Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

AEC Tech | Feb 28, 2024

How to harness LIDAR and BIM technology for precise building data, equipment needs

By following the Scan to Point Cloud + Point Cloud to BIM process, organizations can leverage the power of LIDAR and BIM technology at the same time. This optimizes the documentation of existing building conditions, functions, and equipment needs as a current condition and as a starting point for future physical plant expansion projects.

Data Centers | Feb 28, 2024

What’s next for data center design in 2024

Nuclear power, direct-to-chip liquid cooling, and data centers as learning destinations are among the emerging design trends in the data center sector, according to Scott Hays, Sector Leader, Sustainable Design, with HED.

Windows and Doors | Feb 28, 2024

DOE launches $2 million prize to advance cost-effective, energy-efficient commercial windows

The U.S. Department of Energy launched the American-Made Building Envelope Innovation Prize—Secondary Glazing Systems. The program will offer up to $2 million to encourage production of high-performance, cost-effective commercial windows.

AEC Innovators | Feb 28, 2024

How Suffolk Construction identifies ConTech and PropTech startups for investment, adoption

Contractor giant Suffolk Construction has invested in 27 ConTech and PropTech companies since 2019 through its Suffolk Technologies venture capital firm. Parker Mundt, Suffolk Technologies’ Vice President–Platforms, recently spoke with Building Design+Construction about his company’s investment strategy.

Performing Arts Centers | Feb 27, 2024

Frank Gehry-designed expansion of the Colburn School performing arts center set to break ground

In April, the Colburn School, an institute for music and dance education and performance, will break ground on a 100,000-sf expansion designed by architect Frank Gehry. Located in downtown Los Angeles, the performing arts center will join the neighboring Walt Disney Concert Hall and The Grand by Gehry, forming the largest concentration of Gehry-designed buildings in the world.

Construction Costs | Feb 27, 2024

Experts see construction material prices stabilizing in 2024

Gordian’s Q1 2024 Quarterly Construction Cost Insights Report brings good news: Although there are some materials whose prices have continued to show volatility, costs at a macro level are returning to a level of stability, suggesting predictable historical price escalation factors.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Architects | Feb 21, 2024

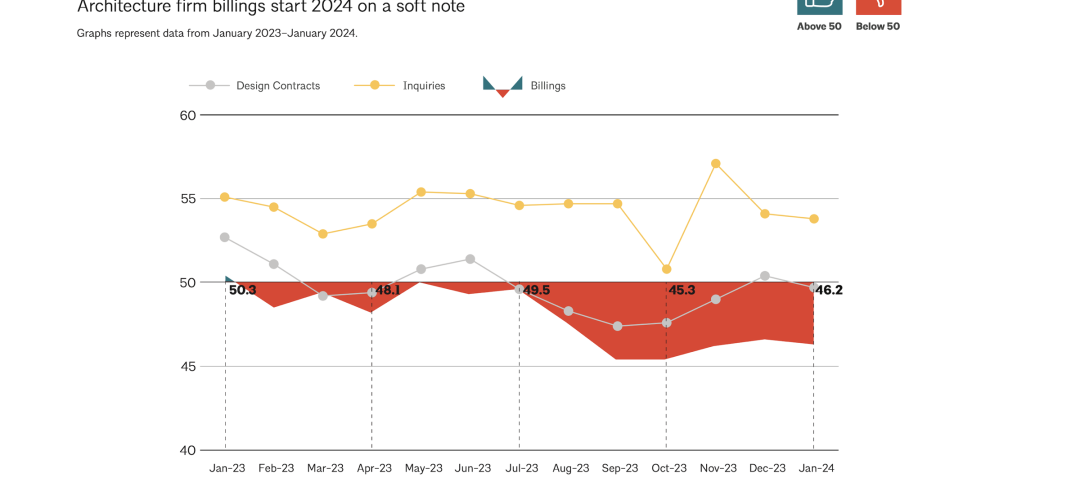

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

AEC Tech | Feb 20, 2024

AI for construction: What kind of tool can artificial intelligence become for AEC teams?

Avoiding the hype and gathering good data are half the battle toward making artificial intelligence tools useful for performing design, operational, and jobsite tasks.