Construction employment grew in 211, or 59%, out of 358 metro areas between December 2018 and December 2019, declined in 73 and was unchanged in 74, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that many firms report they are having a hard time finding enough qualified workers to hire, which likely undermined employment gains in some parts of the country.

“There are not enough qualified workers in many parts of the country for firms to be able to keep pace with strong demand for work,” said Ken Simonson, the association’s chief economist. “Construction workforce shortages appear to be holding back further job gains in many parts of the country.”

The Dallas-Plano-Irving, Texas metro area added the most construction jobs in 2019 (16,700 jobs, 11%). Other metro areas adding a large amount of construction jobs during the past 12 months include Los Angeles-Long Beach-Glendale, Calif. (12,300 jobs, 8%); Las Vegas-Henderson-Paradise, Nev. (9,400 jobs, 14%); Houston-The Woodlands-Sugar Land, Texas (9,300 jobs, 4%) and San Diego-Carlsbad, Calif. (8,600 jobs, 10%). The largest percentage gain occurred in Kansas City, Mo. (17%, 4,800 jobs), followed by Omaha-Council Bluffs, Neb.-Iowa (16%, 4,500 jobs); Auburn-Opelika, Ala. (15 percent, 400 jobs) and Rochester, N.Y. (15 percent, 3,000 jobs). Construction employment reached a new December high in 71 metro areas and a new December low in four areas.

The largest job losses between December 2018 and December 2019 occurred in New York City (-4,500 jobs, -3%), followed by Northern Virginia (-2,900 jobs, -4%); Riverside-San Bernardino-Ontario, Calif. (-2,600 jobs -3%) and Cincinnati, Ohio-Ky. (-2,400 jobs, -5%). The largest percentage decrease took place in Fairbanks, Alaska (-12%, -300 jobs), followed by Longview, Texas (-10%, -1,400 jobs); Wichita Falls, Texas (-10%, -300 jobs); Victoria, Texas (-9%, -400 jobs) and Huntington-Ashland, W.Va.-Ky.-Ohio (-9%, -700 jobs).

Association officials said workforce shortages were undermining strong employment gains in many parts of the country and urged federal officials to take steps to encourage more people to pursue high-paying construction careers. These steps include doubling federal investments in career and technical education to expose more students to construction career opportunities. And they called on Washington officials to establish a temporary work visa program to allow people with construction skills to work in markets impacted by labor shortages.

“Given the current state of demand for their services, many construction firms would be hiring more workers if only they could find them,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of convincing young adults to go into debt to pay for college, Congress and the administration should expose them to other options, including high-paying construction careers.”

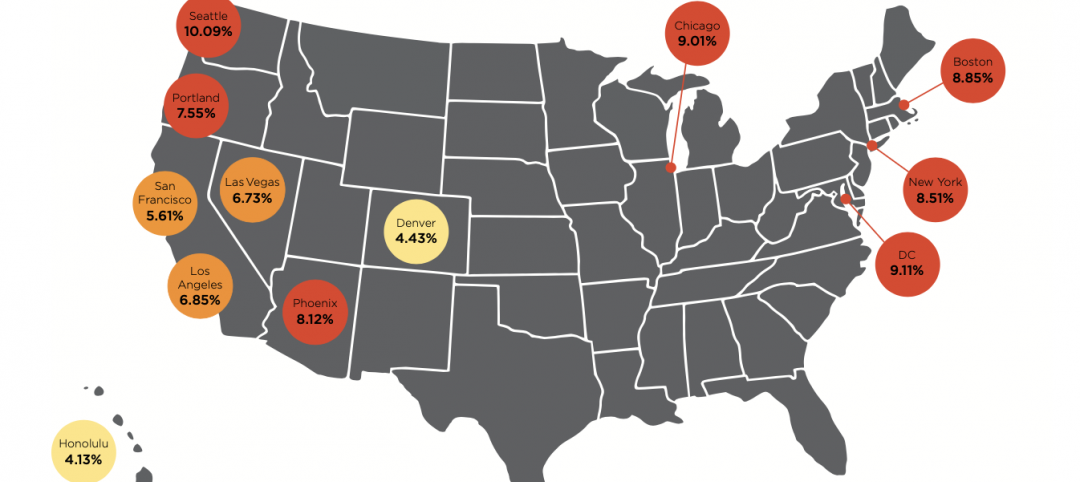

View the metro employment data, rankings, top 10, history and map.

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.