The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

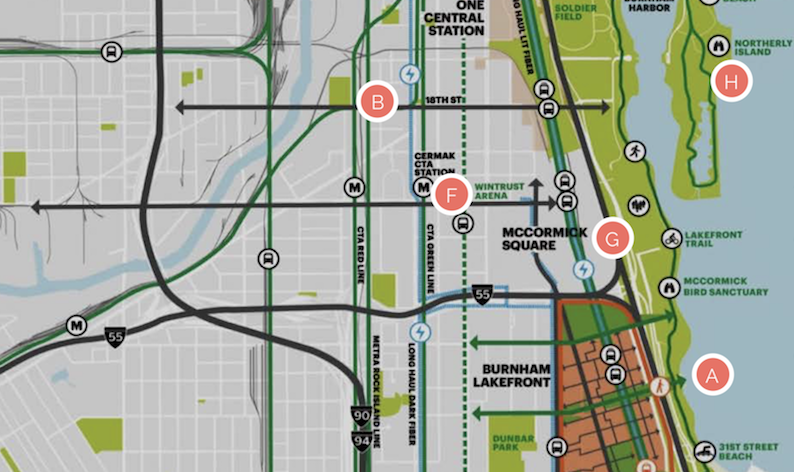

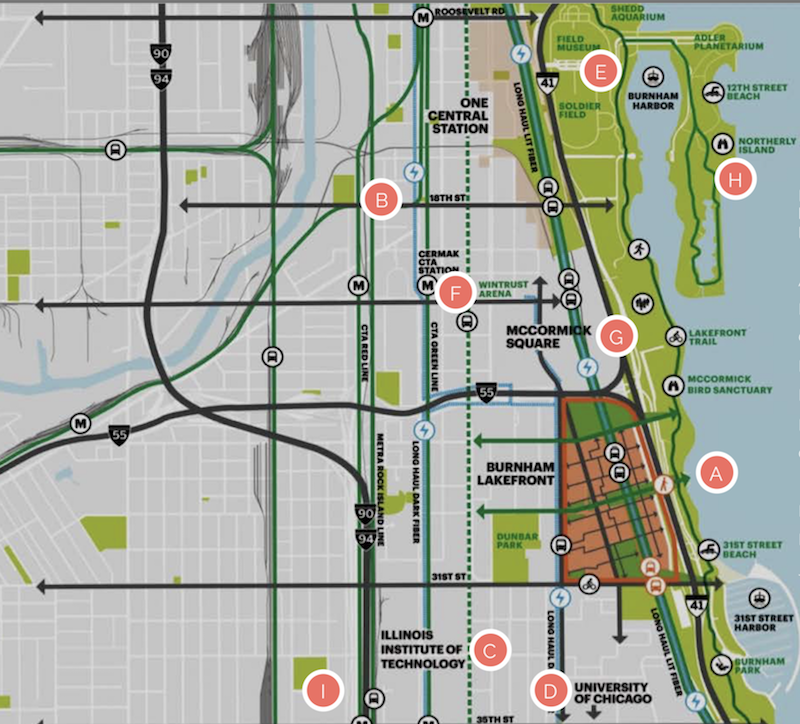

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

| Feb 11, 2011

Kentucky’s first green adaptive reuse project earns Platinum

(FER) studio, Inglewood, Calif., converted a 115-year-old former dry goods store in Louisville, Ky., into a 10,175-sf mixed-use commercial building earned LEED Platinum and holds the distinction of being the state’s first adaptive reuse project to earn any LEED rating. The facility, located in the East Market District, houses a gallery, event space, offices, conference space, and a restaurant. Sustainable elements that helped the building reach its top LEED rating include xeriscaping, a green roof, rainwater collection and reuse, 12 geothermal wells, 81 solar panels, a 1,100-gallon ice storage system (off-grid energy efficiency is 68%) and the reuse and recycling of construction materials. Local firm Peters Construction served as GC.

| Jan 25, 2011

AIA reports: Hotels, retail to lead U.S. construction recovery

U.S. nonresidential construction activity will decline this year but recover in 2012, led by hotel and retail sectors, according to a twice-yearly forecast by the American Institute of Architects. Overall nonresidential construction spending is expected to fall by 2% this year before rising by 5% in 2012, adjusted for inflation. The projected decline marks a deteriorating outlook compared to the prior survey in July 2010, when a 2011 recovery was expected.

| Jan 19, 2011

San Diego casino renovations upgrade gaming and entertainment

The Sycuan Casino in San Diego will get an update with a $27 million, 245,000-sf renovation. Hnedak Bobo Group, Memphis, Tenn., and Cleo Design, Las Vegas, drew design inspiration from the historic culture of the Sycuan tribe and the desert landscape, creating a more open space with better circulation. Renovation highlights include a new “waterless” water entry feature and new sports bar and grill, plus updates to gaming, poker, off-track-betting, retail, and bingo areas. The local office of San Francisco-based Swinerton Builders will provide construction services.

| Dec 17, 2010

Vietnam business center will combine office and residential space

The 300,000-sm VietinBank Business Center in Hanoi, Vietnam, designed by Foster + Partners, will have two commercial towers: the first, a 68-story, 362-meter office tower for the international headquarters of VietinBank; the second, a five-star hotel, spa, and serviced apartments. A seven-story podium with conference facilities, retail space, restaurants, and rooftop garden will connect the two towers. Eco-friendly features include using recycled heat from the center’s power plant to provide hot water, and installing water features and plants to improve indoor air quality. Turner Construction Co. is the general contractor.

| Dec 17, 2010

Toronto church converted for condos and shopping

Reserve Properties is transforming a 20th-century church into Bellefair Kew Beach Residences, a residential/retail complex in The Beach neighborhood of Toronto. Local architecture firm RAWdesign adapted the late Gothic-style church into a five-story condominium with 23 one- and two-bedroom units, including two-story penthouse suites. Six three-story townhouses also will be incorporated. The project will afford residents views of nearby Kew Gardens and Lake Ontario. One façade of the church was updated for retail shops.

| Dec 2, 2010

GKV Architects wins best guest room design award for Park Hyatt Istanbul

Gerner Kronick + Valcarcel, Architects, PC won the prestigious Gold Key Award for Excellence in Hospitality Design for best guest room, Park Hyatt Macka Palas, Istanbul, Turkey. Park Hyatt Maçka Palace marries historic and exotic elements with modern and luxurious, creating a unique space perpetuating Istanbul’s current culture. In addition to the façade restoration, GKV Architects designed 85 guestrooms, five penthouse suites, an ultra-hip rooftop bar, and a first-of-its-kind for Istanbul – a steakhouse, for the luxury hotel.

| Nov 16, 2010

CityCenter’s new Harmon Hotel targeted for demolition

MGM Resorts officials want to demolish the unopened 27-story Harmon Hotel—one of the main components of its brand new $8.5 billion CityCenter development in Las Vegas. In 2008, inspectors found structural work on the Harmon didn’t match building plans submitted to the county, with construction issues focused on improperly placed steel reinforcing bar. In January 2009, MGM scrapped the building’s 200 condo units on the upper floors and stopped the tower at 27 stories, focusing on the Harmon having just 400 hotel rooms. With the Lord Norman Foster-designed building mired in litigation, construction has since been halted on the interior, and the blue-glass tower is essentially a 27-story empty shell.

| Nov 3, 2010

Rotating atriums give Riyadh’s first Hilton an unusual twist

Goettsch Partners, in collaboration with Omrania & Associates (architect of record) and David Wrenn Interiors (interior designer), is serving as design architect for the five-star, 900-key Hilton Riyadh.

| Oct 6, 2010

From grocery store to culinary school

A former West Philadelphia supermarket is moving up the food chain, transitioning from grocery store to the Center for Culinary Enterprise, a business culinary training school.

| Sep 30, 2010

Luxury hotels lead industry in green accommodations

Results from the American Hotel & Lodging Association’s 2010 Lodging Survey showed that luxury and upper-upscale hotels are most likely to feature green amenities and earn green certifications. Results were tallied from 8,800 respondents, for a very respectable 18% response rate. Questions focused on 14 green-related categories, including allergy-free rooms, water-saving programs, energy management systems, recycling programs, green certification, and green renovation.