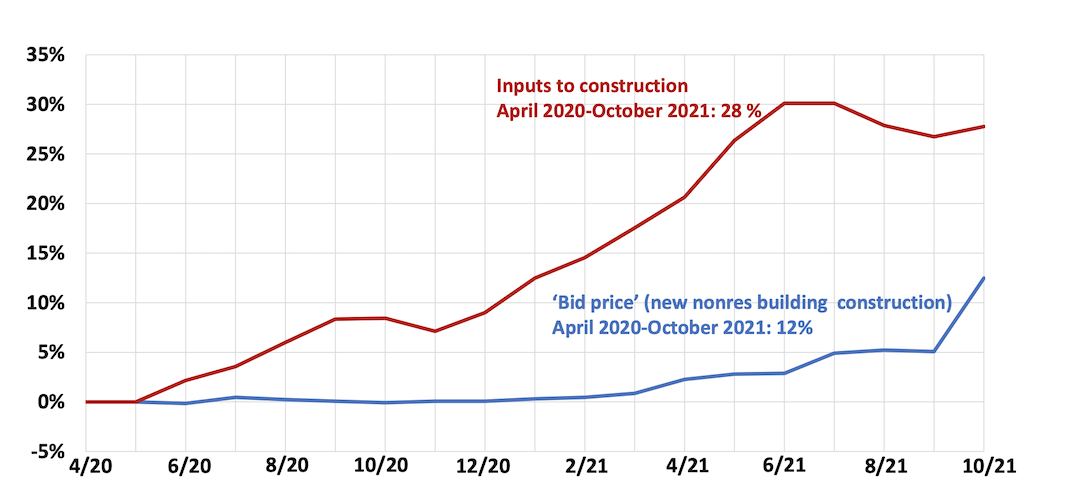

Rising construction materials prices appear to be starting to drive up the price of construction projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials noted that despite a big jump in what contractors charge for projects, the rise in materials prices is still much higher.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—jumped 7.1% from September to October and 12.6% over the past 12 months. But an index of input prices—the prices that goods producers and service providers such as distributors and transportation firms charged for inputs for nonresidential construction—climbed by an even steeper 21.1% compared to October 2020, including a 1.3% increase since September, Simonson noted.

Many products, as well as trucking services, contributed to the extreme runup in construction costs, Simonson observed. The price index for steel mill products more than doubled, soaring nearly 142% since October 2020. The indexes for both aluminum mill shapes and copper and brass mill shapes jumped more than 37% over 12 months, while the index for plastic construction products rose more than 30%. The index for gypsum products such as wallboard climbed 25% and insulation costs increased 17%. Trucking costs climbed 16.3%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, doubled over the year.

Association officials urged the Biden administration and Congress to do more to address supply chain backups that are crippling construction firms and the broader economy. These measures include additional tariff relief for key construction materials. They also urged federal officials to explore other options, like waiving hours of service rules so shippers can tackle freight backlogs.

“Supply chain backlogs are clearly one of the biggest threats to the economy recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials need to be more aggressive in taking steps to get key materials moving again so construction firms can continue rebuilding the country.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.