Current design technology and construction methodologies are changing and advancing the way projects are designed and constructed but they are often not aligned with a health systems procurement practices or equipment vendor sales strategies. This disconnect is a complicated chasm to bridge.

The integration of technology and medical equipment into a construction project is critical to its overall success. Managing the integration in a timely manner while mitigating risk and reducing costs is one of the main responsibilities for the healthcare project manager. Aligning independent divergent processes are critical for superior project outcomes.

CHANGING THE DECISION MAKING CYCLE

Within a healthcare project, the furniture, fixtures, and equipment (FF&E) and medical equipment can constitute between 20%-40% of the overall budget. Procuring furniture and equipment requires detailed attention in the specification and ordering process to ensure the most competitive price, latest technology and fastest speed to market. Early revenue generation and return on investment (ROI) drive the majority of decisions regarding the medical equipment selection. The challenge facing healthcare organizations is how to change their decision making procurement cycle to best meet the new design paradigm created with the construction industry.

Within the last seven years, there has been a shift in how the design industry conducts schematic and design development meetings and the information they require to be efficient. Building information modeling (BIM) requires more upfront direction and decision making earlier in the process to allow for the models to be built. In the past, these decisions and their coordination efforts were made later during the design development or construction documentation phase.

BIM has been a huge asset in resolving clash detection and design conflict issues prior to construction. It also allows for pre-construction of materials delivered to the site, which increases quality and decreases schedule durations. BIM coordination has dramatically reduced change orders during the construction period, but, unfortunately, it has had the opposite effect on medical technology integration. BIM requires that medical equipment decisions be made earlier. The dichotomy of the health system’s vendor selection process versus the equipment vendors business model results in excessive change orders on projects.

"BIM requires that medical equipment decisions be made earlier. The dichotomy of the health system’s vendor selection process versus the equipment vendors business model results in excessive change orders on projects." — Julie Ford, CBRE Healthcare

PROCUREMENT STRATEGY REALIGNMENT

Equipment vendors will not do site specific drawings for large fixed equipment, such as MRIs, X-rays, and CTs, until they have an order and purchase order number in hand. Once the BIM drawings are complete, there will usually be changes that are required for power/data locations, HVAC requirements, and even millwork to accommodate the equipment in the room. When these changes occur during construction it has a major negative effect on the project budget and schedule. Getting all of the players to the table early to make equipment decisions prior to construction will save significant time and money. This obvious solution rarely occurs.

In discussions with procurement specialists, bio-med specialists, information systems analysts, and medical equipment vendors, everyone agrees that there is a problem, but few offer a solution. Including all team members early, communicating often, and setting realistic budgets is only part of the answer.

PROPER COMMUNICATION LEADS TO POSITIVE RESULTS

Successful projects require positive and constant communication among all team members. Including stakeholders that are not traditionally engaged at the beginning of a project creates an environment for productive communication and also:

1. Provides knowledge and buy-in from stakeholders and allows for a clearer understanding of design decisions, project definitions, and “lines in the sand” related to project changes.

2. Brings a different perspective to the project and opens dialogue that the design team, construction team, or project manager may not be aware of regarding equipment limitations and future technologies that need to be planned for or corporate standards that user groups may not be aware of.

3. Changes the procurement timeline so supply chain can negotiate equipment further in advance of when it is needed resulting in potential cost savings, early production of site specific drawings, and better construction coordination.

EQUIPMENT UPGRADES AND ENHANCEMENTS

Changing advancements in healthcare is a significant project challenge. Healthcare organizations often submit POs for large equipment one to two years in advance of delivery to secure the best pricing. Contracts typically state that the client will receive the latest technology available at the time of delivery. If the new equipment varies in size, power/data or technological enhancements this could cause cost and schedule issues for the project. Upgrades/alterations result in last minute change orders that may be very costly. Unfortunately, vendors often have non-disclosure agreements that prohibit them from sharing new technology upgrades, even with a PO in place.

At a large ambulatory surgery center with four OR’s, 16 pre/post-op bays, minor procedure rooms, and four GI/Endo rooms, the team specified a monitor and bracket to hang on the head wall in the pre/post-op bays and on the booms in the ORs and procedure rooms. The original equipment order was placed in December 2013 as part of a larger order, securing deep discounted pricing. Receipt of the equipment will be in spring 2015.

The current specified monitor, which required one data drop, has now been discontinued. The vendor will still warranty the item and maintain parts for five years, but the hospital would be basically purchasing new equipment that has reached obsolescence. These types of purchases typically occur every 15 to 20 years, and not in the best interest of the client. As per the contract, the upgraded unit they would receive required two data drops.

If the design team had been aware of this new feature during the BIM design or the beginning of BIM construction, the power/data requirements could have been added with little or no cost impact to the project. Instead, installing 45 additional data drops a few months prior to completion had a significant impact on the project. The actual cost of adding 45 data drops to the project in labor and materials was expensive. The contractor had to return to spaces previously completed to make the changes.

In the end, the change order totaled over $80,000. This seemingly minor port change to the vendor equipment had significant implications to the overall project budget and schedule. If the equipment vendor could have alerted the client to the design/feature changes earlier this could have been avoided.

There are two solutions to address this issue. As previously mentioned, the project manager’s role is to mitigate risk and cost. In addition, they must foster a culture of participation and trust between the equipment vendor and the health system’s procurement department.

One of the largest obstacles is the proprietary nature of technological advances and product enhancements to the medical equipment. Vendors are hesitant to discuss changes and upgrades prior to product release. This is contradictory to a collaborative customer/vendor relationship. If an equipment vendor has a health system’s PO (which is an expression of trust between the supplier and the client) and the client agrees to sign a NDA, the vendor should be able to review items ordered and advise the client of upcoming changes as soon as possible.

The way to mitigate change orders related to medical equipment is to have the HVAC/electrical/data requirements examined, planned for and reviewed early in the process by the vendor, prior to construction. This is the disconnect between the vendor’s sales strategy and the client’s procurement strategy. Navigating solutions and negotiating terms prior to order entry can reduce risk and cost. Another recommendation is for the project manager to alert the client to any potential issues and if warranted, advocate for an equipment contingency within the total project budget to cover change orders beyond typical construction contingencies.

CONCLUSION

Fixing project disconnects that can derail a facility project related to medical equipment integration can be overcome by involving procurement, FMS, IS, and bio-med specialists at the beginning of a project. In addition, early vendor integration, good project communication and appropriate budget allocation will align the appropriate strategies of all stakeholders. This will not occur on its own. It is dependent upon the direction and guidance of a strategic minded project manager. Fostering a collaborative environment that is focused on the overall project, as opposed to individual outcomes and divergent business models, will best position your next healthcare project to handle the ever changing evolving technology landscape and ensure success.

About the Author: Julie Ford is the Director of Healthcare Project Management at CBRE Healthcare.

Related Stories

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.

Healthcare Facilities | Mar 13, 2023

Next-gen behavioral health facilities use design innovation as part of the treatment

An exponential increase in mental illness incidences triggers new behavioral health facilities whose design is part of the treatment.

Healthcare Facilities | Mar 6, 2023

NBBJ kicks off new design podcast with discussion on behavioral health facilities

During the second week of November, the architecture firm NBBJ launched a podcast series called Uplift, that focuses on the transformative power of design. Its first 30-minute episode homed in on designing for behavioral healthcare facilities, a hot topic given the increasing number of new construction and renovation projects in this subsector.

Sustainability | Mar 2, 2023

The next steps for a sustainable, decarbonized future

For building owners and developers, the push to net zero energy and carbon neutrality is no longer an academic discussion.

University Buildings | Feb 23, 2023

Johns Hopkins shares design for new medical campus building named in honor of Henrietta Lacks

In November, Johns Hopkins University and Johns Hopkins Medicine shared the initial design plans for a campus building project named in honor of Henrietta Lacks, the Baltimore County woman whose cells have advanced medicine around the world. Diagnosed with cervical cancer, Lacks, an African-American mother of five, sought treatment at the Johns Hopkins Hospital in the early 1950s. Named HeLa cells, the cell line that began with Lacks has contributed to numerous medical breakthroughs.

Healthcare Facilities | Feb 21, 2023

Cleveland's Glick Center hospital anchors neighborhood revitalization

The newly opened MetroHealth Glick Center in Cleveland, a replacement acute care hospital for MetroHealth, is the centerpiece of a neighborhood revitalization. The eleven-story structure is located within a ‘hospital-in-a-park’ setting that will provide a bucolic space to the community where public green space is lacking. It will connect patients, visitors, and staff to the emotional and physical benefits of nature.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.

Intelligent Lighting | Feb 13, 2023

Exploring intelligent lighting usage in healthcare, commercial facilities

SSR's Todd Herrmann, PE, LEEP AP, explains intelligent lighting's potential use cases in healthcare facilities and more.

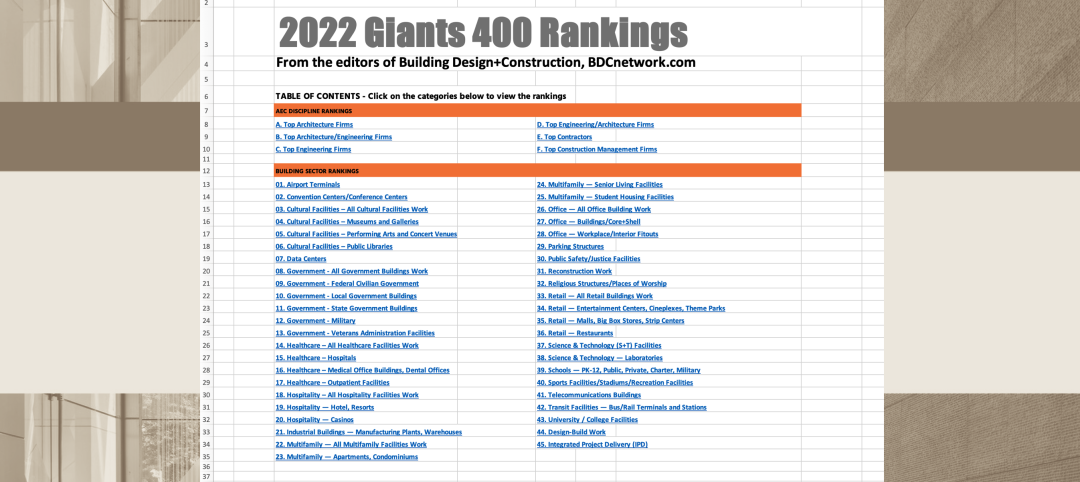

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.