Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Architects | Feb 21, 2024

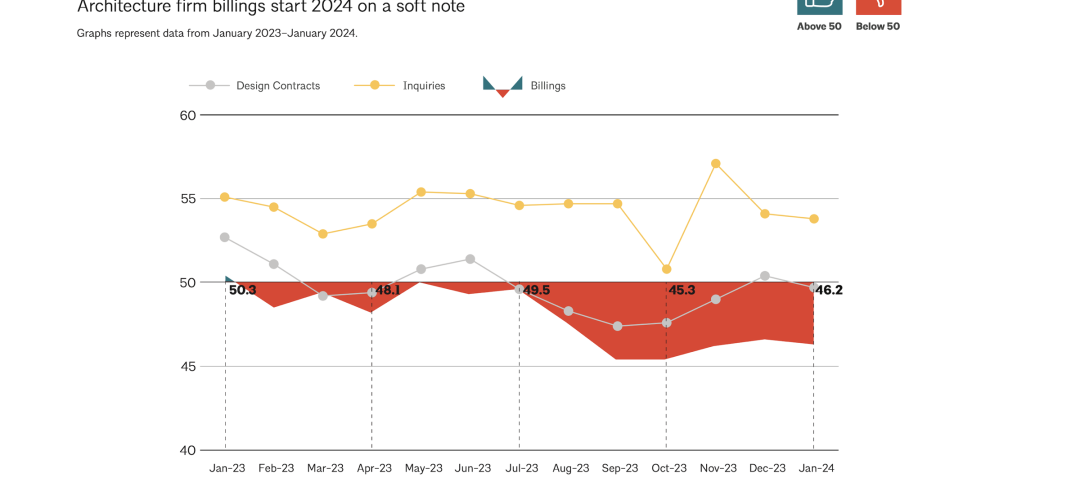

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

AEC Tech | Feb 20, 2024

AI for construction: What kind of tool can artificial intelligence become for AEC teams?

Avoiding the hype and gathering good data are half the battle toward making artificial intelligence tools useful for performing design, operational, and jobsite tasks.

Building Tech | Feb 20, 2024

Construction method featuring LEGO-like bricks wins global innovation award

A new construction method featuring LEGO-like bricks made from a renewable composite material took first place for building innovations at the 2024 JEC Composites Innovation Awards in Paris, France.

AEC Tech | Feb 20, 2024

ABC releases technology guide for AI in construction

Associated Builders and Contractors has released an artificial intelligence (AI) technology guide for the U.S. construction industry. AI in Construction — What Does It Mean for Our Contractors? outlines definitions, construction use cases, and considerations for the implementation of AI in construction.

Codes and Standards | Feb 20, 2024

AISC, AIA release second part of design assist guidelines for the structural steel industry

The American Institute of Steel Construction and AIA Contract Documents have released the second part of a document intended to provide guidance for three common collaboration strategies.

Student Housing | Feb 19, 2024

UC Law San Francisco’s newest building provides student housing at below-market rental rates

Located in San Francisco’s Tenderloin and Civic Center neighborhoods, UC Law SF’s newest building helps address the city’s housing crisis by providing student housing at below-market rental rates. The $282 million, 365,000-sf facility at 198 McAllister Street enables students to live on campus while also helping to regenerate the neighborhood.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.