The institutional investment capital that’s been flowing into real estate globally is expected to increase as an already rebounding economy expands. But there’s also a growing consensus among real estate professionals that environmental, social, and governance (ESG) elements will factor more impactfully—and uncertainly—into future development. Broader housing affordability is one of those elements that could create diverse workforces and drive equitable outcomes.

These are some of the trends that arise from a survey of industry experts whose responses form the basis of “Emerging Trends in Real Estate 2022,” the 43rd edition of this series, which was released today. (To download the full report, click here.)

Researchers for the latest report’s co-sponsors, PwC and Urban Land Institute (ULI), interviewed 930 individuals and evaluated survey responses from another 1,200. Private property owners or commercial/multifamily real estate developers accounted for 35% of the respondents; real estate advisory, service, or asset managers 22%.

Among the AEC firms whose representatives were interviewed were BOKA Powell, Brasfield & Gorrie, CM Constructors, Gensler, Kimley Horn, Malasri Engineering, Swinerton, STG Design, Tenet Design, and Turner Construction.

The 100-page report lays out the challenges that lie ahead for the real estate sector to cope with changing consumer expectations and a “massive shift” in the functionality of homes, offices, retail, and healthcare spaces. “Property markets that were once predictable will likely remain in a bubble of uncertainty,” the reports states. It will also be “imperative” for businesses’ strategies to approach environmental, social, and governance issues holistically.

IS HOUSING AFFORDABILITY INTRACTABLE?

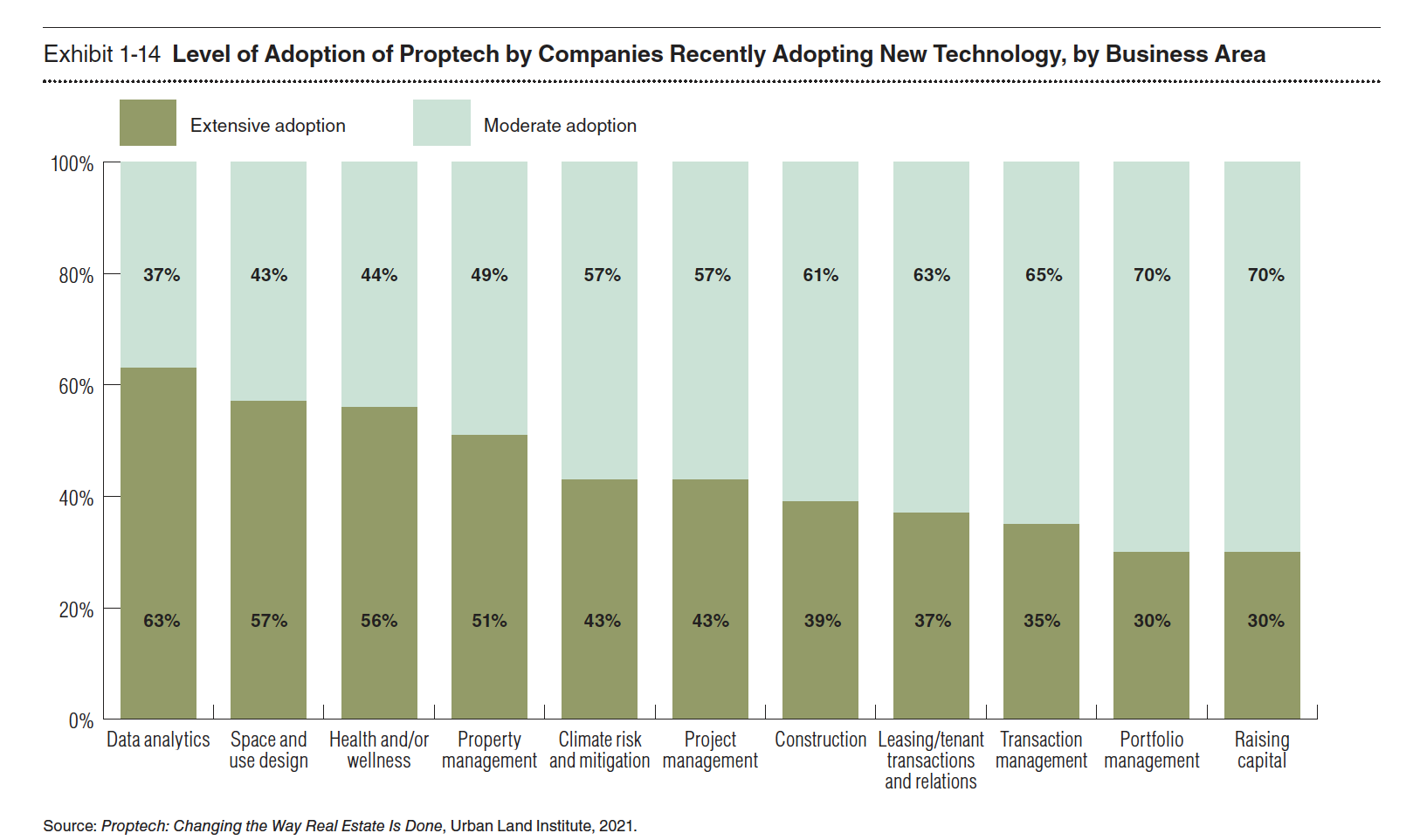

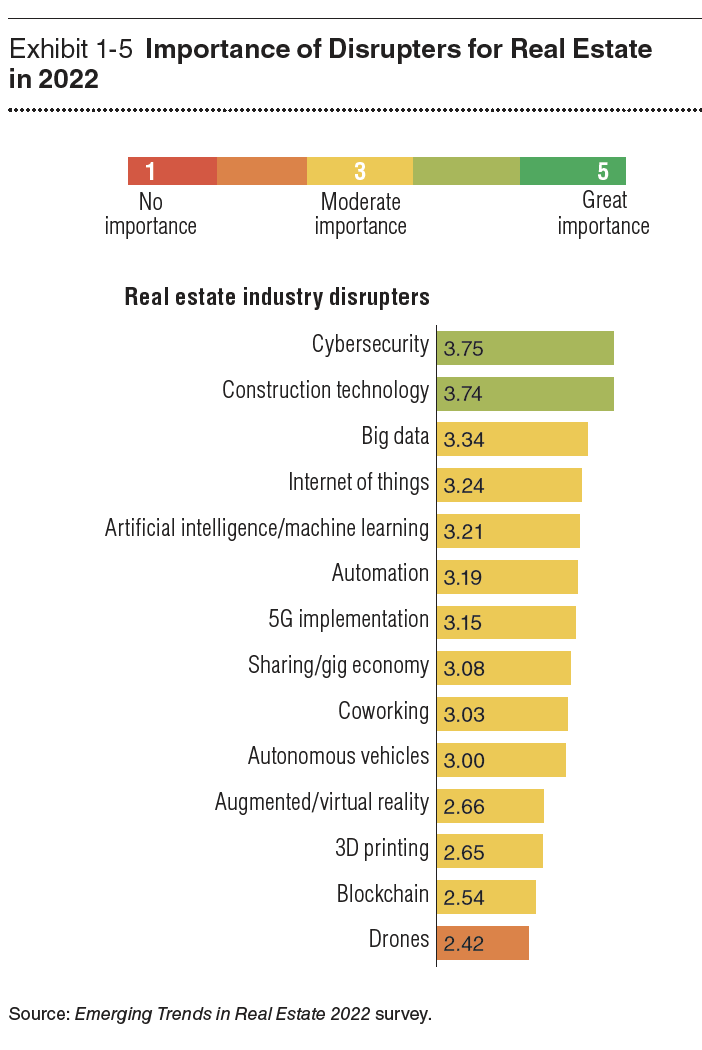

The report finds the real estate community optimistic about its future, and the main reason is “an abundance of investable capital, low interest rates, and continued demand for many product types,” says Byron Carlock, a Partner and U.S. Real Estate Practice Leader for PwC. The real estate industry is also finally getting into the 21st Century by adopting technology to assess investments and manage properties. But despite higher acceptance, property technology “still has significant areas of future growth,” the report states.

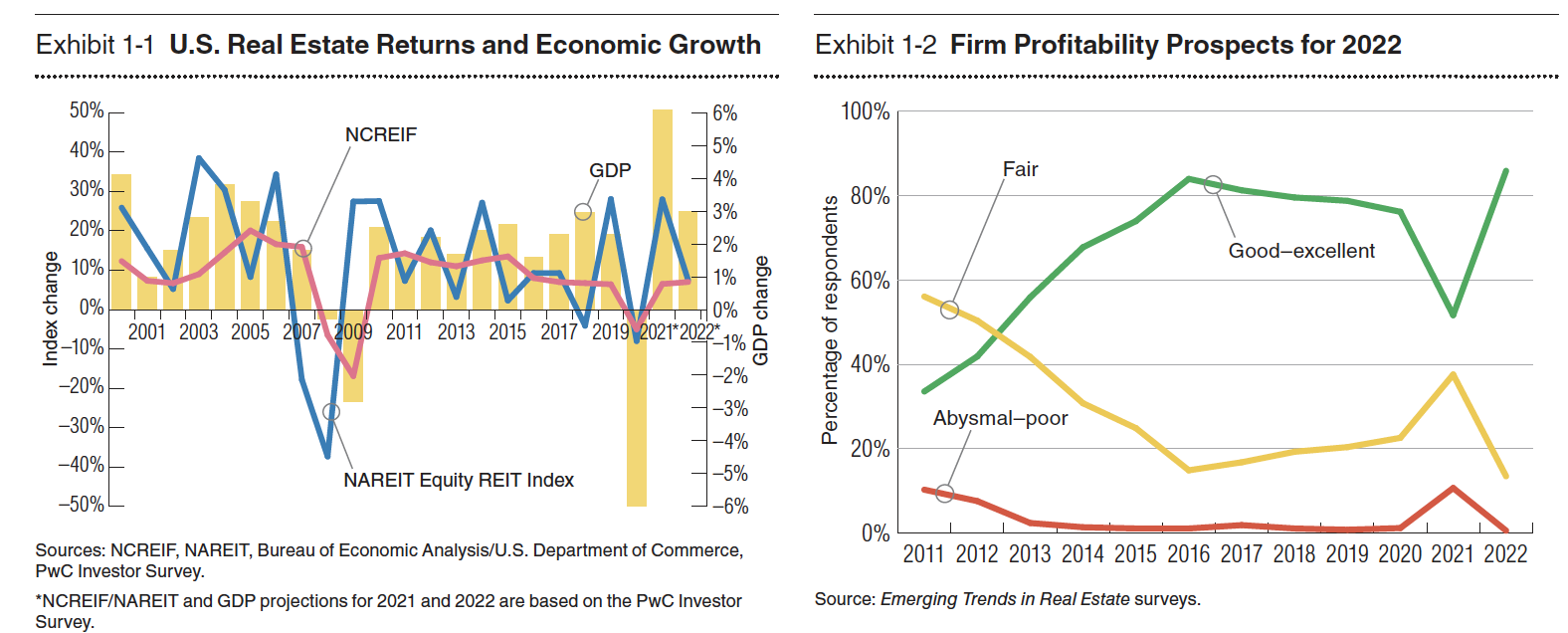

The report highlights several other trends that include a rebound from a COVID-19 induced “brief and muted real estate downturn” in real estate investment. Economic output is forecasted to grow “at the highest rate in decades” in 2021 and 2022. One area of concern, however, is housing affordability, which “worsened” during the pandemic and as the economy reopened. “Affordability will likely continue to deteriorate in the absence of significant private-sector and government intervention,” the report asserts.

Remarkably, 82% of respondents claimed that their companies consider ESG elements when making operational or investment decisions. However, the report also observes that investors “have been slow to incorporate environmental risks into underwriting.”

THE SUNBELT OFFERS FERTILE CRE PROSPECTS

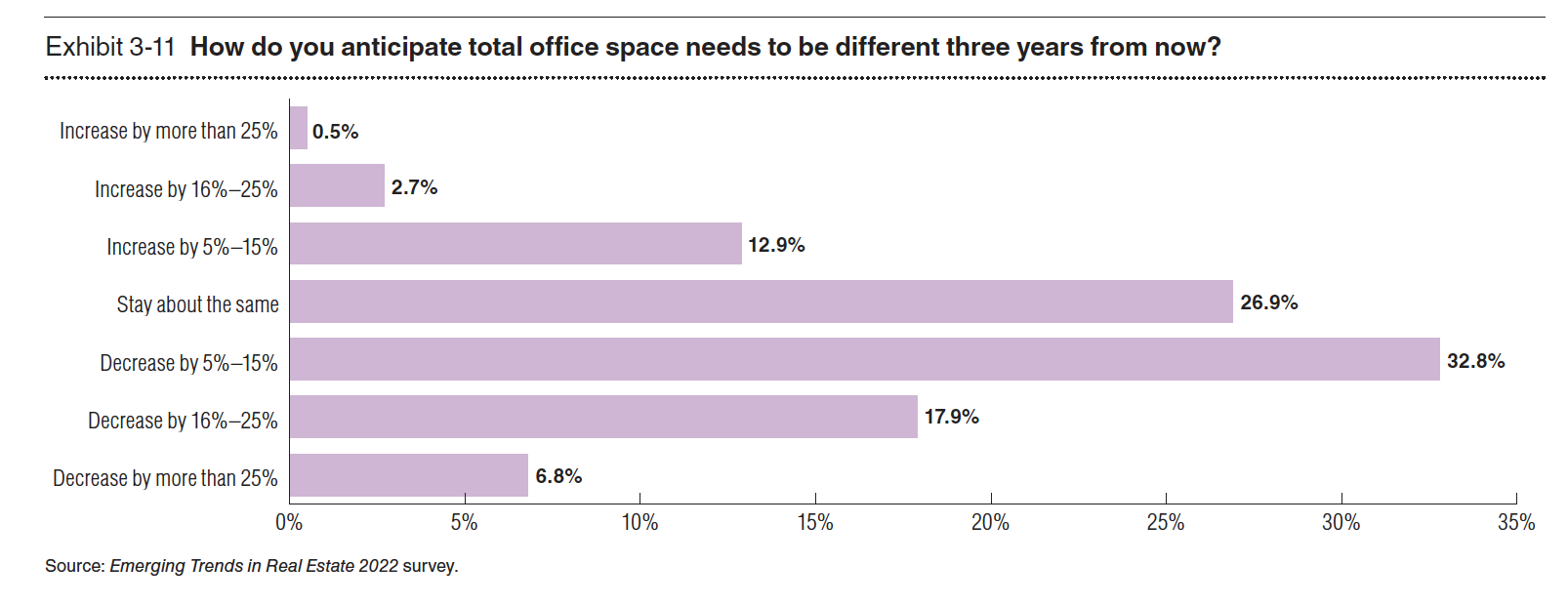

One of the question marks in the real estate sector revolves around the future value of office space. Nearly two-thirds of the report’s respondents believe that fewer than 75% of workers will return to their offices at least three days a week in 2022. In fact, industry leaders predict that the need for office space will decrease by 5-15 percent in the next three years. This trend is already leading to redesigns of offices for hybrid work patterns and flexible usage.

The office conundrum is compounded by what the report calls the Great Relocation, where highly paid office workers are moving away from their workplaces. The report’s authors think this phenomenon could create more of a suburban and Sun Belt future. “Sun Belt metropolitan areas account for the eight to-rated overall real estate prospects [and] occupy the top five places in the homebuilding prospects rating.”

Nashville was identified as the No. 1 market for real estate prospects, based on growth, homebuilding, affordability, and employment opportunity. It was followed by Raleigh-Durham, N.C., Phoenix, Austin, Texas, Tampa-St. Petersburg, Fla., Charlotte, Dallas-Fort Worth, Atlanta, Seattle, and Boston.

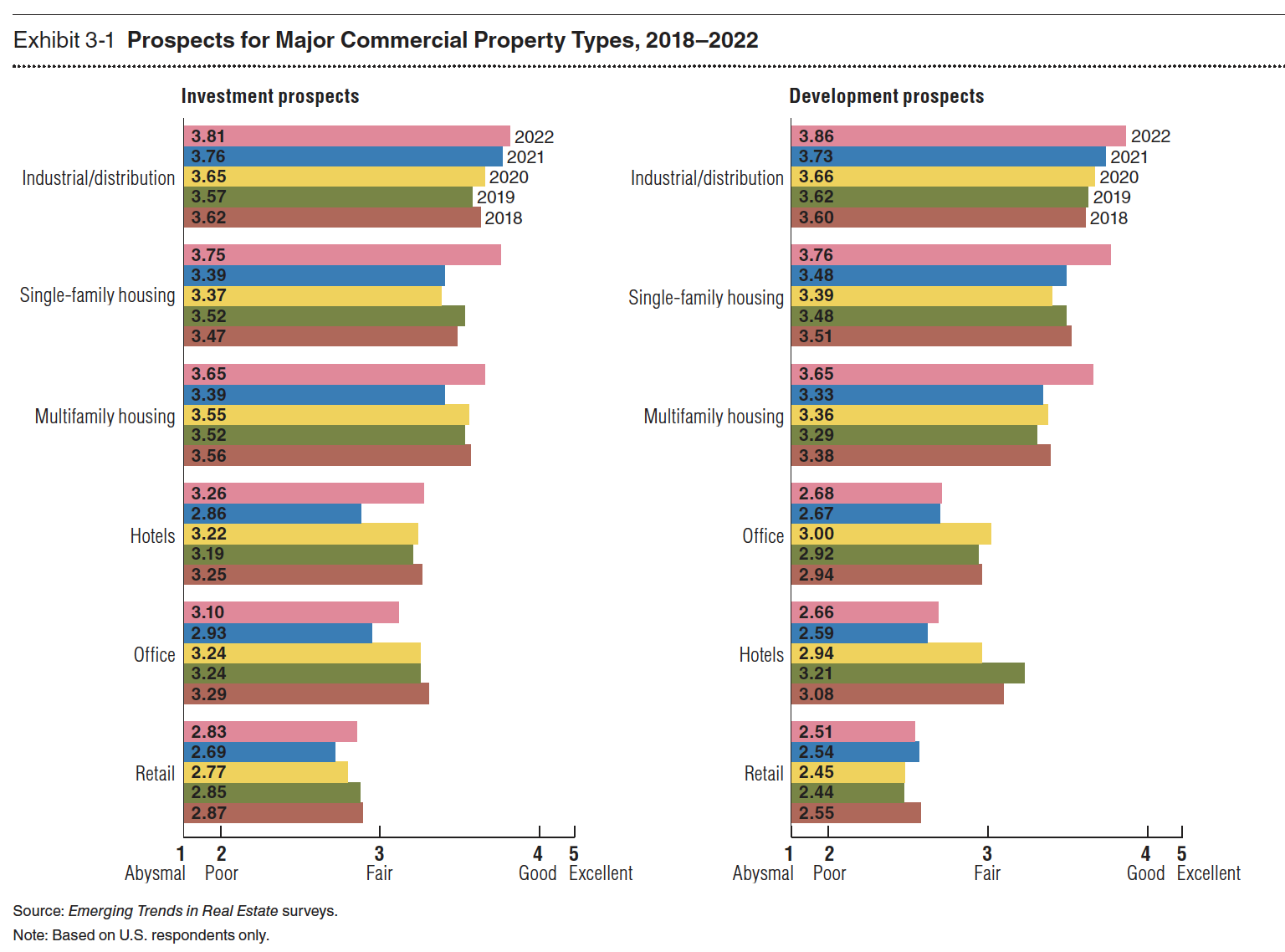

The report points out as well that investors and Real Estate Investment Trusts (REITs) are now more disposed to consider alternative sectors like student and senior housing, life sciences, and industrial. These sectors, the report explains, offer higher returns at lower prices. They are less volatile to business cycles, too.

Related Stories

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.