Construction employment increased by 16,000 jobs in August, but the gains were concentrated in housing, while the infrastructure and nonresidential building construction sector lost 11,000 jobs, according to an analysis by the Associated General Contractors of America of government data released today. The new jobs data comes as association officials reported that a survey of more than 2000 contractors it released this week found growing pessimism about a return to normal levels of construction business amid a proliferation of project cancellations.

“Construction is becoming a tale of two sectors, as homebuilding and limited nonresidential niches thrive but most other private, as well as public, construction shrinks,” said Ken Simonson, the association’s chief economist. “These employment numbers are in line with our survey, which found a plurality of construction firms expect it will take more than six months before their volume of business matches year-ago levels.”

The AGC of America-Autodesk Workforce Survey, released on September 2, found that 38% of respondents expect it will take more than six months for their firm’s volume of business to return to normal, relative to a year earlier. In a survey the association conducted in mid-June, only 30% of firms said they expected a return to normal volume would require more than six months.

A likely reason for the more pessimistic outlook is the rapid increase in postponed or canceled projects, the economist said. He noted that the latest survey found 60% of firms report a scheduled project has been postponed or canceled, nearly double the 32% reporting cancellations in the June survey.

The employment pickup in August was limited to homebuilding, home improvement and a portion of nonresidential construction, Simonson noted. There was a rise of 27,700 jobs in residential construction employment, comprising residential building (3,200) and residential specialty trade contractors (24,500). There was a net decrease of 11,000 jobs in nonresidential construction employment, covering nonresidential building (10,200), specialty trades (-15,700) and heavy and civil engineering construction (-5,500).

The industry’s unemployment rate in August was 7.6%, with 762,000 former construction workers idled. These figures were more than double the August 2019 figures of 3.6% and 361,000 workers, respectively.

Association officials said that the commercial construction sector was likely to continue losing jobs without additional federal coronavirus relief measures. They urged Congress and the administration to pass a one-year extension to the current highway and transit law so state officials can properly plan for the next construction season. They also called for additional infrastructure funding, liability protections for contractors who are taking appropriate steps to protect workers from the coronavirus and other pro-growth measures.

“It is clear that the commercial construction industry will not begin to recover unless Washington can enact responsible new recovery measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the administration should take the opportunity to create needed new middle-class jobs, rebuild infrastructure and restore the economy.”

View the 2020 AGC of America-Autodesk Workforce Survey release and related materials.

Related Stories

Market Data | Apr 11, 2023

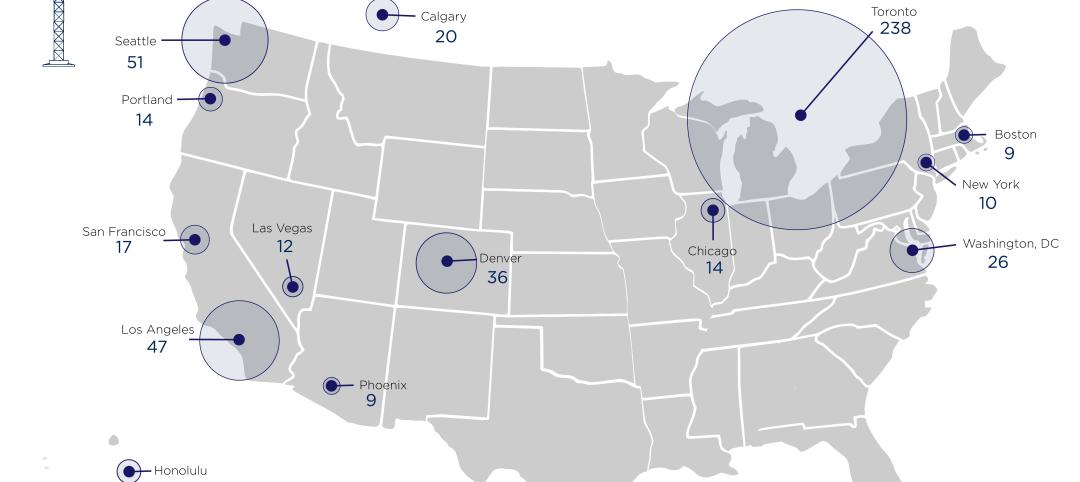

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

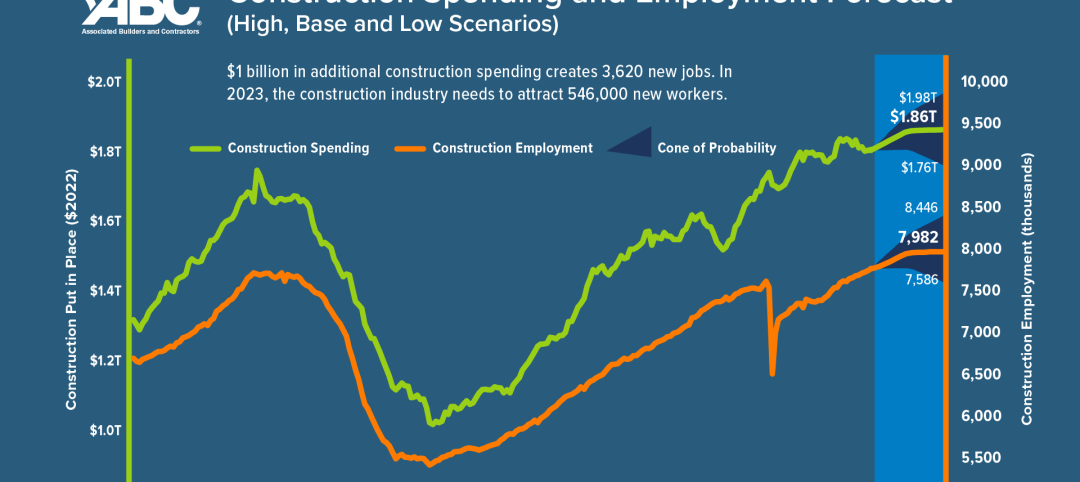

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

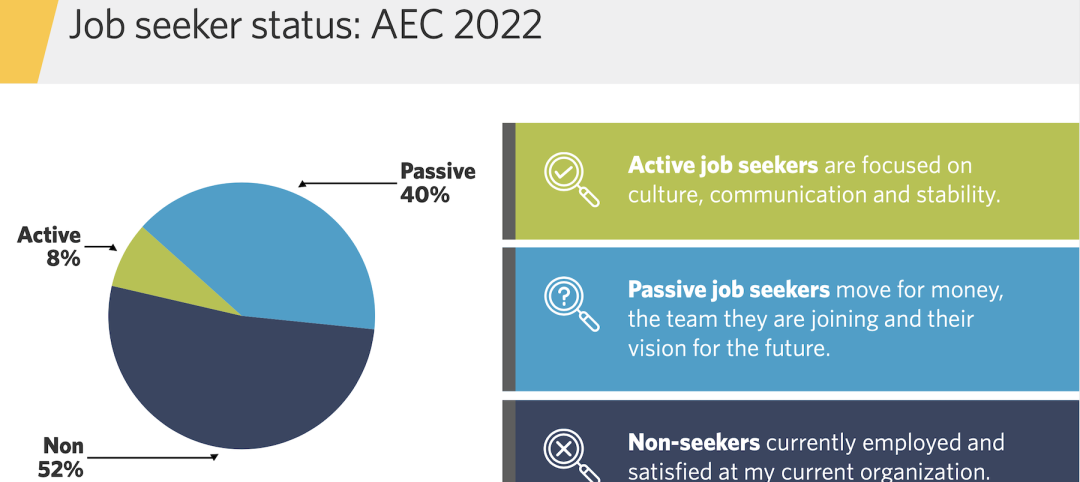

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.