The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

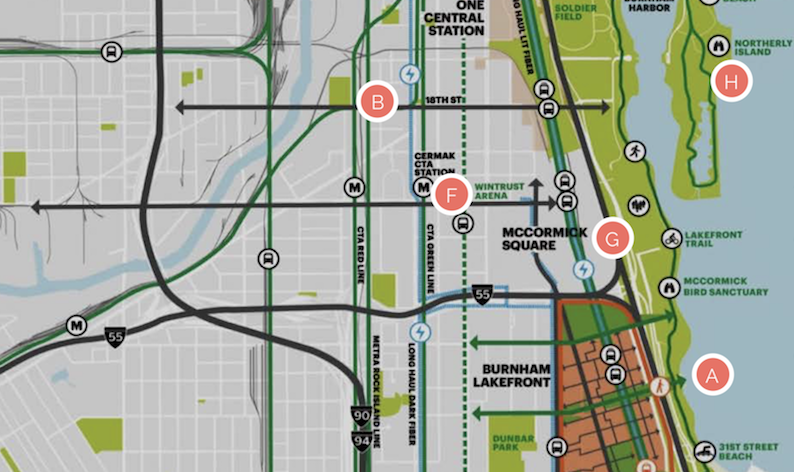

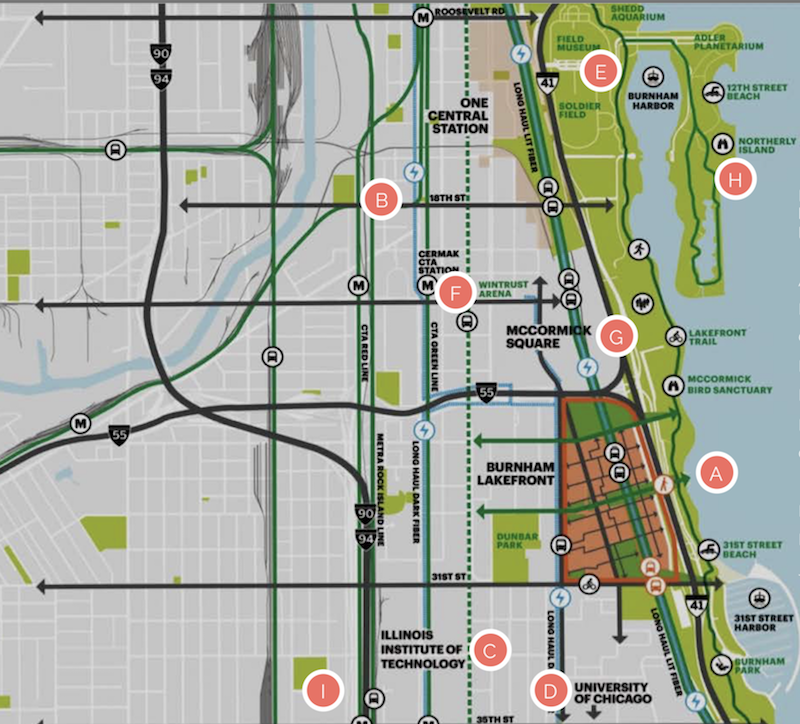

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

| Sep 13, 2010

Conquering a Mountain of Construction Challenges

Brutal winter weather, shortages of materials, escalating costs, occasional visits from the local bear population-all these were joys this Building Team experienced working a new resort high up in the Sierra Nevada.

| Aug 11, 2010

Accor North America launches green hotel pilot program

Accor North America, a division of Accor Hospitality, has announced that it will pilot the Green Key Eco-Rating Program within its portfolio in the United States in 2010. Green Key is the first program of its kind to rank, certify and inspect hotels and resorts based on their commitment to sustainable "green" practices; the Accor North America pilot will involve 20 properties.

| Aug 11, 2010

CTBUH changes height criteria; Burj Dubai height increases, others decrease

The Council on Tall Buildings and Urban Habitat (CTBUH)—the international body that arbitrates on tall building height and determines the title of “The World’s Tallest Building”—has announced a change to its height criteria, as a reflection of recent developments with several super-tall buildings.

| Aug 11, 2010

Jacobs, Arup, AECOM top BD+C's ranking of the nation's 75 largest international design firms

A ranking of the Top 75 International Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

See what $3,000 a month will get you at Chicago’s Aqua Tower

Magellan Development Group has opened three display models for the rental portion of Chicago’s highly anticipated Aqua Tower, designed by Jeanne Gang. Lease rates range from $1,498 for a studio to $3,111 for a two-bedroom unit with lake views.

| Aug 11, 2010

Architecture Billings Index flat in May, according to AIA

After a slight decline in April, the Architecture Billings Index was up a tenth of a point to 42.9 in May. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. Any score above 50 indicates an increase in billings.

| Aug 11, 2010

Construction employment declined in 333 of 352 metro areas in June

Construction employment declined in all but 19 communities nationwide this June as compared to June-2008, according to a new analysis of metropolitan-area employment data released today by the Associated General Contractors of America. The analysis shows that few places in America have been spared the widespread downturn in construction employment over the past year.

| Aug 11, 2010

Casino Queen breaks ground on $2.15 million entertainment venue

The Casino Queen in East St. Louis, Ill., is raising the stakes in its bid to capture a larger share of the local gaming market with the start of construction on a new $2.15 million sports bar and entertainment venue that will enhance the overall experience for guests.