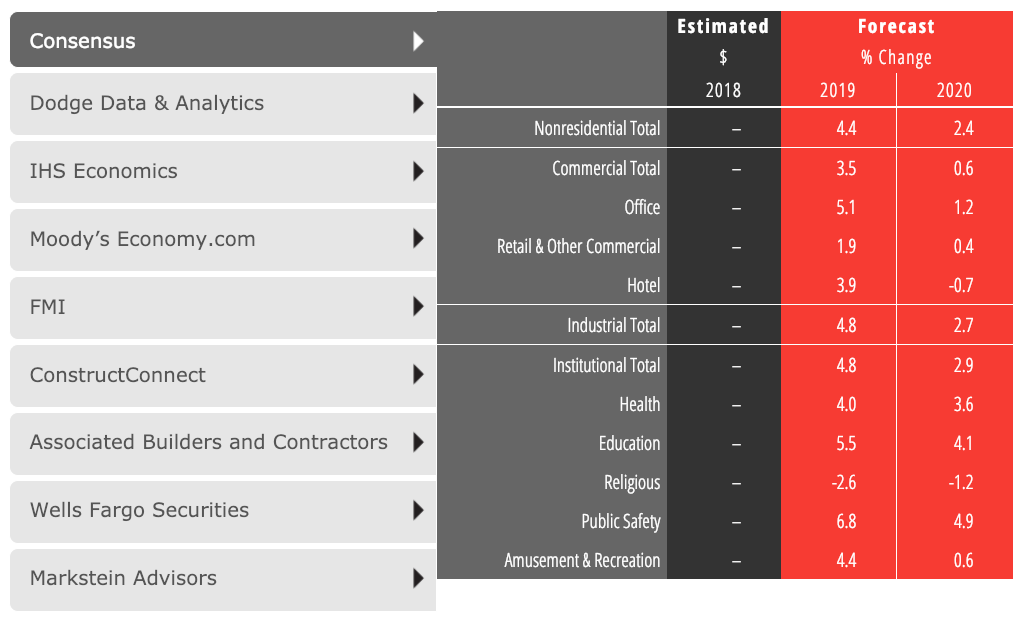

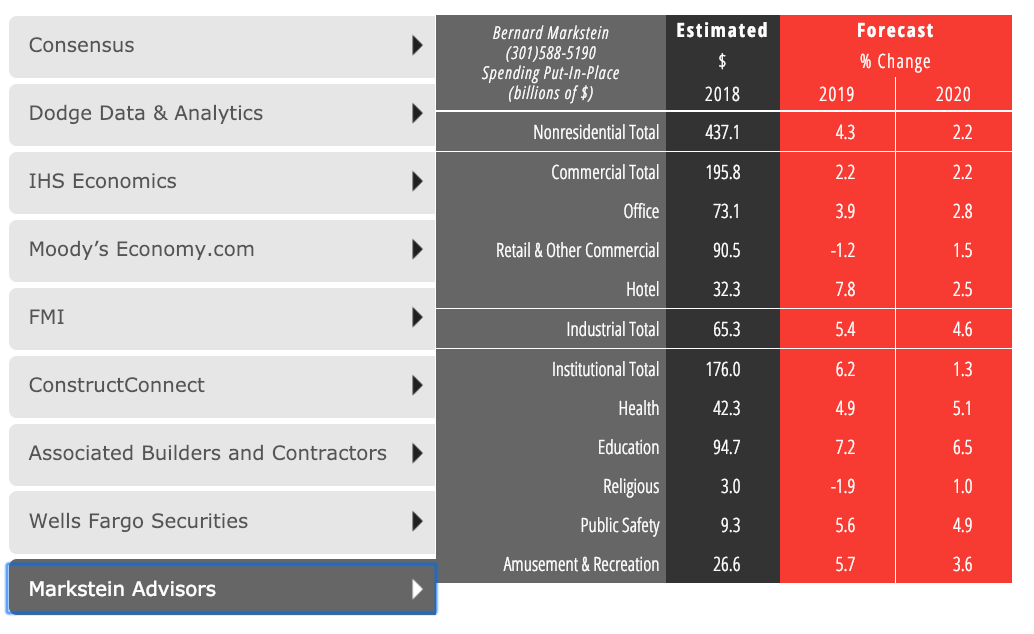

Nonresidential construction spending on buildings is projected to grow by 4.4% through 2019, according to a new consensus forecast from The American Institute of Architects (AIA).

Healthy gains in the industrial and institutional building sectors have bolstered growth projections for 2019. However, the AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—is suggesting that a broader economic downturn may be materializing over the next 12-24 months. See what each panelist forecasts for 2019 below, and using this interactive chart.

“Though the economy has been performing very well recently, trends in business confidence scores are red flags that suggest a slowdown is likely for 2020,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “These signals may be temporary responses to negative short-term conditions, but historically they have preceded a more widespread downturn.”

OVERALL CONSENSUS

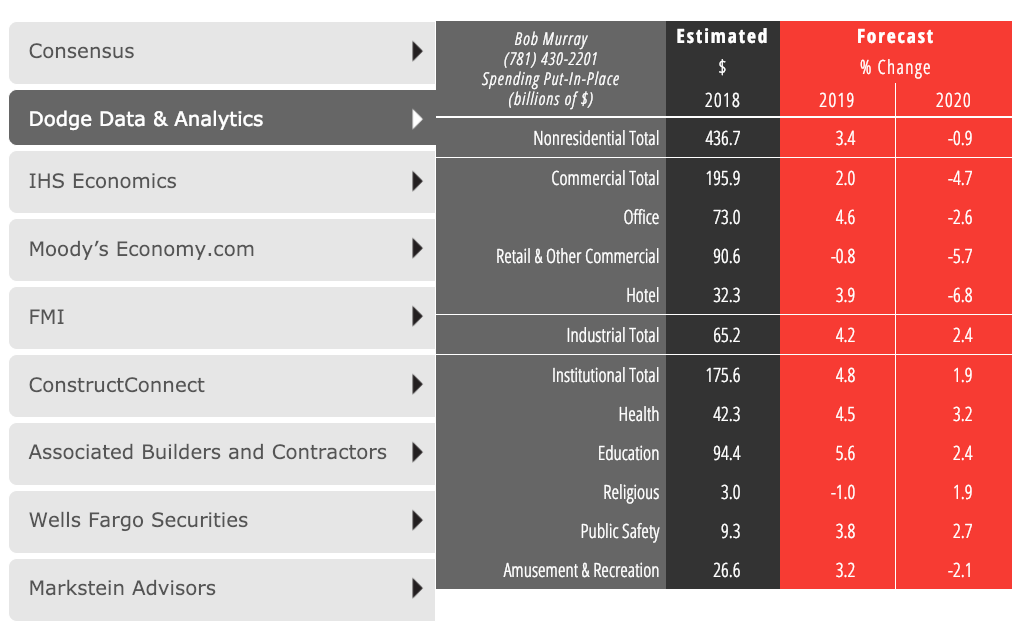

DODGE DATA & ANALYTCS

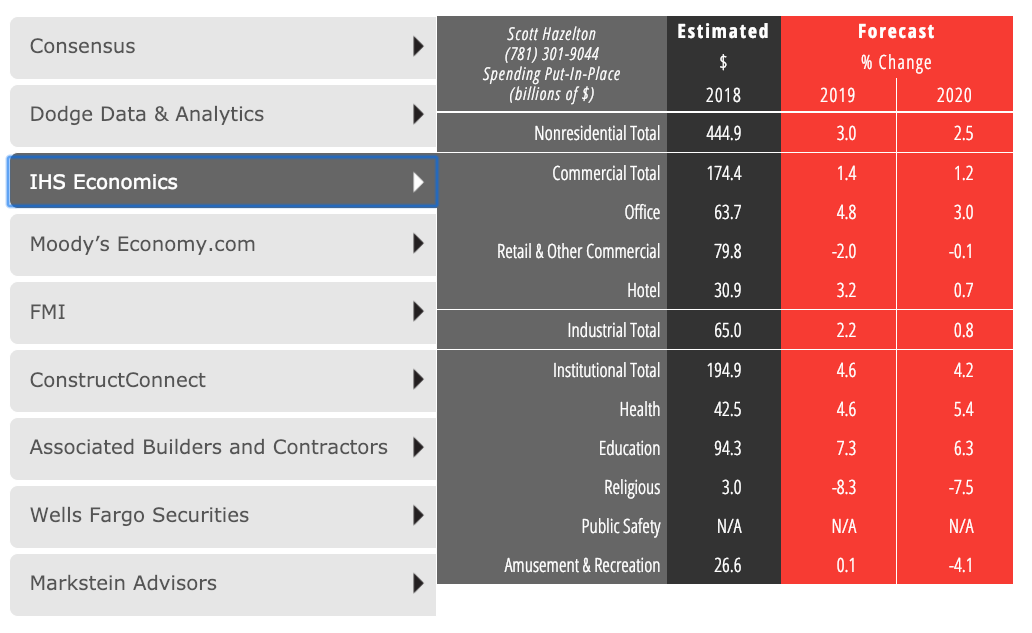

IHS ECONOMICS

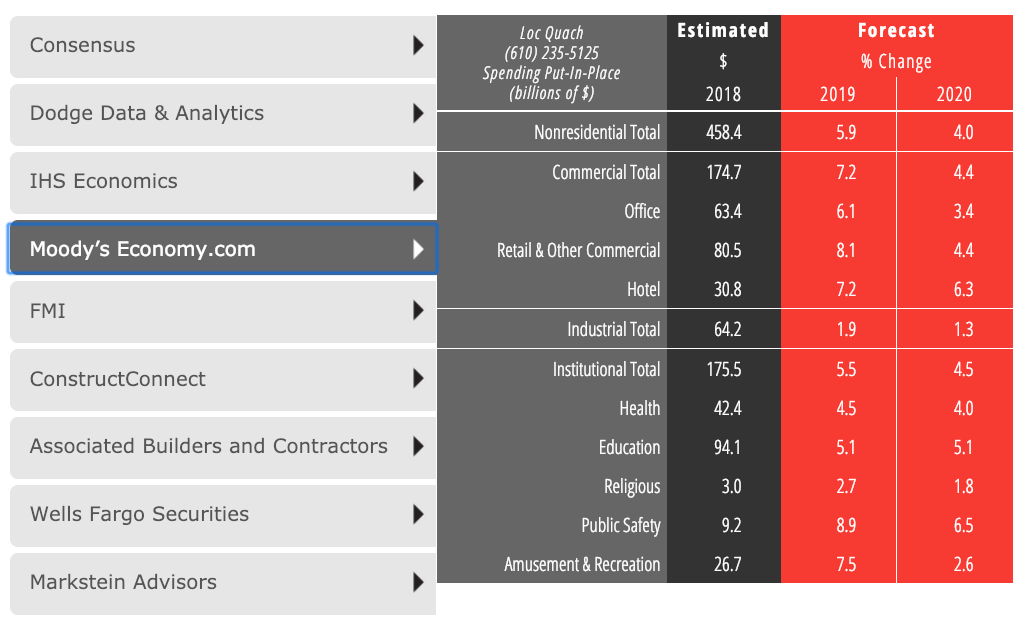

MOODY'S ECONOMY.COM

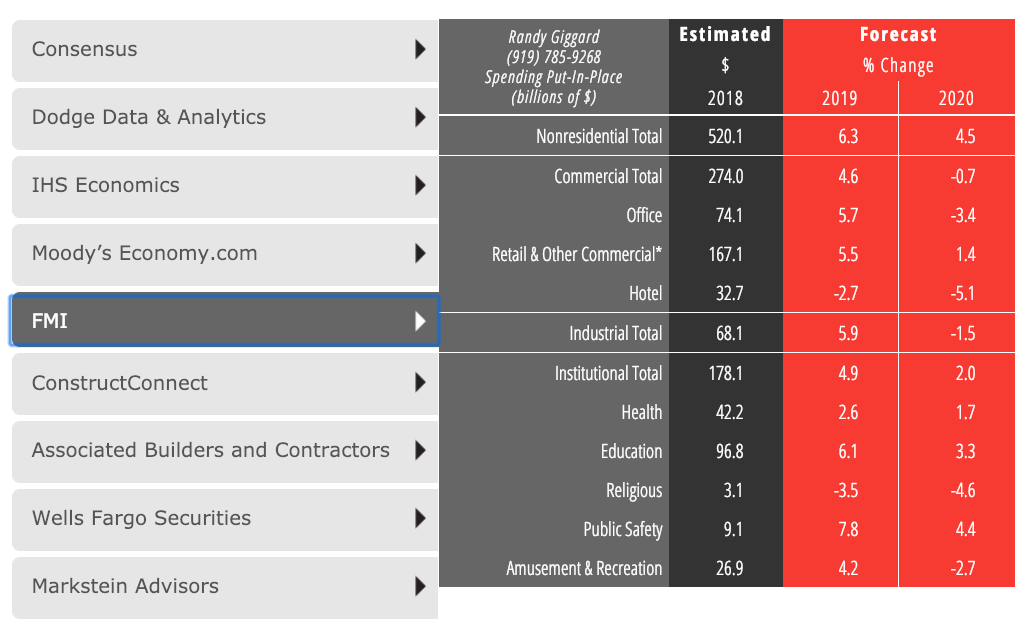

FMI

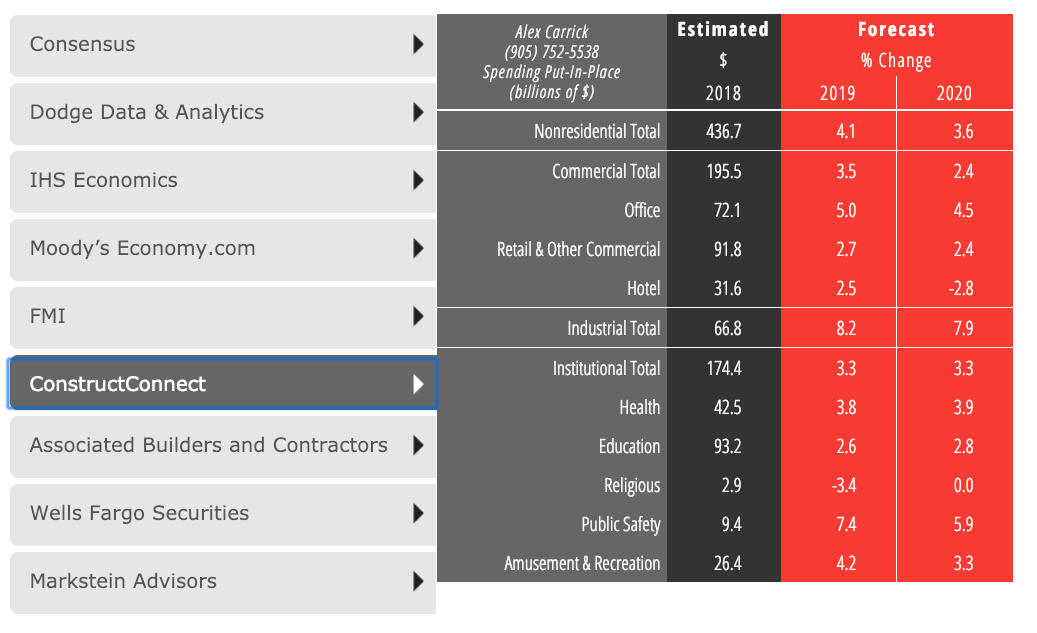

CONSTRUCTCONNECT

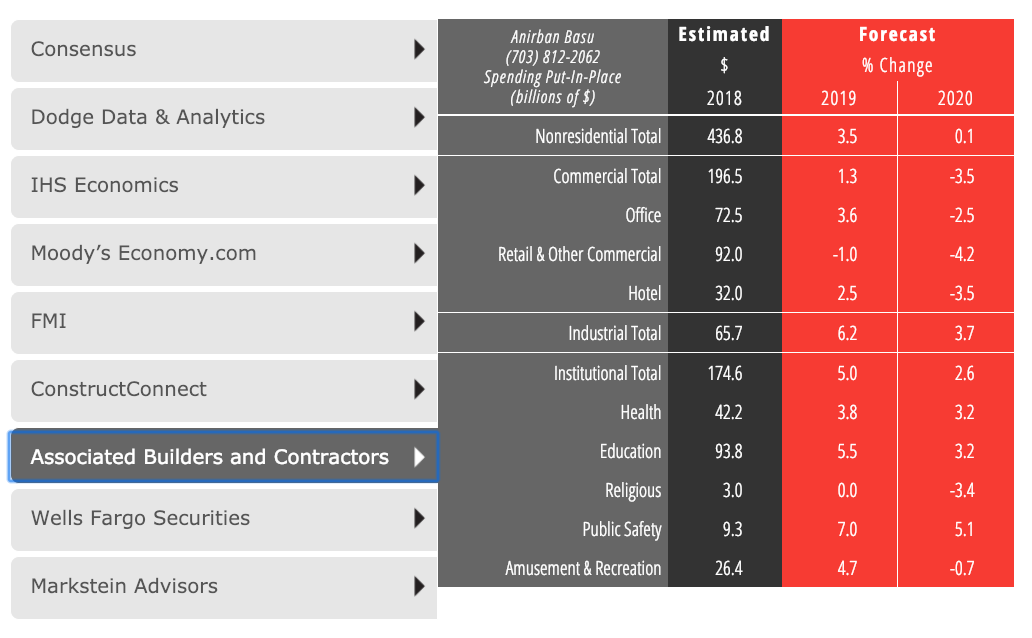

ASSOCIATED BUILDERS AND CONTRACTORS (ABC)

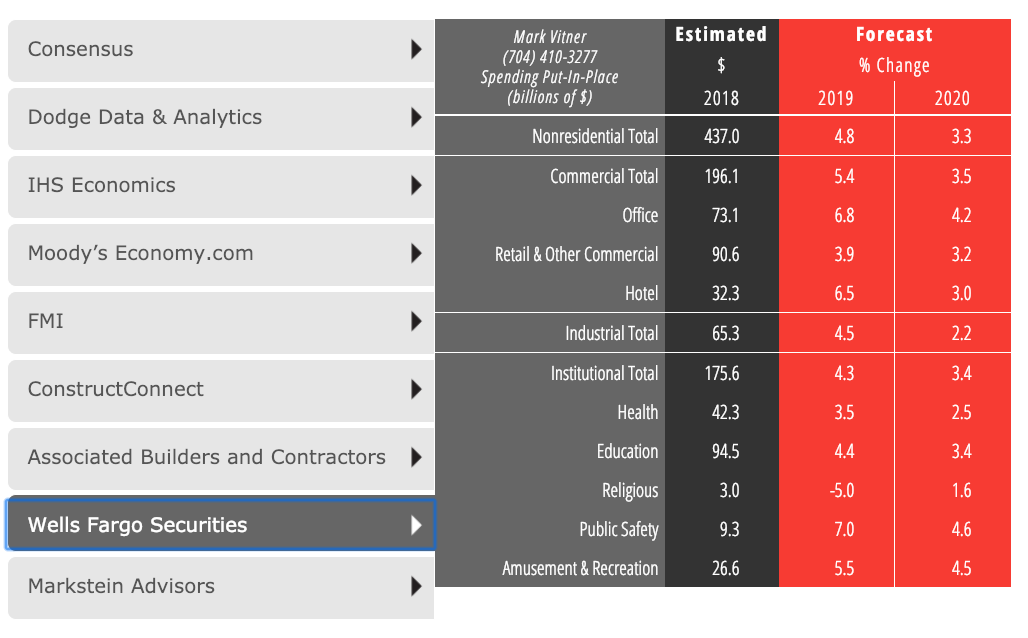

WELLS FARGO SECURITIES

MARKSTEIN ADVISORS

Notes:

• FMI's Retail & Other Commercial category includes transportation and communication sectors.

• The AIA Consensus Forecast is computed as an average of the forecasts provided by the panelists that submit forecasts for each of the included building categories.

• There are no standard definition of some nonresidential building categories, so panelists may define a given category somewhat differently.

• Panelists may forecast only a portion of a category (e.g public buildings but not private buldings); these forecasts are treated like other forecasts in computing the consensus.

• All forecasts are presented in current (non-inflation adjusted) dollars.

Related Stories

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.