Construction employment increased by 84,000 jobs in October, with jobs added in both nonresidential and residential categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned, however, that the pandemic is causing a growing number of construction projects to be canceled or delayed, according to a survey the association released in late October.

“The employment data for October is good news, but our latest survey found that only a minority of contractors expect to add to their workforce in the next 12 months,” said Ken Simonson, the association’s chief economist. “As project cancellations mount, so too will job losses on the nonresidential side unless the federal government provides funding for infrastructure and relief for contractors.”

Construction employment climbed to 7,345,000 in October, an increase of 1.2% compared to September. However, employment in the sector is down by 294,000 or 3.9% since the most recent peak in February, just before the pandemic triggered widespread project cancellations. Despite the employment pickup in October, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—remains 262,000 jobs or 5.6% below its recent peak in February, Simonson noted.

The construction economist added that residential construction, covering residential building and specialty trade contractors, has had a stronger recovery, with employment down by just 32,000 jobs or 1.1% since February. The industry’s unemployment rate in October was 6.8%, with 674,000 former construction workers idled. These figures were the lowest since the pandemic struck but considerably higher than the October 2019 figures of 4.0% and 398,000 workers, respectively, the economist added.

In the association’s October survey, which covered more than 1,000 contractors that perform all types of nonresidential and multifamily construction, three out of four respondents reported that a scheduled project had been postponed or canceled. Only 37% of respondents expect their headcount to increase over the next 12 months. That was a sharp drop from the 75% who predicted an increase in the association’s annual Hiring and Business Outlook Survey released last December.

Association officials said they were encouraged by reports that Congress plans to consider new coronavirus relief measures before the end of the year. They noted that new measures, including investments in infrastructure, new Paycheck Protection Program flexibility and tax relief, and liability reforms will help offset the impacts of the growing number of project cancellations and delays.

“Congressional leaders understand that employers cannot afford to wait until next year for relief from the broad economic impacts of the coronavirus pandemic,” said Stephen E. Sandherr, the association’s chief executive officer. “We stand ready to work with Congress to make sure any new relief measures include new infrastructure investments, tax relief and liability reform so honest firms don’t fall victim to predatory lawyers seeking to profit from the coronavirus.”

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

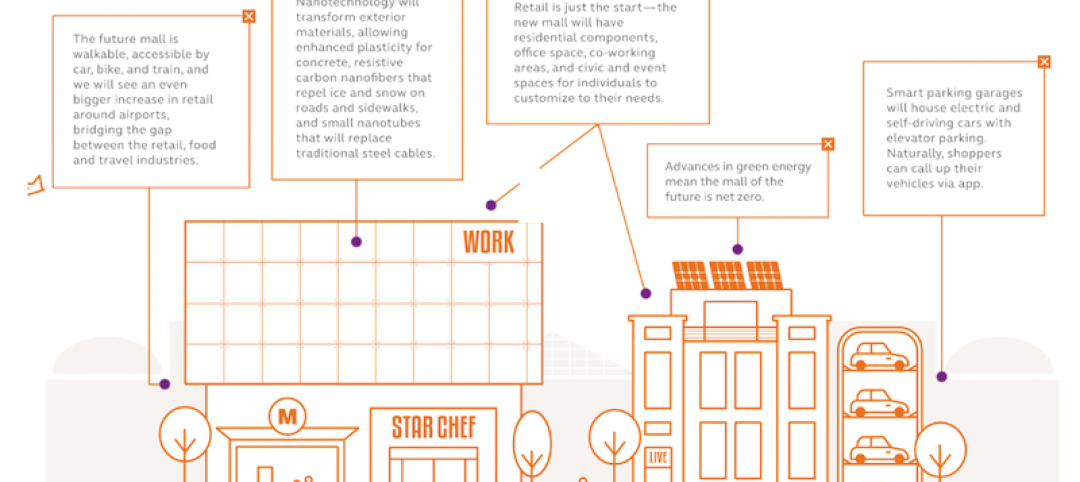

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.