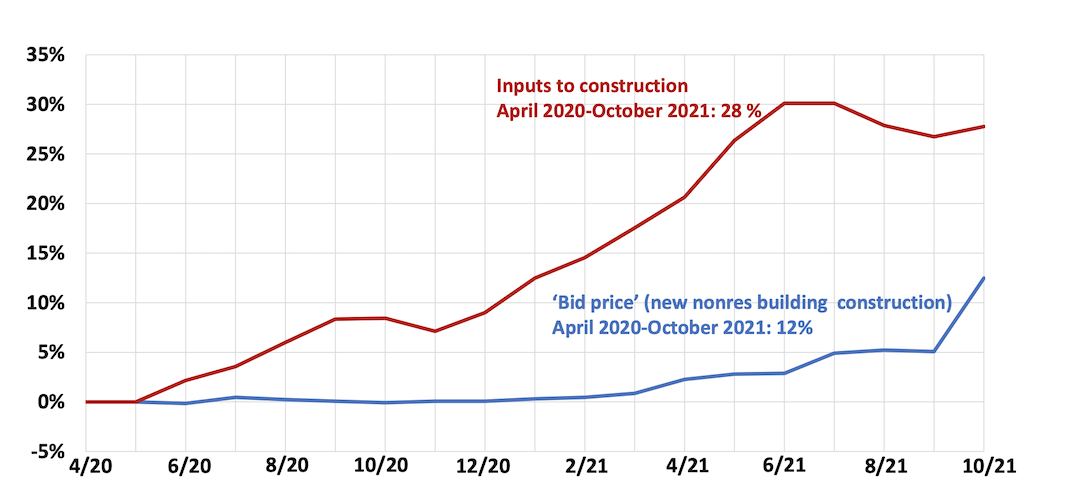

Rising construction materials prices appear to be starting to drive up the price of construction projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials noted that despite a big jump in what contractors charge for projects, the rise in materials prices is still much higher.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—jumped 7.1% from September to October and 12.6% over the past 12 months. But an index of input prices—the prices that goods producers and service providers such as distributors and transportation firms charged for inputs for nonresidential construction—climbed by an even steeper 21.1% compared to October 2020, including a 1.3% increase since September, Simonson noted.

Many products, as well as trucking services, contributed to the extreme runup in construction costs, Simonson observed. The price index for steel mill products more than doubled, soaring nearly 142% since October 2020. The indexes for both aluminum mill shapes and copper and brass mill shapes jumped more than 37% over 12 months, while the index for plastic construction products rose more than 30%. The index for gypsum products such as wallboard climbed 25% and insulation costs increased 17%. Trucking costs climbed 16.3%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, doubled over the year.

Association officials urged the Biden administration and Congress to do more to address supply chain backups that are crippling construction firms and the broader economy. These measures include additional tariff relief for key construction materials. They also urged federal officials to explore other options, like waiving hours of service rules so shippers can tackle freight backlogs.

“Supply chain backlogs are clearly one of the biggest threats to the economy recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials need to be more aggressive in taking steps to get key materials moving again so construction firms can continue rebuilding the country.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.