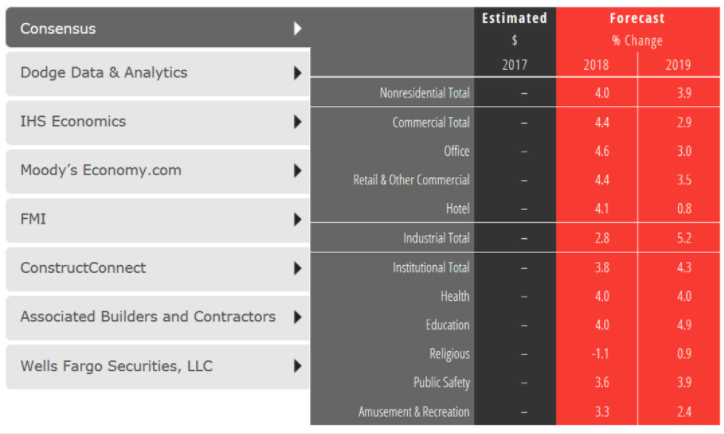

Despite labor shortages and rising material costs that continue to impact the construction sector, construction spending for nonresidential buildings is projected to increase 4.0% this year and continue at a 3.9% pace of growth through 2019.

The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast indicates the commercial construction sectors will generate much of the expected gains this year, and by 2019 the industrial and institutional sectors will dominate the projected construction growth.

“Rebuilding after the record-breaking losses from natural disasters last year, the recently enacted tax reform bill, and the prospects of an infrastructure package are expected to provide opportunities for even more robust levels of activity within the industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The Architecture Billings Index (ABI) and other major leading indicators for the industry also point to an upturn in construction activity over the coming year.”

CLICK TO VIEW INTERACTIVE CHART

CLICK TO VIEW INTERACTIVE CHART

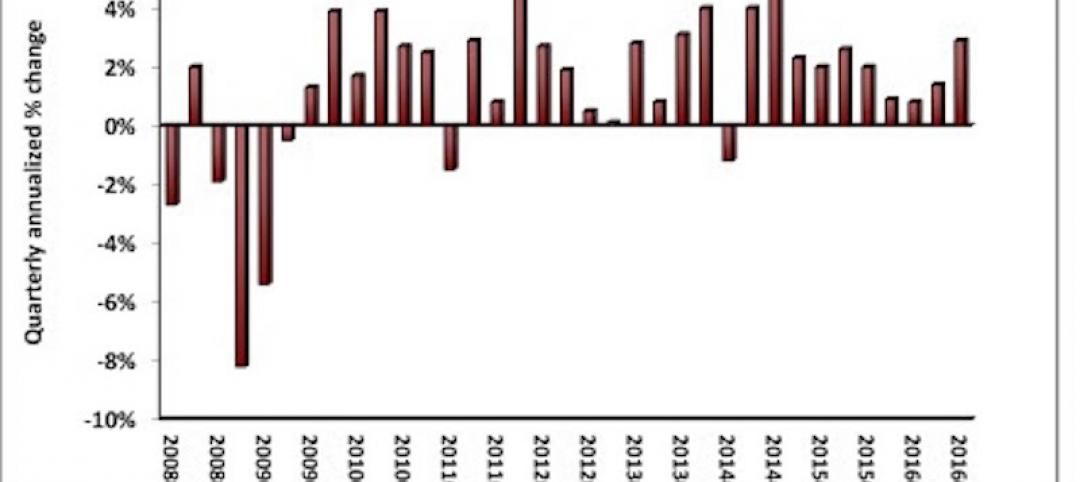

Even eight and a half years into this current national economic cycle, the US economy remains on solid footings. Given the strong levels of business investment, economic growth is estimated to have been 2.2% to 2.3% range last year, easily topping the 1.5% growth from 2016. Over two million new payroll positions on net were added to the economy last year, the seventh straight year that payroll growth exceeded that level.

The national unemployment rate ended the year at 4.1%, its lowest level since 2000. And while low interest rates have helped to fuel this growth, rising stock prices have ensured that public companies have had access to capital to expand their operations. The Dow Jones industrial average increased almost 25% during the year.

However, in the face of a supportive economy, construction spending on nonresidential buildings disappointed last year. Overall spending on these facilities grew by only about 2.5%, with spending on manufacturing facilities seeing a steep double-digit decline.

The only sector achieving healthy growth was retail and other commercial facilities, an odd result given the numerous reports of failing shopping centers due to strong growth in e-commerce sales. However, much of the spending reported in the retail and other commercial facilities category was for distribution facilities and related logistic operations to support a more efficient e-commerce system.

Still, the slowdown in spending last year was sharper than expected. Annual 2015 increases were almost 16% across the entire nonresidential building category, with the office and lodging categories realizing strong gains, and the institutional categories posting increases of almost 8% overall.

Growth in activity eased in 2016, with overall spending on nonresidential buildings increasing by only 6% even though the office and lodging categories posted gains of nearly 25%. Spending on institutional facilities was disappointing, with increases totaling less than 2% in this category.

Related Stories

Market Data | Oct 31, 2016

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.