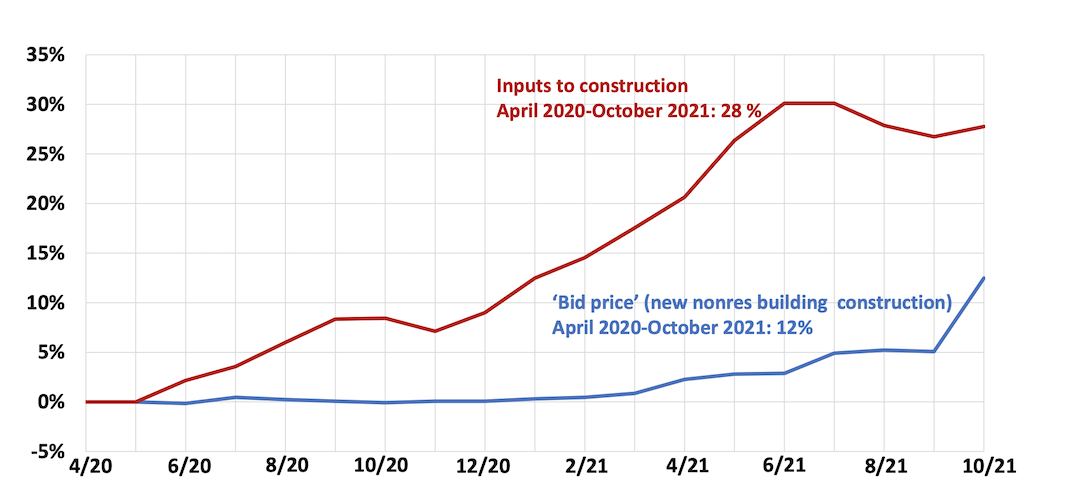

Rising construction materials prices appear to be starting to drive up the price of construction projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials noted that despite a big jump in what contractors charge for projects, the rise in materials prices is still much higher.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—jumped 7.1% from September to October and 12.6% over the past 12 months. But an index of input prices—the prices that goods producers and service providers such as distributors and transportation firms charged for inputs for nonresidential construction—climbed by an even steeper 21.1% compared to October 2020, including a 1.3% increase since September, Simonson noted.

Many products, as well as trucking services, contributed to the extreme runup in construction costs, Simonson observed. The price index for steel mill products more than doubled, soaring nearly 142% since October 2020. The indexes for both aluminum mill shapes and copper and brass mill shapes jumped more than 37% over 12 months, while the index for plastic construction products rose more than 30%. The index for gypsum products such as wallboard climbed 25% and insulation costs increased 17%. Trucking costs climbed 16.3%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, doubled over the year.

Association officials urged the Biden administration and Congress to do more to address supply chain backups that are crippling construction firms and the broader economy. These measures include additional tariff relief for key construction materials. They also urged federal officials to explore other options, like waiving hours of service rules so shippers can tackle freight backlogs.

“Supply chain backlogs are clearly one of the biggest threats to the economy recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials need to be more aggressive in taking steps to get key materials moving again so construction firms can continue rebuilding the country.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Codes and Standards | Mar 1, 2022

Engineering Business Sentiment study finds optimism despite growing economic concerns

The ACEC Research Institute found widespread optimism among engineering firm executives in its second quarterly Engineering Business Sentiment study.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Market Data | Feb 23, 2022

2022 Architecture Billings Index indicates growth

The Architectural Billings Index measures the general sentiment of U.S. architecture firms about the health of the construction market by measuring 1) design billings and 2) design contracts. Any score above 50 means that, among the architecture firms surveyed, more firms than not reported seeing increases in design work vs. the previous month.

Market Data | Feb 15, 2022

Materials prices soar 20% between January 2021 and January 2022

Contractors' bid prices accelerate but continue to lag cost increases.

Market Data | Feb 4, 2022

Construction employment dips in January despite record rise in wages, falling unemployment

The quest for workers intensifies among industries.

Market Data | Feb 2, 2022

Majority of metro areas added construction jobs in 2021

Soaring job openings indicate that labor shortages are only getting worse.

Market Data | Feb 2, 2022

Construction spending increased in December for the month and the year

Nonresidential and public construction lagged residential sector.