Construction firms are struggling to find enough qualified workers to hire even as they continue to be impacted by pandemic-induced project delays and supply chain disruptions, according to the results of a workforce survey conducted by the Associated General Contractors of America and Autodesk. The survey results underscore how the coronavirus pandemic has created constraints on the demand for work even as it limits the number of workers available to hire.

“Market conditions are nowhere near as robust as they were prior to the onset of the pandemic,” said Ken Simonson, the association’s chief economist. “At the same time, the pandemic and political responses to it are limiting the size of the workforce, leading to labor shortages that are as severe as they were in 2019 when demand for construction was more robust.”

Simonson noted that nearly nine out of ten firms (88%) are experiencing project delays. Among these firms, 75% cite delays due to longer lead times or shortages of materials, while 57% cite delivery delays. Sixty-one percent of firms said their projects are being delayed because of workforce shortages. And delays due to the lack of approvals or inspectors, or an owner’s directive to halt or redesign a project, were each cited by 30% of contractors.

An even higher percentage of firms, 93%, report that rising materials costs have affected their projects. These rising materials costs are undermining firms’ abilities to profit from the work they have, with 37 percent reporting they have been unsuccessful in passing those added costs onto project owners.

As a result of these supply chain challenges, more than half of firms report having projects canceled, postponed or scaled back due to increasing costs. Twenty-six percent of firms report their projects have been delayed or canceled because of lengthening or uncertain completion times and 22% say changing market conditions have led to project delays or cancellations.

These challenging market conditions are a key reason why 26% of respondents expect it will take more than six months for their firm’s revenue to match or exceed year-earlier levels. And 17% are unsure when to expect a return to previous demand levels.

While the pandemic has led to project delays and cancellations nationwide, contractor expectations of recovery do vary by region. Forty percent of respondents in the Northeast expect it will take more than six months for their firm’s volume of business to return to normal, compared to only 12% of respondents in the Midwest, 22% in the West, and 34% in the South.

There are also some differences by project type and revenue size. For instance, 100% of building contractors and 97% of firms that work on federal government projects report at least some projects were canceled, postponed or scaled back, compared to 61% of utility infrastructure contractors and 56% of highway and transportation contractors. Two-thirds of the firms with revenues that exceeded $500 million increased their headcount in the past 12 months, compared to just over half (53%) of midsized firms—those with revenues of $50.1 million to $500 million—and slightly more than one-third (36%) of firms with revenues of $50 million or less.

Despite these challenges, contractors report as much difficulty filling positions as they experienced before the pandemic. Eighty-nine percent of firms that are seeking to fill hourly craft positions report having a hard time doing so. And 86% of firms seeking to fill salaried positions are also having a hard time hiring.

There are two main reasons so many firms report having trouble finding workers to hire. The first is that 72% of firms say available candidates are not qualified to work in the industry due to a lack of skills, failure to pass a drug test, etc. The lack of qualified candidates affects union and open-shop firms almost equally: 70% of firms that always use union craft workers exclusively and 74% of open-shop firms report a lack of qualified candidates. And 58% of respondents report that unemployment insurance supplements are keeping workers away.

As a result of these shortages, almost one-third of firms report they have increased spending on training and professional development. Most firms, 73%, report they have increased base pay rates during the past year. And just over one-third of firms have also provided hiring bonuses or incentives during the past year.

In addition, 37% of firms report engaging with career-building programs at the high school, collegiate or career and technical levels. Thirty-one percent have added online strategies – like Instagram Live – to better connect with younger applicants. And roughly one-in-four say they have partnered with government workforce development or unemployment agencies or used software to track job applications.

Many firms have turned to new technologies to become more efficient operators. Fifty-seven percent of respondents report the rate of technology adoption at their firms has increased over the last 12 months. And 60% said they anticipate the rate of technology adoption at their firms to increase within the next 12 months.

“Challenges often drive resolve, and we started to see this acutely in the construction industry last year” said Allison Scott, director of construction thought leadership and customer marketing at Autodesk. “The continued investments in hiring, training and technology highlighted in this year’s study show that even while dealing with ongoing challenges nearly two years into the pandemic, the industry remains committed to building better with a resilient workforce.”

Association officials called on Washington leaders to take steps to help address challenging market conditions and labor shortages. They urged House members to quickly pass a bipartisan infrastructure measure that already passed in the Senate. And they called on the Biden administration and Congress to work together to boost investments in career and technical education.

“The federal government currently spends only one dollar on career training for every six it puts into college prep, despite the fact only one-in-three jobs requires a college degree,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting federal investments in career and technical education will help attract and prepare more people into high-paying careers in construction.”

Association officials added that they were supporting members’ efforts to address labor shortages. This includes launching a targeted digital advertising campaign, “Construction is Essential,” and providing resources to help members establish or improve construction training programs. And the association’s “Culture of Care” program is designed to help firms retain newly hired workers.

The association and Autodesk conducted the Workforce Survey in late July and early August. Over 2,100 firms completed the survey from a broad cross-section of the construction industry, including union and open shop firms of all sizes. The 2021 Workforce Survey is the association’s ninth annual workforce-related survey.

Click here for survey materials including national, regional and state fact sheets, survey analysis and event remarks.

Related Stories

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

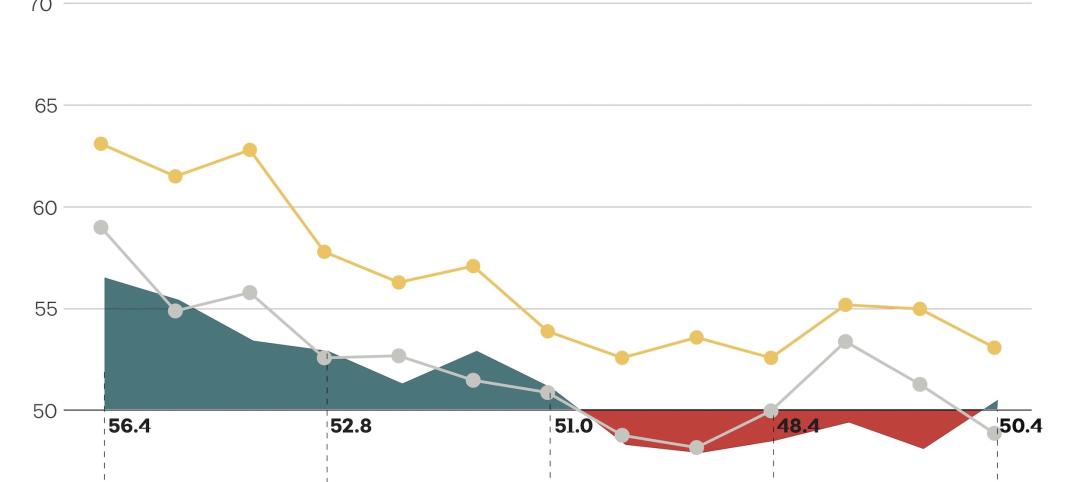

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

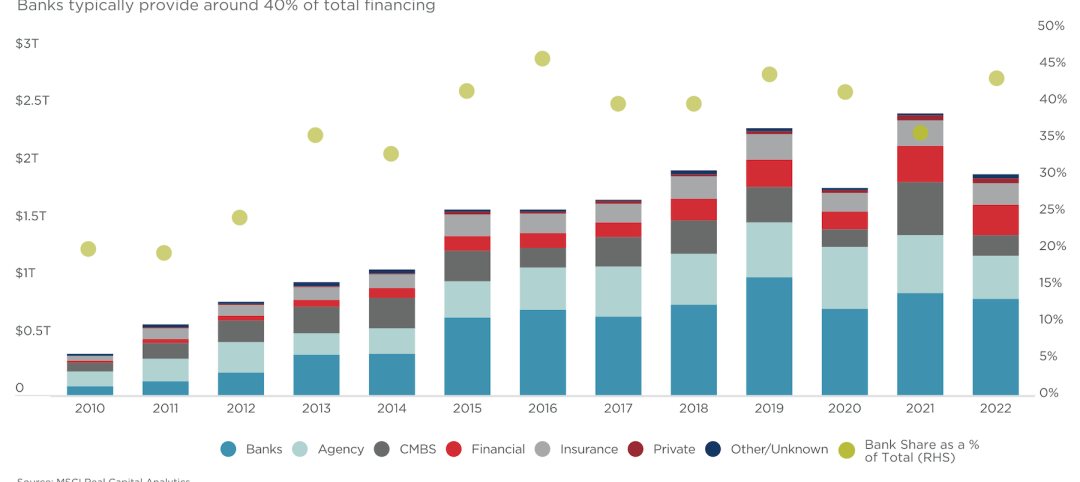

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.