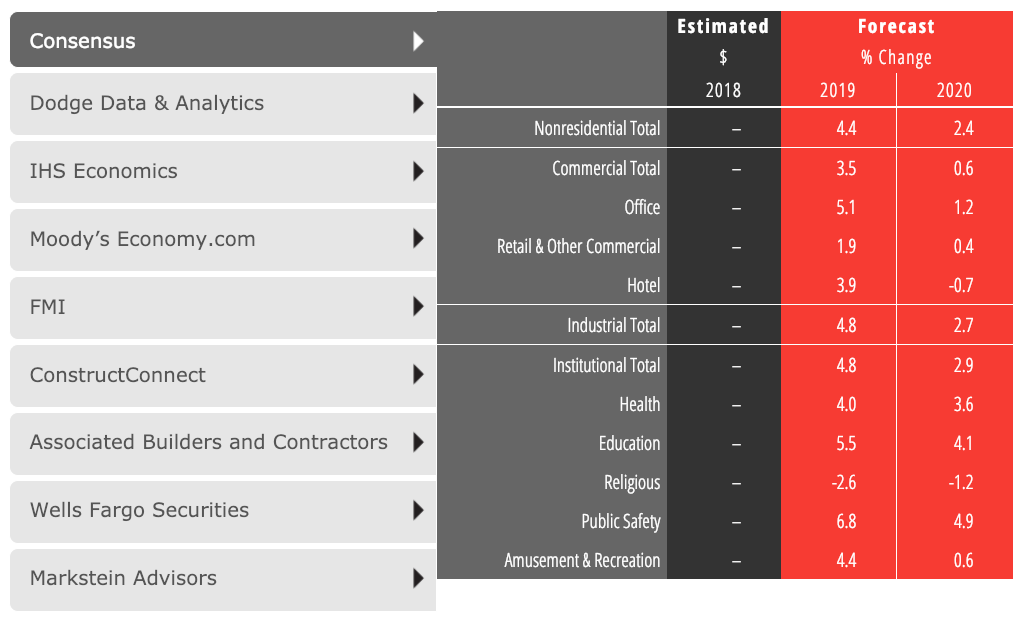

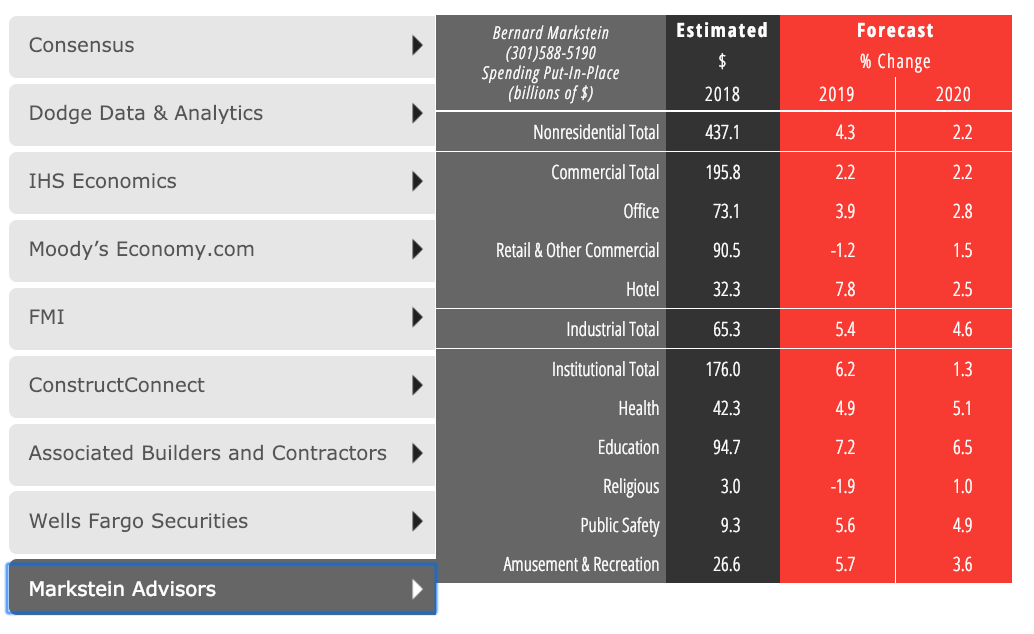

Nonresidential construction spending on buildings is projected to grow by 4.4% through 2019, according to a new consensus forecast from The American Institute of Architects (AIA).

Healthy gains in the industrial and institutional building sectors have bolstered growth projections for 2019. However, the AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—is suggesting that a broader economic downturn may be materializing over the next 12-24 months. See what each panelist forecasts for 2019 below, and using this interactive chart.

“Though the economy has been performing very well recently, trends in business confidence scores are red flags that suggest a slowdown is likely for 2020,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “These signals may be temporary responses to negative short-term conditions, but historically they have preceded a more widespread downturn.”

OVERALL CONSENSUS

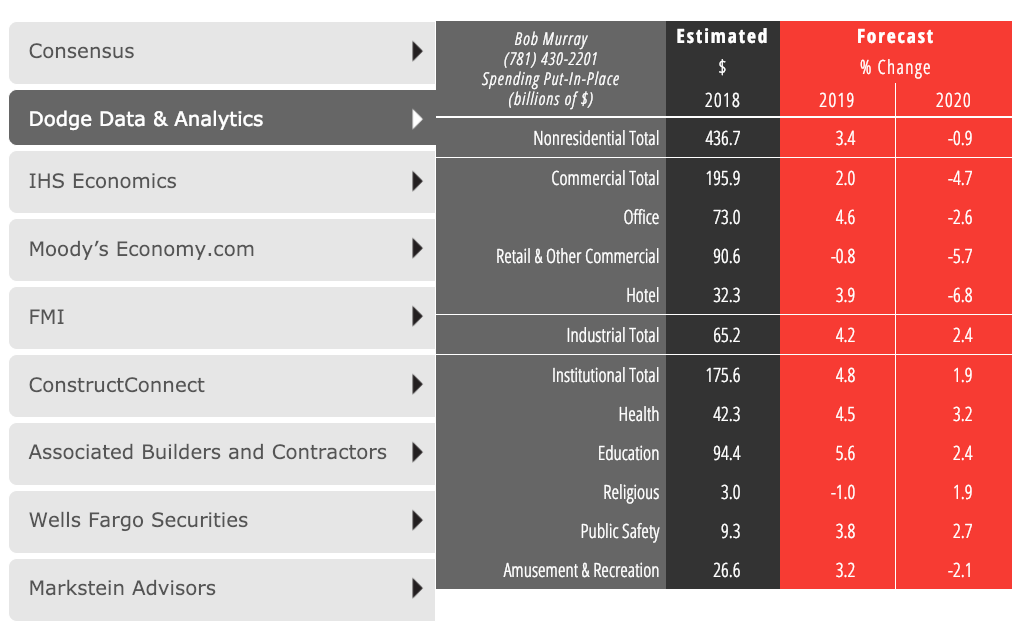

DODGE DATA & ANALYTCS

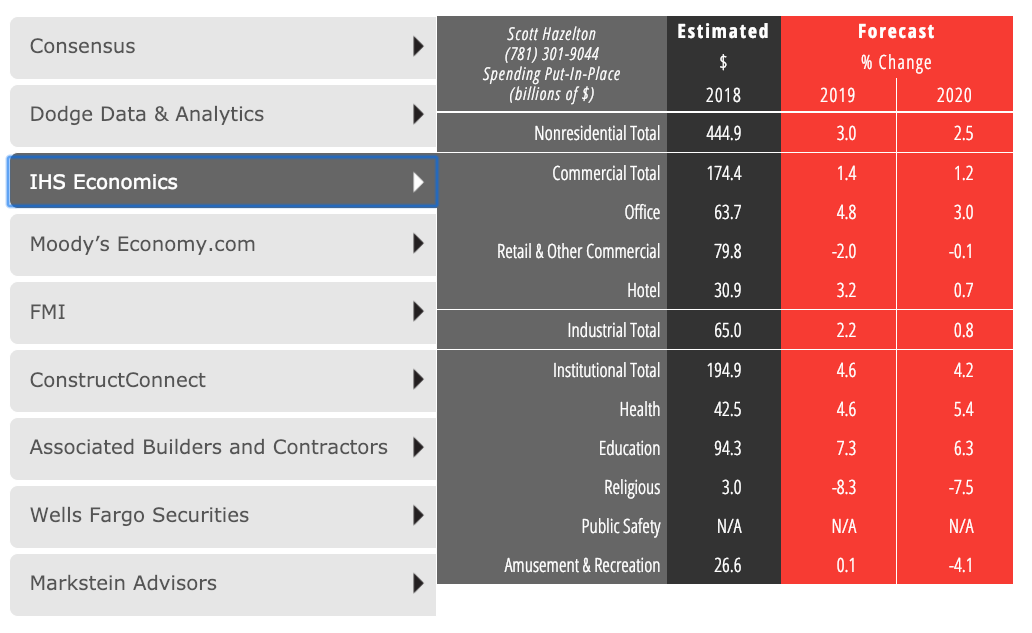

IHS ECONOMICS

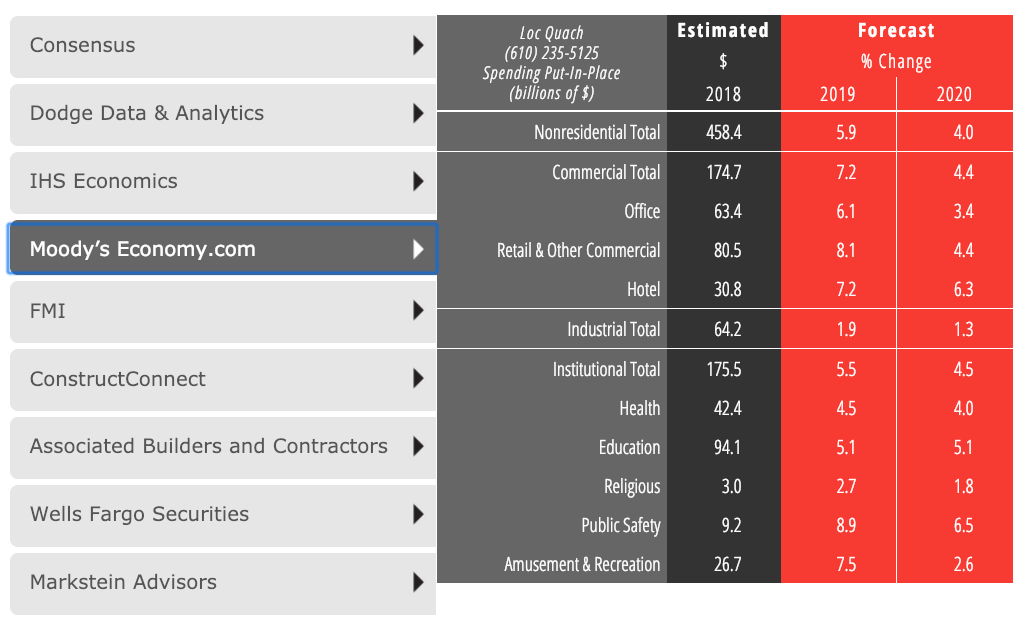

MOODY'S ECONOMY.COM

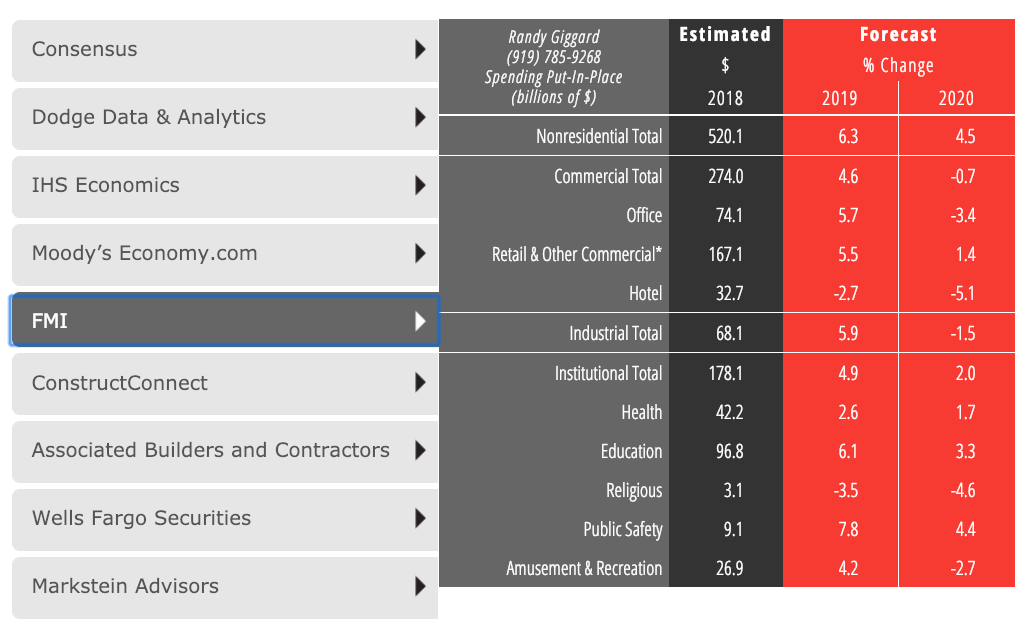

FMI

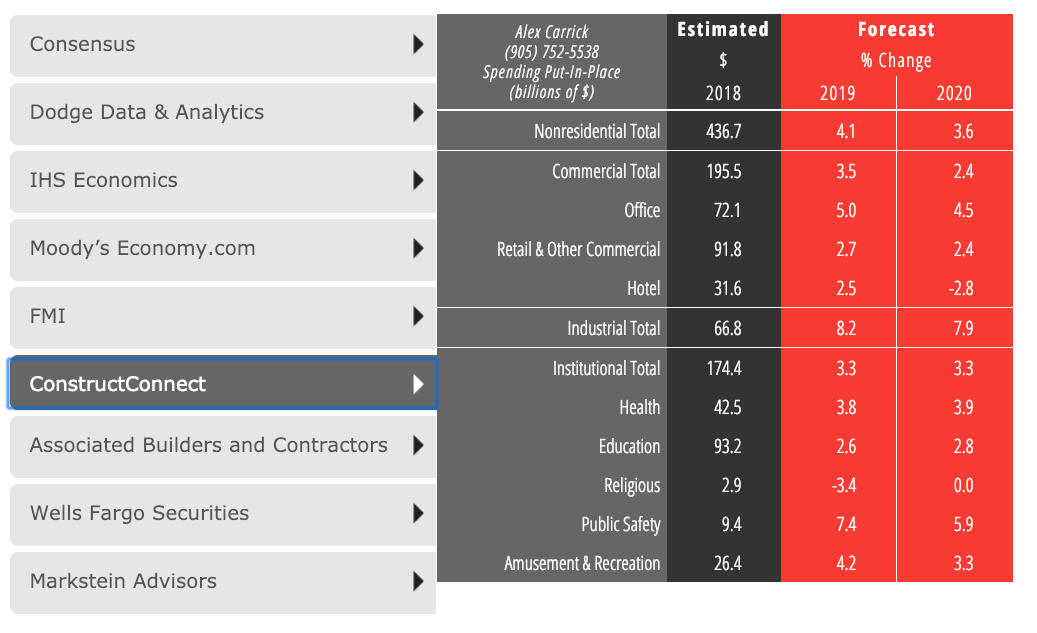

CONSTRUCTCONNECT

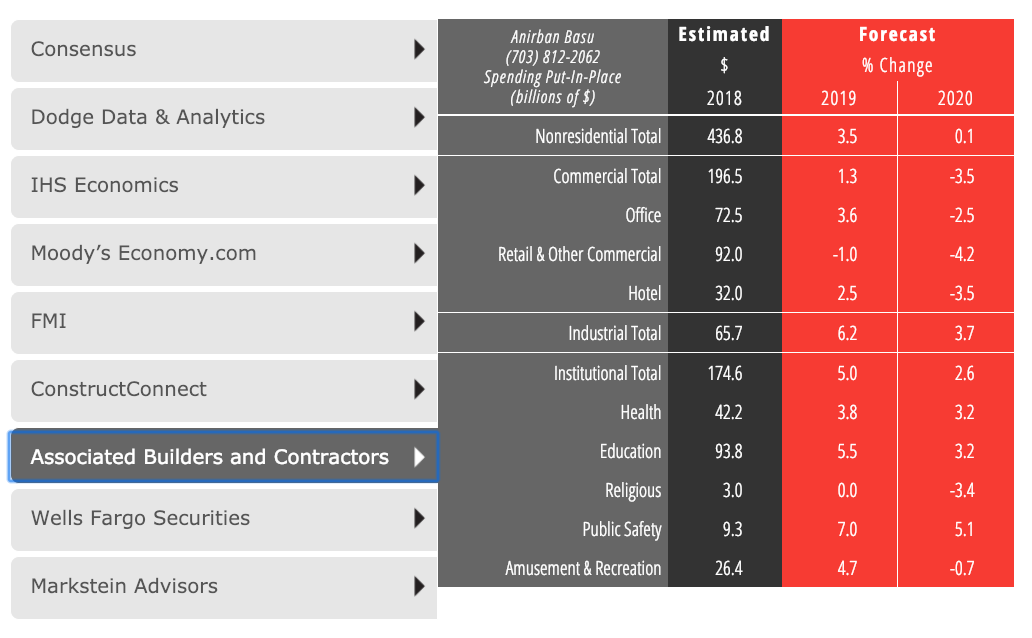

ASSOCIATED BUILDERS AND CONTRACTORS (ABC)

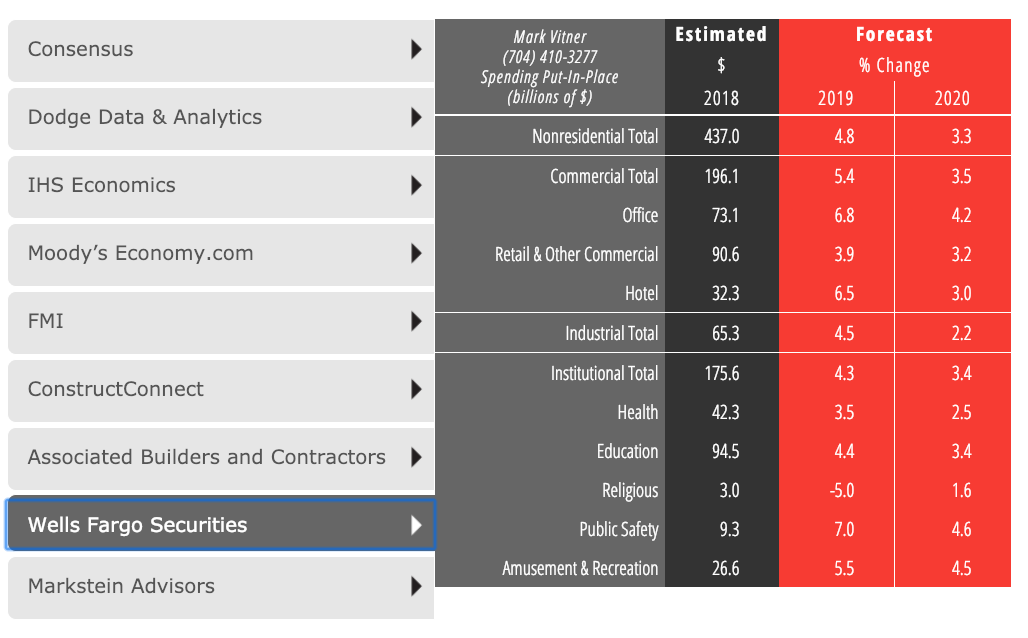

WELLS FARGO SECURITIES

MARKSTEIN ADVISORS

Notes:

• FMI's Retail & Other Commercial category includes transportation and communication sectors.

• The AIA Consensus Forecast is computed as an average of the forecasts provided by the panelists that submit forecasts for each of the included building categories.

• There are no standard definition of some nonresidential building categories, so panelists may define a given category somewhat differently.

• Panelists may forecast only a portion of a category (e.g public buildings but not private buldings); these forecasts are treated like other forecasts in computing the consensus.

• All forecasts are presented in current (non-inflation adjusted) dollars.

Related Stories

Market Data | Aug 2, 2017

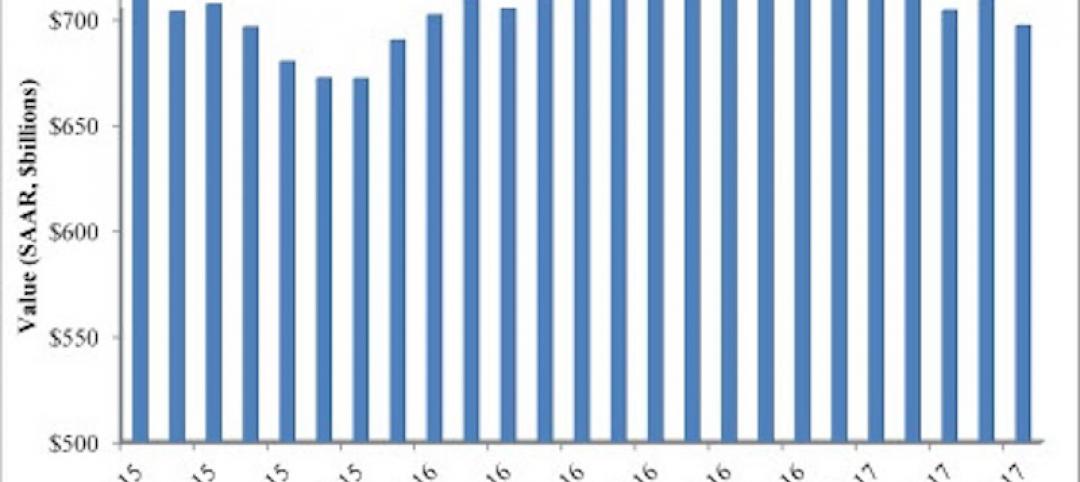

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

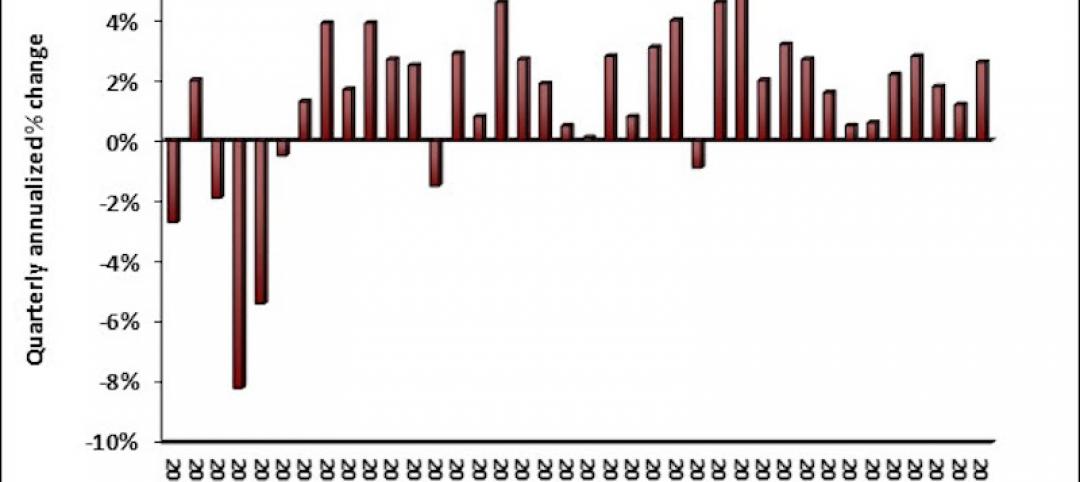

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

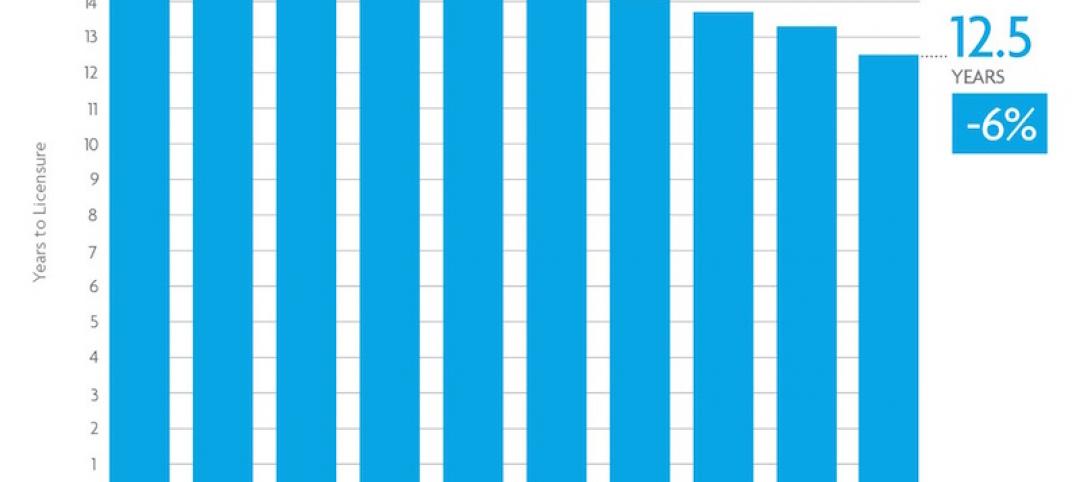

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

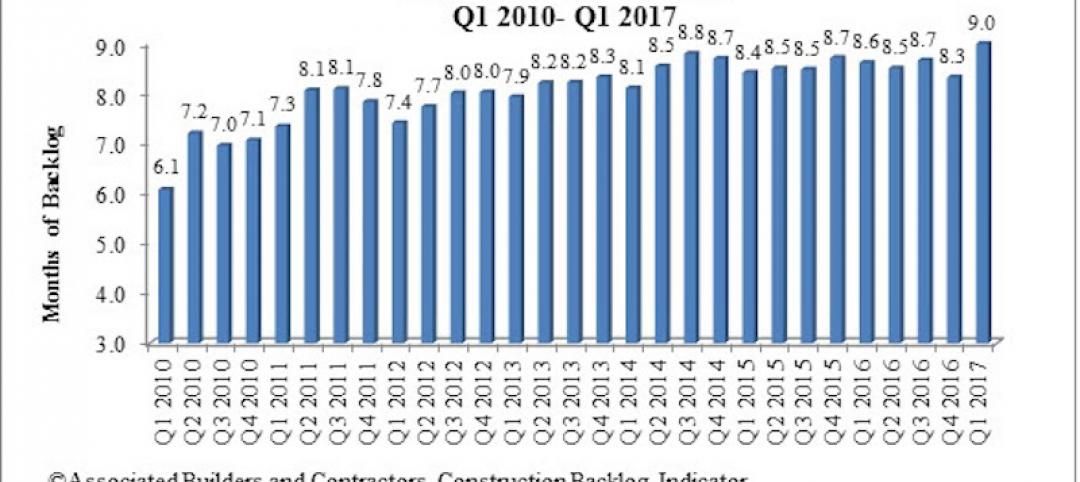

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.