Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey. The November 2023 report collected two month's of data to find clarity in the multifamily market, including capital access, lease-up challenges, and the overall development pipeline.

Overall, Burns has outlined four key takeaways for developers and investors to be mindful of in 2024.

Burns Apartment Developer and Investor Survey Takeaways

1. Apartment developers anticipate a dramatic decrease in construction and new starts

As post-Covid construction has peaked, developers expect new apartment starts to slow by 20–50%.

Forty percent of developers surveyed have over 500 units currently under construction. While a surge of projects will finish by 2025, future starts are believed to slow dramatically.

Nearly all respondents have found securing financing to be increasingly difficult.

2. Investors “sidelined” as interest rates create cautious lenders

Apartment transactions have come to a halt as financing tightens and pricing uncertainty grows. Only 16% of those surveyed reported selling an apartment property in the last six months, and 70% say they are not planning to purchase in the next six months.

There was little consensus on current pricing levels. A few respondents believe their assets are undervalued, while the rest are split between seeing their assets as fairly-priced or overvalued. According to Burns, this disparity reflects the ongoing disconnect between buyers and sellers.

3. Affordability is an important factor for residents of newly opened communities

A significant factor for resident retention is affordability. The research finds that the most common reasons tenants won't renew their lease is to move into a less expensive apartment or to move in with roommates instead.

Three-quarters (75%) of respondents are averaging double-digit monthly leases at unstabilized communities as well, indicating healthy lease-up trends.

4. Thoughtful design and amenities—especially service-oriented ones—must be superior

According to Burns, developers have underscored the importance of project design and high-quality amenities. Those surveyed indicated that new communities must have amenities that are in-line, if not superior, to the competition.

Some have also begun focusing less on physical amenities like pools and parks, and more on service-oriented amenities such as concierge services.

Click here to access the entire Apartment Developer and Investor Survey.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Office Buildings | Nov 10, 2023

3 important early considerations for office-to-residential conversions

Scott Campagna, PE, Senior Director of Housing, IMEG Corp, shares insights from experts on office-to-residential conversion issues that may be mitigated when dealt with early.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

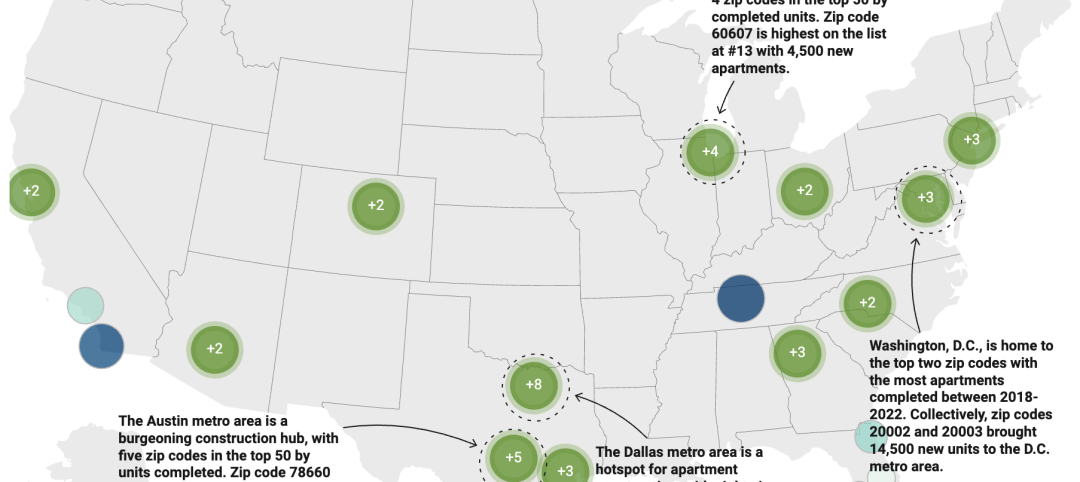

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Smart Buildings | Oct 27, 2023

Cox Communities partnership levels up smart tech for multifamily customers

Yesterday, Cox Communities announced its partnership with Level Home Inc., a provider of next-generation smart IoT solutions for multifamily customers.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.