Total construction spending edged higher in October, as gains in public and private project types outmatched decreases in single- and multifamily residential outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments would likely rise in the near future because of the recently-passed infrastructure bill, but cautioned that labor shortages and supply chain problems were posing significant challenges for the industry.

“It is encouraging to see such a broad-based pickup in spending on nonresidential projects in the latest month,” said Ken Simonson, the association’s chief economist. “But the construction industry still faces major challenges from workforce shortages and supply-chain bottlenecks.”

Construction spending in October totaled $1.60 trillion at a seasonally adjusted annual rate, 0.2% above the September rate and 8.6% higher than in October 2020. Year-to-date spending in the first 10 months of 2021 combined increased 7.5% from the total for January-October 2020.

Among the 16 nonresidential project types the Census Bureau reports on, all but two posted spending increases from September to October. Total public construction spending rose 1.8% for the month, while private nonresidential spending inched up 0.2%. However, for the first 10 months of 2021 combined, nonresidential spending trailed the January-October 2020 total by 4.7%, with mixed results by type.

Combined private and public spending on electric power and oil and gas projects--the largest nonresidential segment--declined 0.6% for the month and lagged 2020 year-to-date total by 1.7%. But the other large categories all rose in October. Highway and street construction spending increased 2.4% for the month, though the year-to-date total lagged the same months of 2020 by 0.8%. Education construction rose 0.2% in October but trailed the 2020 year-to-date total by 9.2%. Commercial construction--comprising warehouse, retail, and farm structures--was nearly unchanged from September to October but was 1.9% higher for the first 10 months combined than in January-October 2020.

Residential construction spending declined for the second month in a row, slipping 0.5% from the rate in September. Nevertheless, the year-to-date total for residential spending was 24.2% higher than in the same months of 2020. Spending on new single-family houses decreased 0.8% for the month but outpaced the 2020 year-to-date total by 25.9%. Multifamily construction spending dipped 0.1% in October but topped the 2020 year-to-date total by 16.6%.

Association officials said that spending on many categories of public construction is likely to increase soon as the investments from the Bipartisan Infrastructure bill begin to flow. But they cautioned that the supply chain challenges and labor shortages were impacting construction schedules and budgets and prompting some owners to delay or cancel projects. They urged the Biden administration to explore new ways to relieve shipping delays and to invest more in career and technical education programs that serve as a pipeline into construction careers.

“Getting a handle on supply chains and encouraging more people to work in construction will go a long way in helping this industry recover,” said Stephen E. Sandherr, the association’s chief executive officer.

Related Stories

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

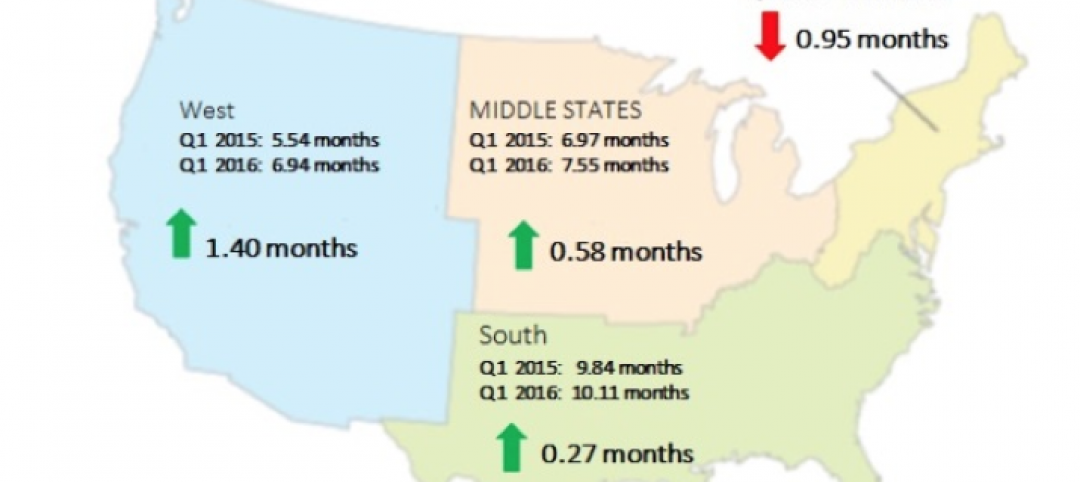

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.