The institutional investment capital that’s been flowing into real estate globally is expected to increase as an already rebounding economy expands. But there’s also a growing consensus among real estate professionals that environmental, social, and governance (ESG) elements will factor more impactfully—and uncertainly—into future development. Broader housing affordability is one of those elements that could create diverse workforces and drive equitable outcomes.

These are some of the trends that arise from a survey of industry experts whose responses form the basis of “Emerging Trends in Real Estate 2022,” the 43rd edition of this series, which was released today. (To download the full report, click here.)

Researchers for the latest report’s co-sponsors, PwC and Urban Land Institute (ULI), interviewed 930 individuals and evaluated survey responses from another 1,200. Private property owners or commercial/multifamily real estate developers accounted for 35% of the respondents; real estate advisory, service, or asset managers 22%.

Among the AEC firms whose representatives were interviewed were BOKA Powell, Brasfield & Gorrie, CM Constructors, Gensler, Kimley Horn, Malasri Engineering, Swinerton, STG Design, Tenet Design, and Turner Construction.

The 100-page report lays out the challenges that lie ahead for the real estate sector to cope with changing consumer expectations and a “massive shift” in the functionality of homes, offices, retail, and healthcare spaces. “Property markets that were once predictable will likely remain in a bubble of uncertainty,” the reports states. It will also be “imperative” for businesses’ strategies to approach environmental, social, and governance issues holistically.

IS HOUSING AFFORDABILITY INTRACTABLE?

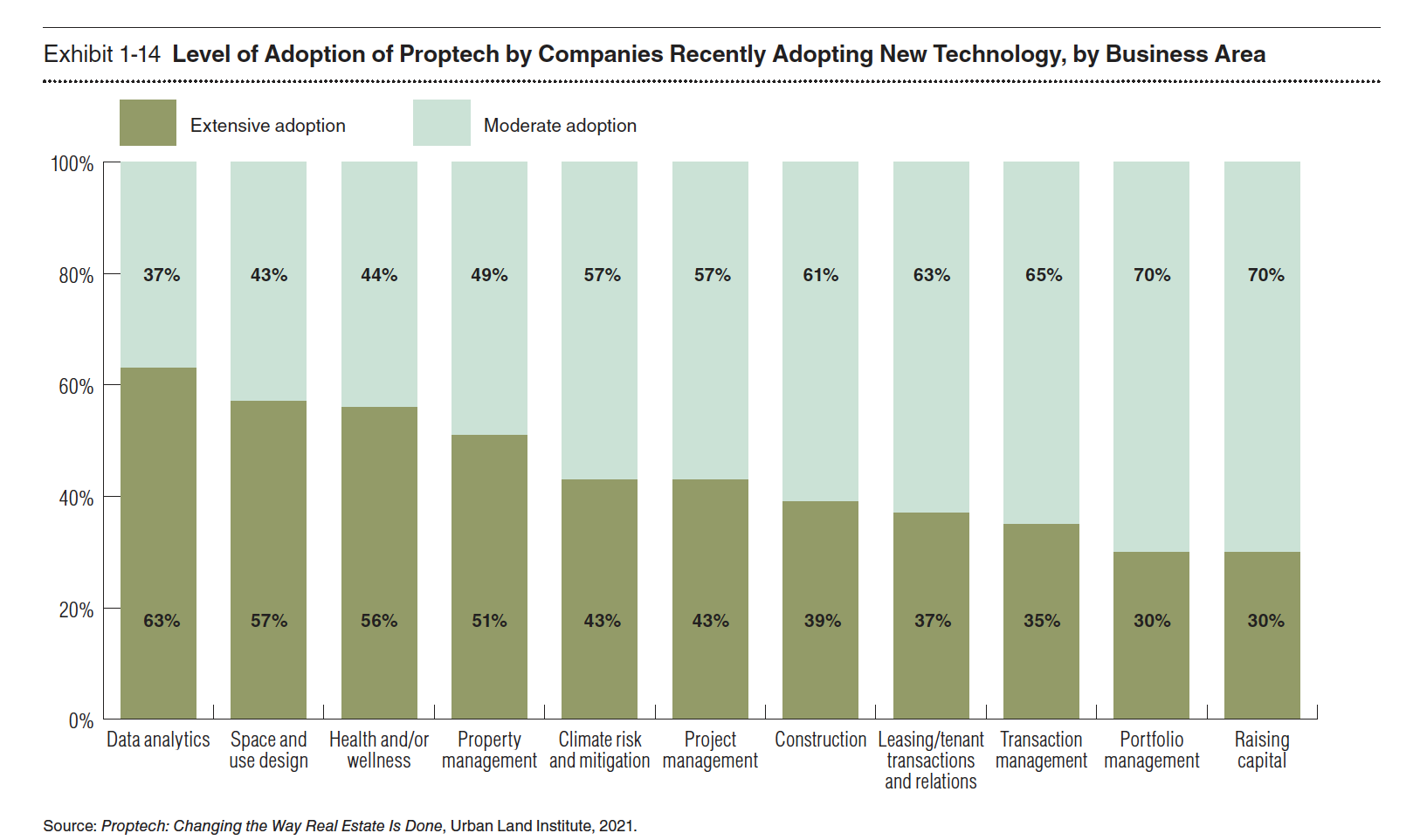

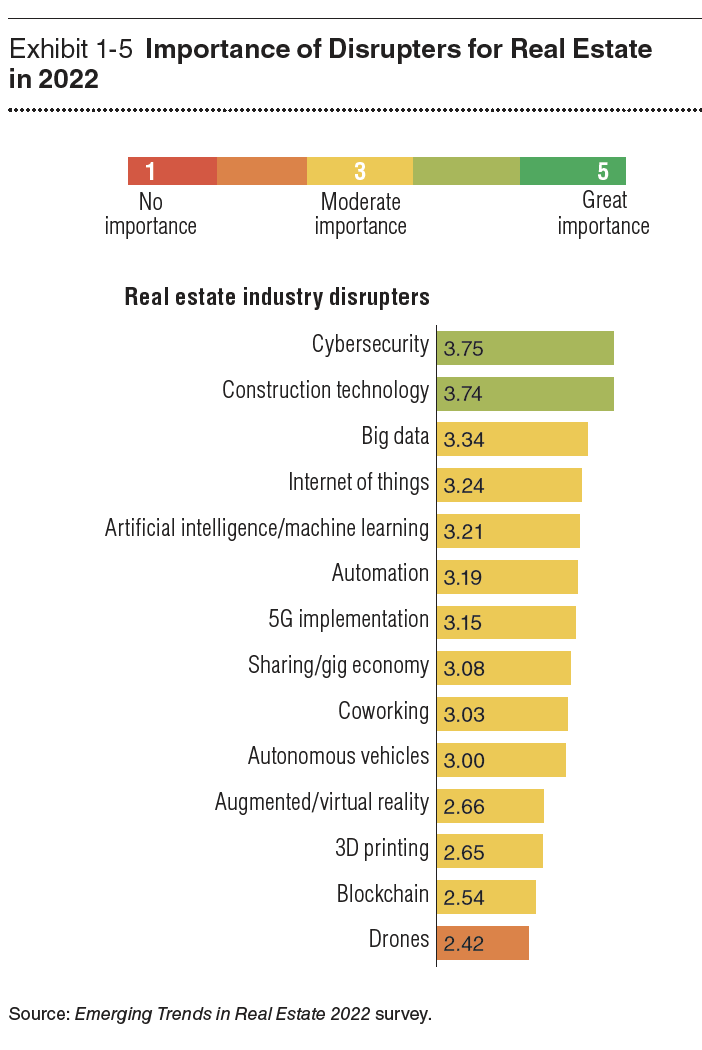

The report finds the real estate community optimistic about its future, and the main reason is “an abundance of investable capital, low interest rates, and continued demand for many product types,” says Byron Carlock, a Partner and U.S. Real Estate Practice Leader for PwC. The real estate industry is also finally getting into the 21st Century by adopting technology to assess investments and manage properties. But despite higher acceptance, property technology “still has significant areas of future growth,” the report states.

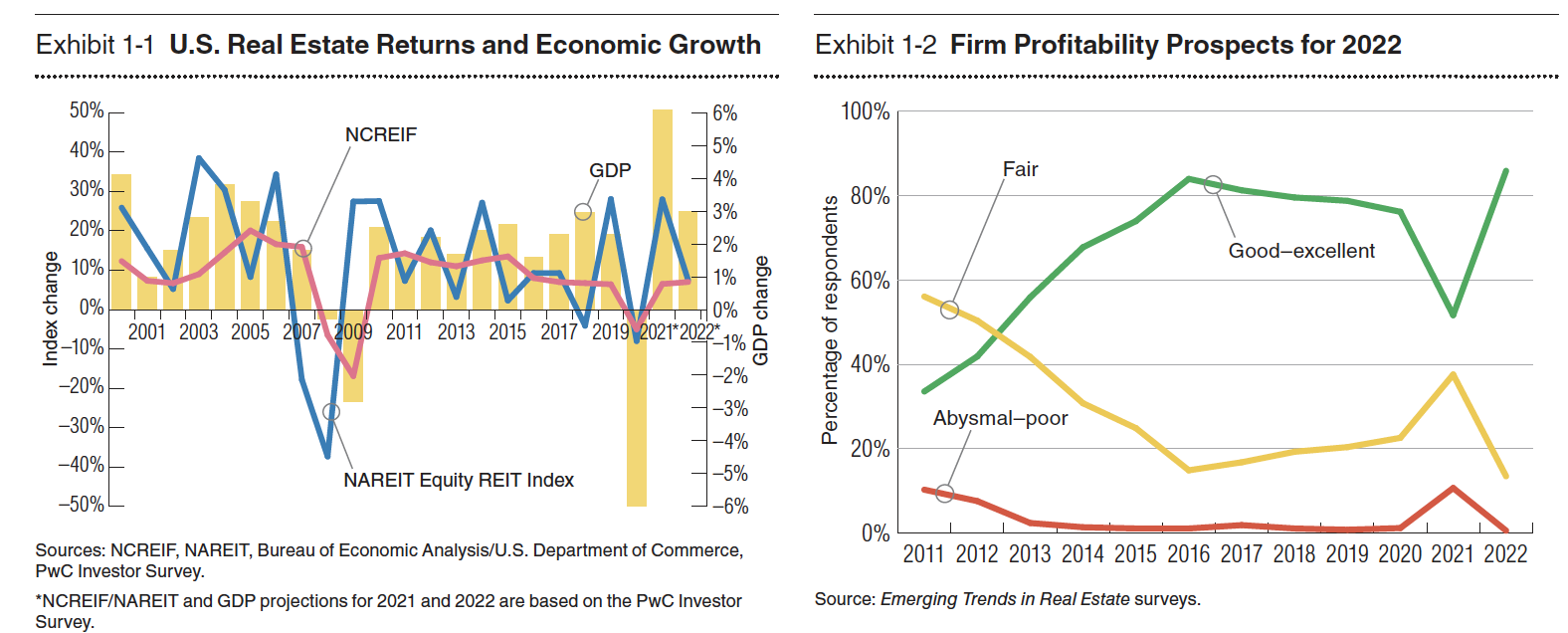

The report highlights several other trends that include a rebound from a COVID-19 induced “brief and muted real estate downturn” in real estate investment. Economic output is forecasted to grow “at the highest rate in decades” in 2021 and 2022. One area of concern, however, is housing affordability, which “worsened” during the pandemic and as the economy reopened. “Affordability will likely continue to deteriorate in the absence of significant private-sector and government intervention,” the report asserts.

Remarkably, 82% of respondents claimed that their companies consider ESG elements when making operational or investment decisions. However, the report also observes that investors “have been slow to incorporate environmental risks into underwriting.”

THE SUNBELT OFFERS FERTILE CRE PROSPECTS

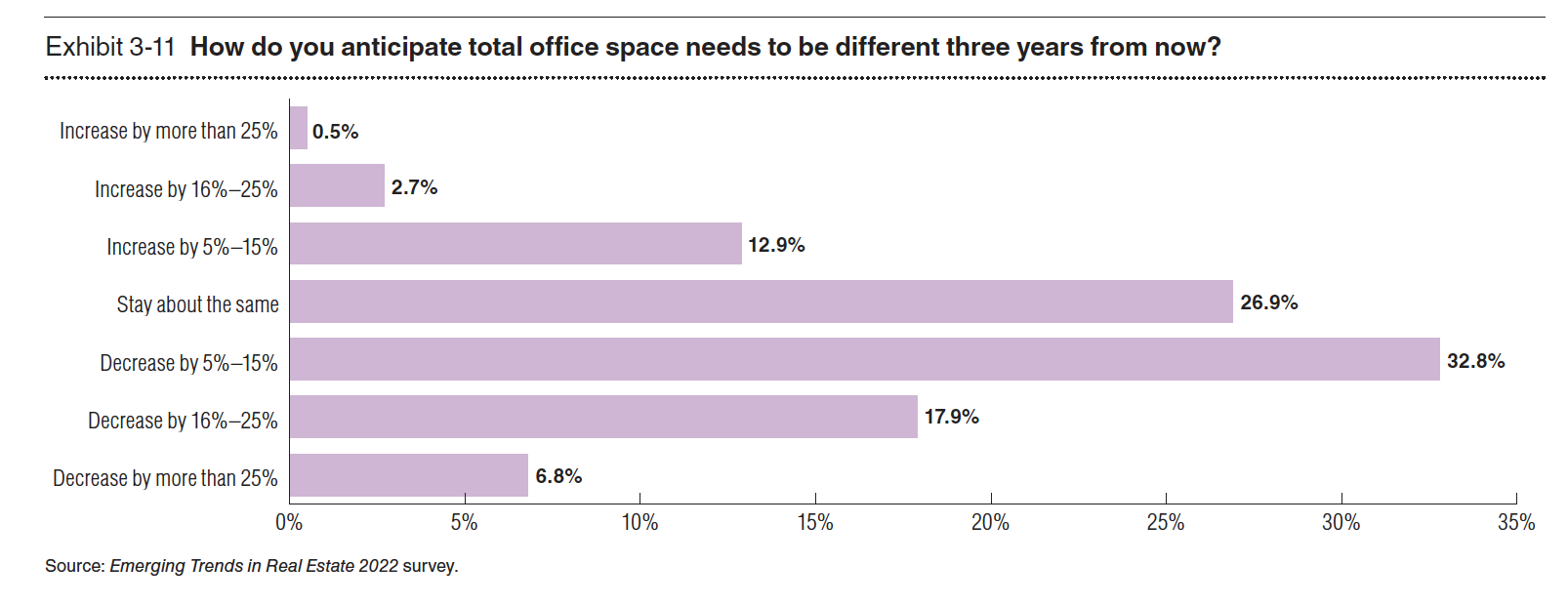

One of the question marks in the real estate sector revolves around the future value of office space. Nearly two-thirds of the report’s respondents believe that fewer than 75% of workers will return to their offices at least three days a week in 2022. In fact, industry leaders predict that the need for office space will decrease by 5-15 percent in the next three years. This trend is already leading to redesigns of offices for hybrid work patterns and flexible usage.

The office conundrum is compounded by what the report calls the Great Relocation, where highly paid office workers are moving away from their workplaces. The report’s authors think this phenomenon could create more of a suburban and Sun Belt future. “Sun Belt metropolitan areas account for the eight to-rated overall real estate prospects [and] occupy the top five places in the homebuilding prospects rating.”

Nashville was identified as the No. 1 market for real estate prospects, based on growth, homebuilding, affordability, and employment opportunity. It was followed by Raleigh-Durham, N.C., Phoenix, Austin, Texas, Tampa-St. Petersburg, Fla., Charlotte, Dallas-Fort Worth, Atlanta, Seattle, and Boston.

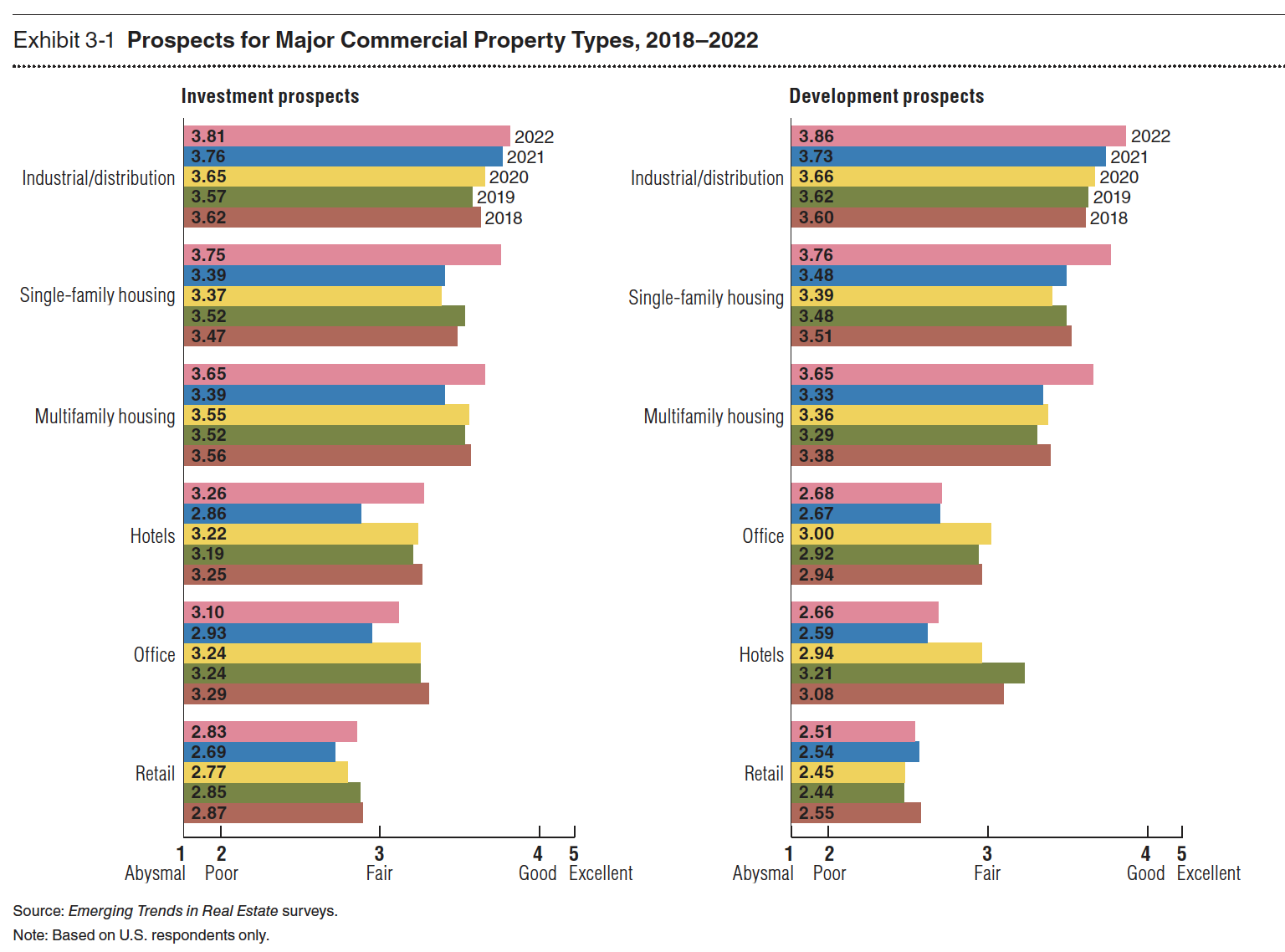

The report points out as well that investors and Real Estate Investment Trusts (REITs) are now more disposed to consider alternative sectors like student and senior housing, life sciences, and industrial. These sectors, the report explains, offer higher returns at lower prices. They are less volatile to business cycles, too.

Related Stories

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

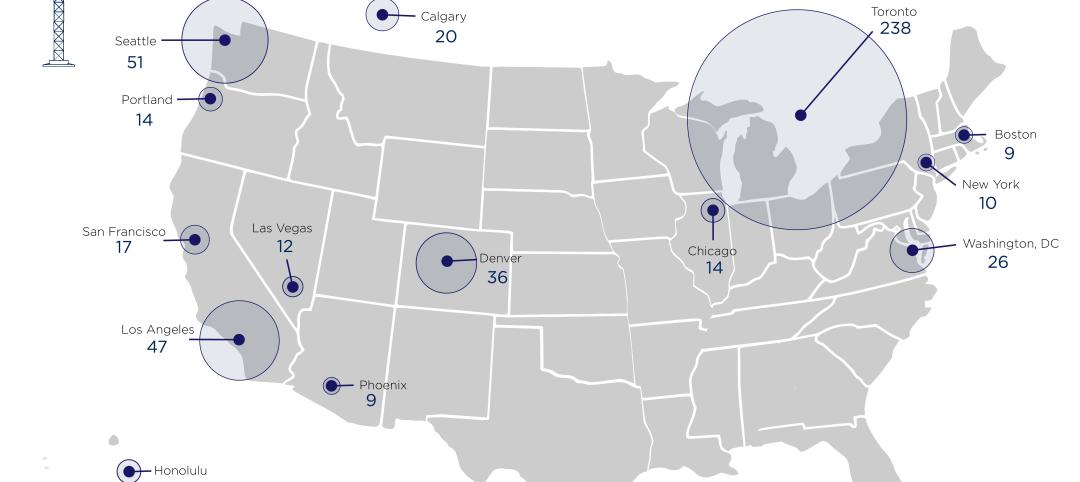

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.