The news this week that the regional First Republic Bank lost $102 billion in bank deposits in the first quarter of 2023—more than half of the $176 billion the bank was holding at the end of last year—was further evidence that investors and depositors are more than a little jittery about the financial condition of the banking industry.

While First Republic stated that its deposit-and-withdrawal activities had stabilized in late March and mid April, the bank is also in the process of reducing its workforce by one quarter and slashing its executive compensation.

First Republic’s travails, coupled with the recent takeover of Silicon Valley Bank and Signature Bank by federal regulators, has industry observers wondering whether these bank failures are signs of something more ominous. This is particularly true among real estate developers that rely heavily on bank lenders to capitalize their purchases and projects.

To sort out the latest banking turmoil and where the Commercial Real Estate (CRE) sector fits in, Cushman & Wakefield on April 19 posted a list of 14 frequently asked questions and weighed in on each. The topics touched on:

•What happened?

•How is this different from other banking failures?

•Why is commercial real estate in the limelight?

•What key metrics bear watching?

“Don’t panic,” C&W advises. But developers should also be aware that recent banking failures have toughened the lending environment; the percentage of banks that say they have tightened their lending standards for CRE loans and other business loans is the highest it’s been in 13 years.

“There are reasons to be both optimistic and concerned,” says C&W. “The sky isn’t falling; at this stage, it’s more overcast than anything else.”

This doesn't look like mid-2000s déjà vu

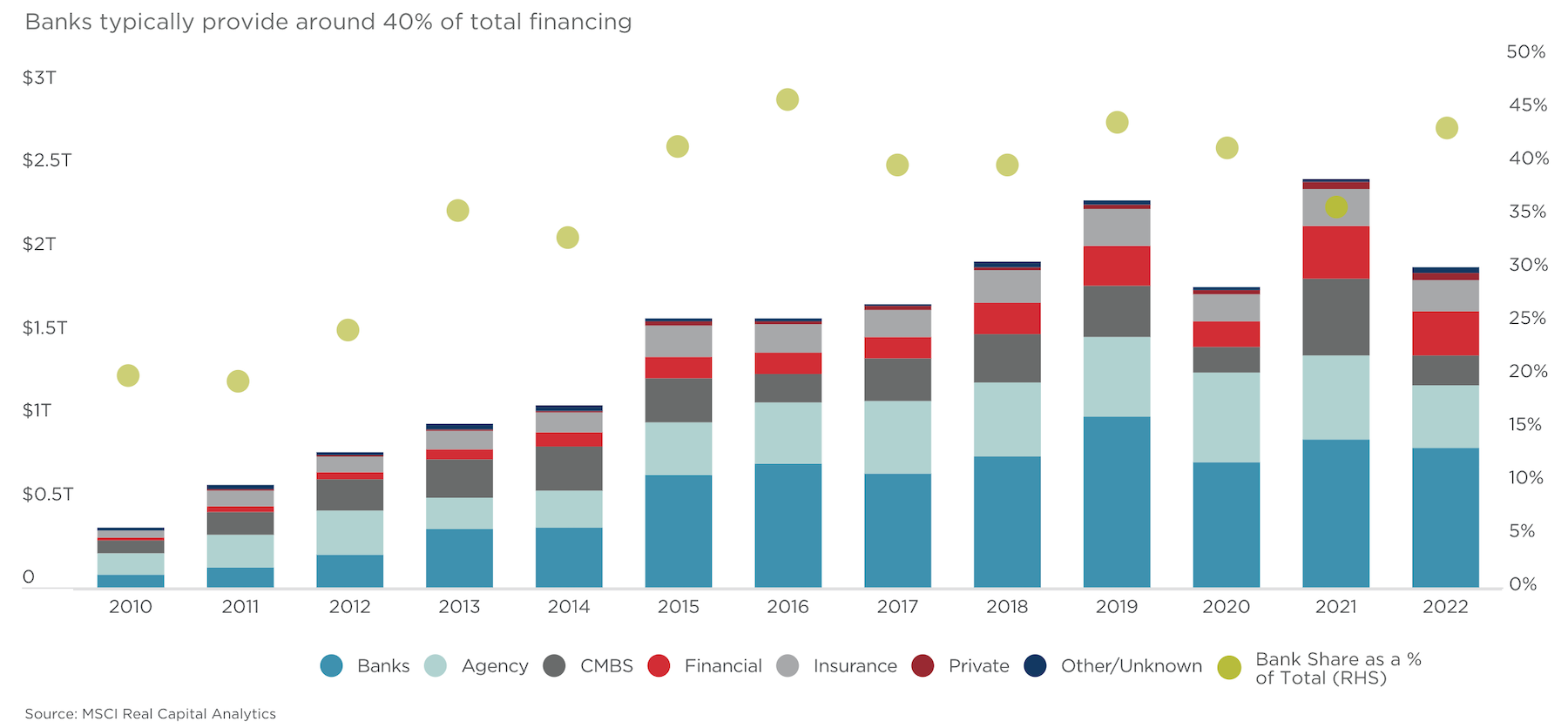

Of all the sources the CRE sector turns to for money, banks provide between 40 and 45 percent of the sector’s financing. Community and regional banks “are the lifeblood of the CRE lending landscape,” says Cushman & Wakefield. And smaller banks are responsible for the majority of multifamily, nonfarm residential, and acquisition/development/construction loan lending.

The failures of a handful of banks, out of a total of more than 5,000, don’t qualify as a crisis. And the banks that have failed in recent months had idiosyncratic factors that contributed to their unraveling. For example, C&W observes that, in the failures of Signature Bank and Silvergate Bank (the latter of which started liquidation proceedings in March), “underlying losses in the value of cryptocurrency served to act as a deposit outflow prior to outright withdrawals happening.”

C&W states that while no bank can survive a run on its deposits, and that a few more failures wouldn’t be a surprise, the U.S. banking system as a whole remains “well capitalized,” with most bank deposits spread across an array of sectors and individuals. The key in the future, C&W says, will be sustaining confidence in the solvency of that system.

It's worth noting that lenders had been pulling back on their CRE lending since last summer, homing in on high-quality assets like industrial and multifamily. C&W is keeping an eye on how the debt market perceives risk for CRE borrowers. On a broader scale, C&W is watching deposit flows, lending patterns to see how banks are navigating incoming maturities, liquidity based on the Federal Reserve’s provision of credit to banks, and jobless claims and inflation, which could be signs of recession.

Recent banking failures haven’t altered Cushman & Wakefield’s prediction of a mild recession in 2023 that will abate as tighter credit and slower economic growth stem inflation.

What C&W doesn’t predict is a repeat of the Great Financial Crisis of the mid-2000s. The financial system is “much stronger” now, and policymakers are responding to problems much quicker and aggressively. The size of the banking failures (so far, at least) is much smaller, and those failures relate not so much to credit but to the ramifications of a rising-rate environment and its impact on bond and securities values.

Most development is an attractive risk

Any weaknesses in the CRE sector will pose challenges to lenders. C&W doesn’t expect those weaknesses to pose a systemic banking sector failure. But, it cautions, there could be isolated instances of loan or credit stress for the banking sector, stemming from any combination of factors that might include oncoming loan maturity, a diminishing of underlying asset value, or deteriorating cash flows.

What does this mean for companies that are leasing space? C&W predicts that most property types will shift toward a tenant-friendlier environment. But landlords will also favor higher-quality tenants “to ensure the viability of the lease agreement.” For companies leasing space in ongoing construction, “the good news is that most development is considered to be attractive on a risk-adjusted basis.” So even if banks pull back, other lending groups are likely to step into that breech.

For signposts about what might happen next, C&W recommends following commercial mortgage-backed securities loan performance data across the CRE industry, and measuring that data against CRE debt financing. It might also be insightful to track prevailing underwriting standards and banks’ forward-looking expectations for the credit market.

What C&W doesn’t recommend is overreacting to the recent failure of Credit Suisse, and its takeover by rival UBS, as indicators of a European domino effect to what’s happening in the U.S.

Related Stories

Industry Research | Nov 4, 2016

New survey exposes achievement gap between men and women designers

Female architects still feel disadvantaged when it comes to career advancement.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Industry Research | Nov 1, 2016

Perkins Eastman Research releases white paper on ‘Centers for Healthy Living’ and whole-person wellness

Among the spotlight projects used as case studies for this white paper are C.C. Young, Dallas, Texas; Clark-Lindsey Village, Urbana, Ill.; Moorings Park, Naples, Fla.; NewBridge on the Charles, Dedham, Mass.; Rockwood Retirement Living: The Summit, Spokane, Wash.; Saint John’s on the Lake, Milwaukee, Wis.; and Spring Lake Village, Santa Rosa, Calif.

Market Data | Oct 31, 2016

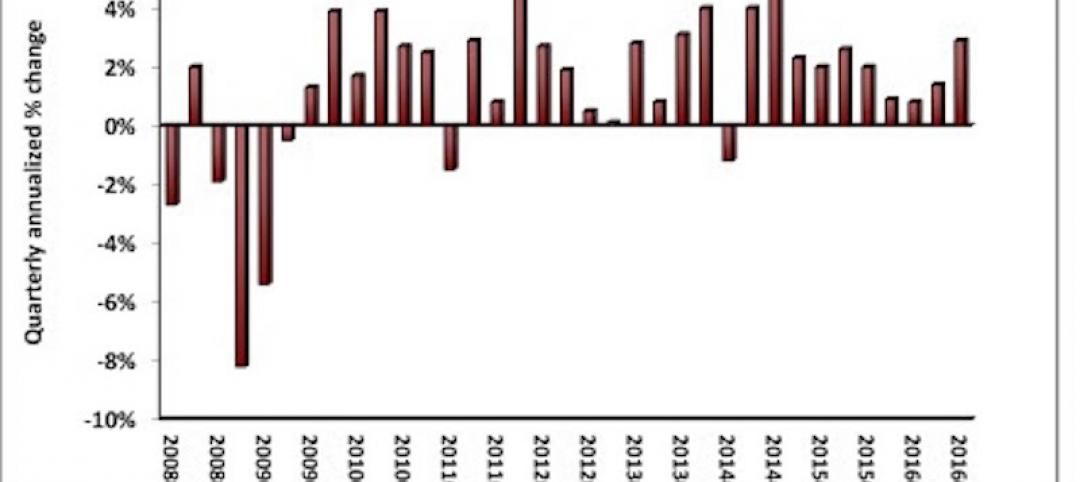

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

Industry Research | Oct 20, 2016

New book from HDR explores opportunities for how healthcare organizations can reinvent the patient experience

Delta offers a close look at specific activities and behaviors that can help healthcare providers and caregivers discover revolutionary concepts to help them embrace and thrive in the rapid change that surrounds them.

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion