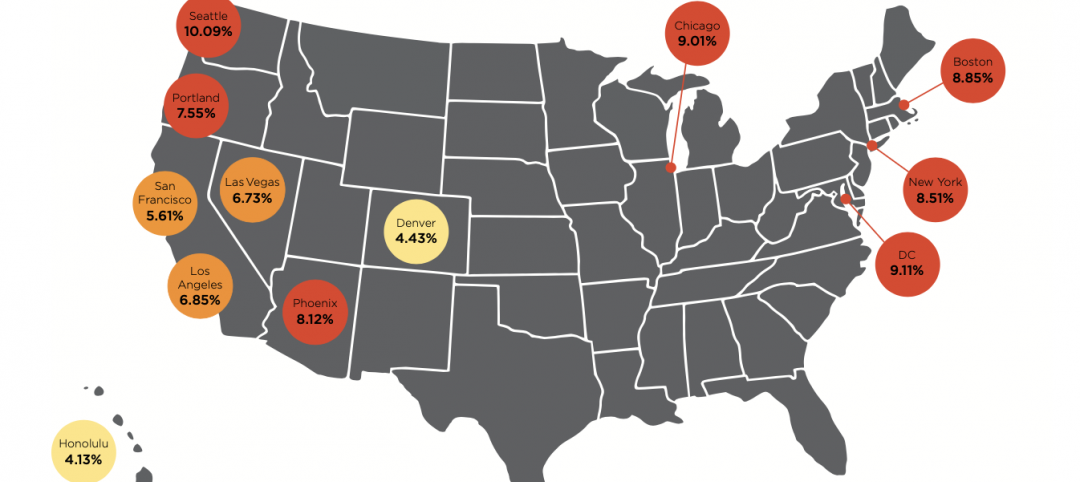

Nonresidential construction spending on buildings is projected to grow by 4.4% through 2019, according to a new consensus forecast from The American Institute of Architects (AIA).

Healthy gains in the industrial and institutional building sectors have bolstered growth projections for 2019. However, the AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—is suggesting that a broader economic downturn may be materializing over the next 12-24 months. See what each panelist forecasts for 2019 below, and using this interactive chart.

“Though the economy has been performing very well recently, trends in business confidence scores are red flags that suggest a slowdown is likely for 2020,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “These signals may be temporary responses to negative short-term conditions, but historically they have preceded a more widespread downturn.”

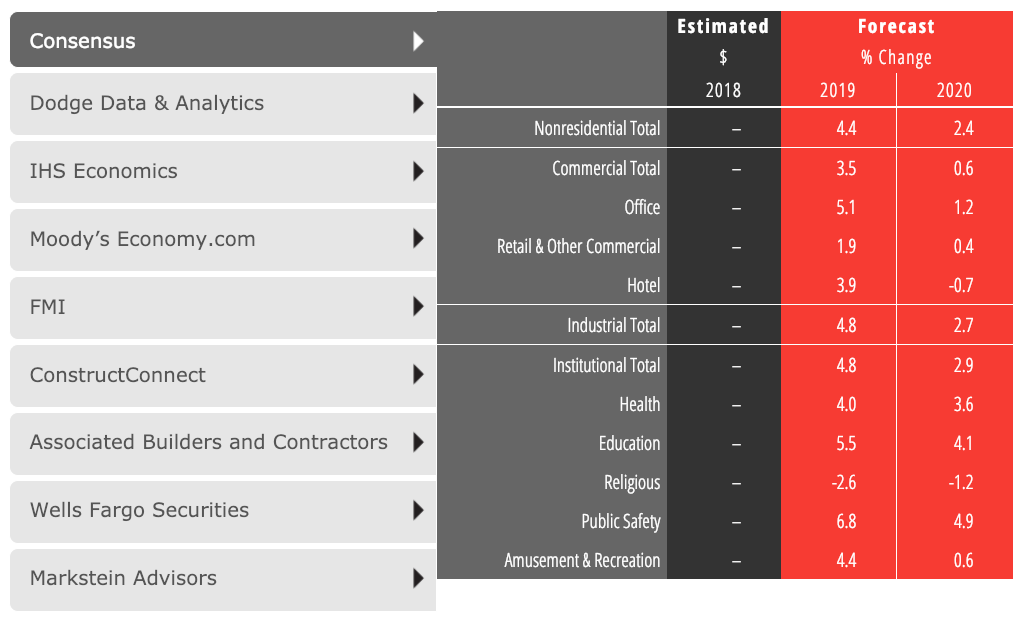

OVERALL CONSENSUS

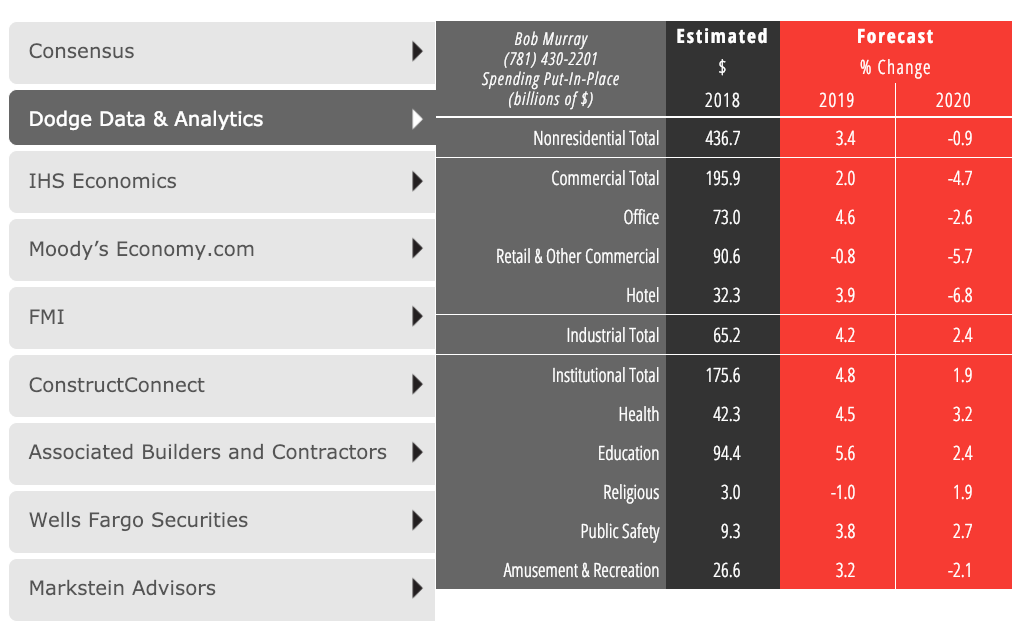

DODGE DATA & ANALYTCS

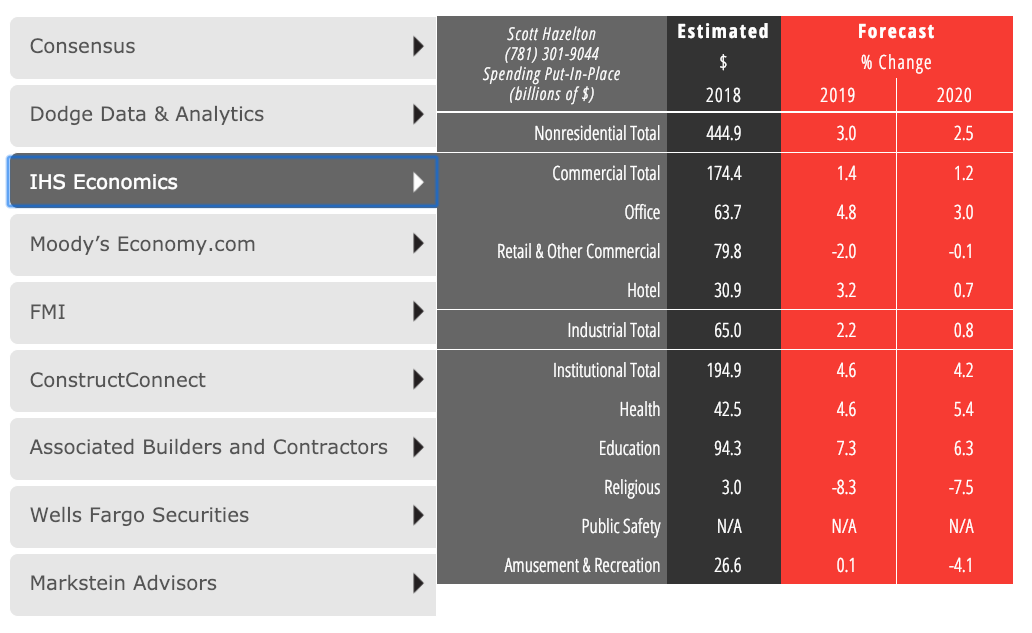

IHS ECONOMICS

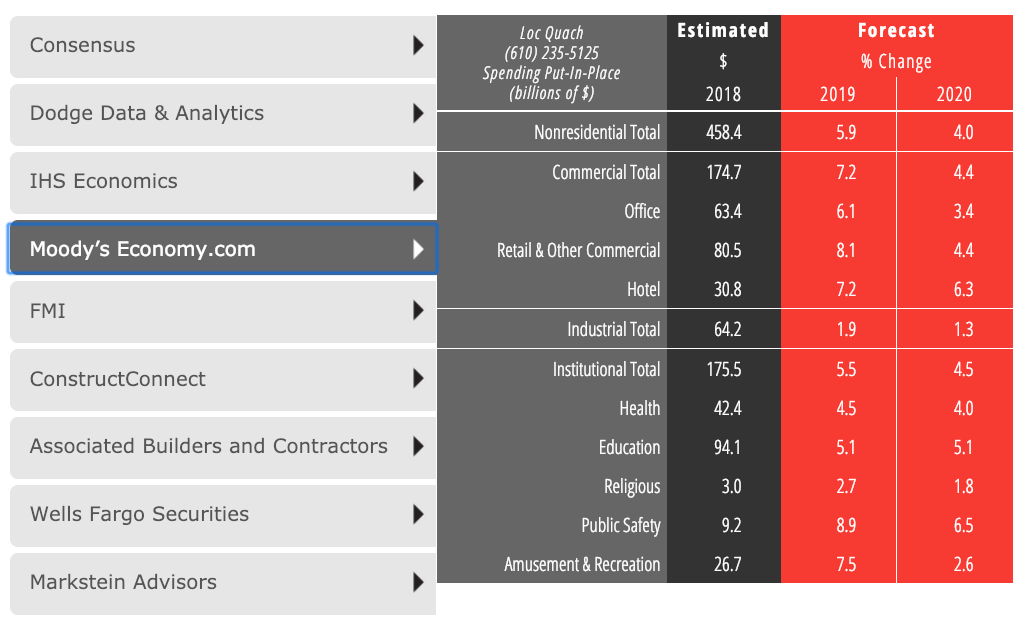

MOODY'S ECONOMY.COM

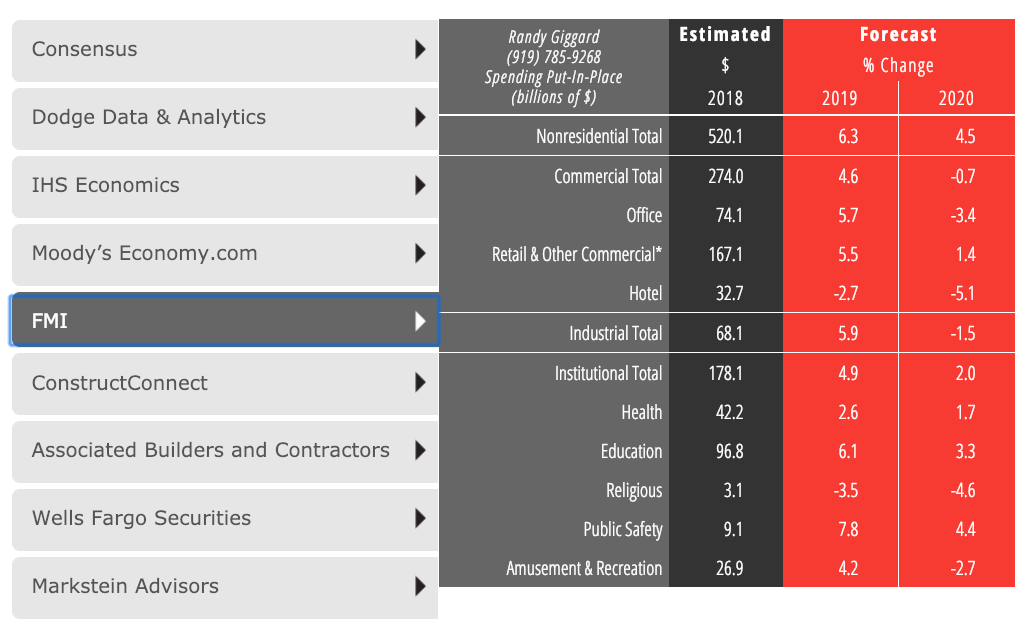

FMI

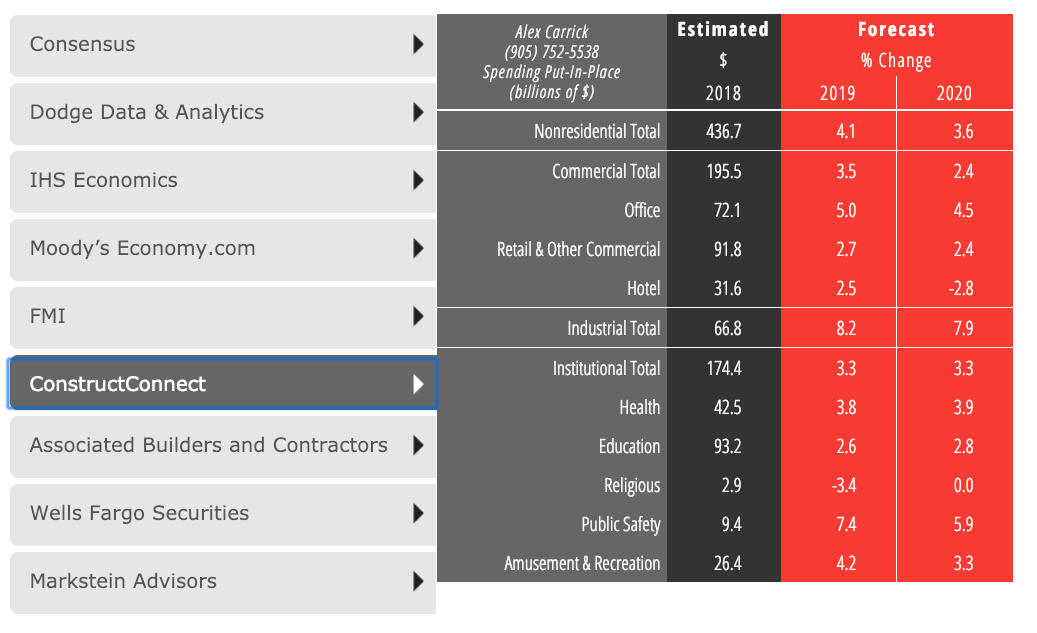

CONSTRUCTCONNECT

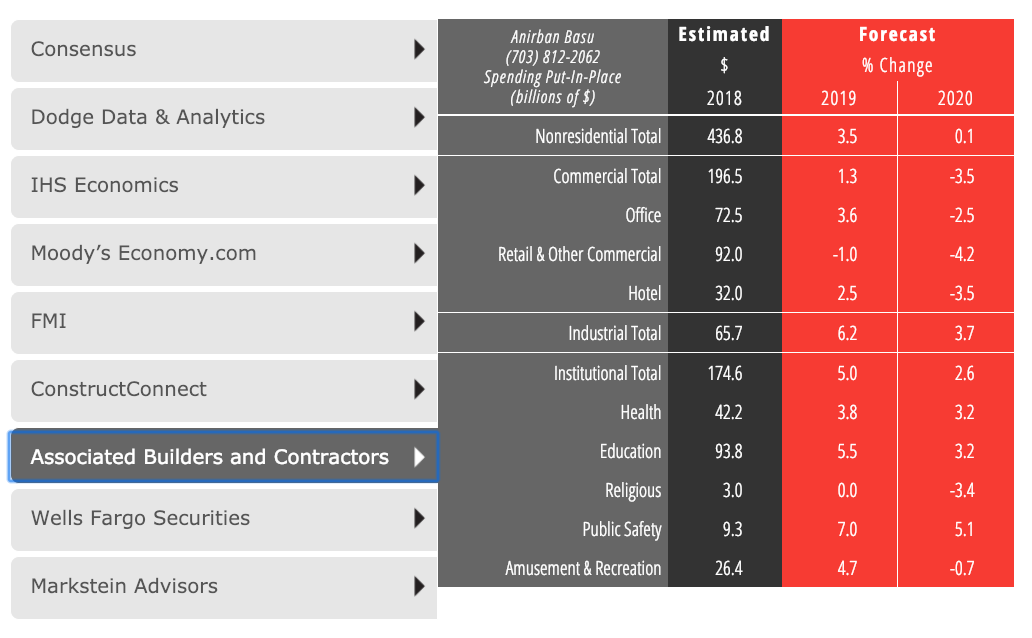

ASSOCIATED BUILDERS AND CONTRACTORS (ABC)

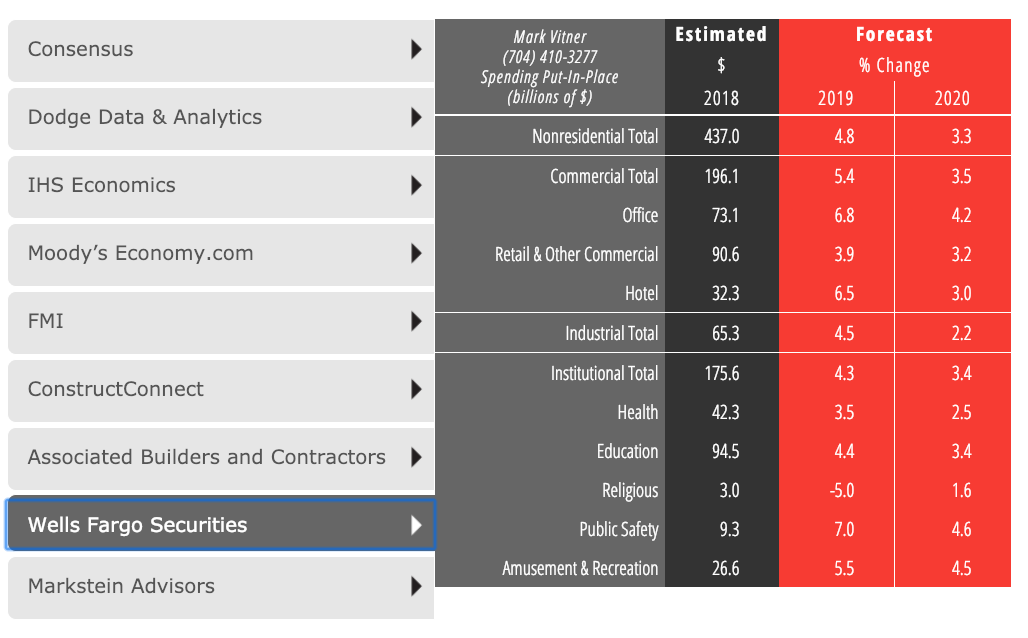

WELLS FARGO SECURITIES

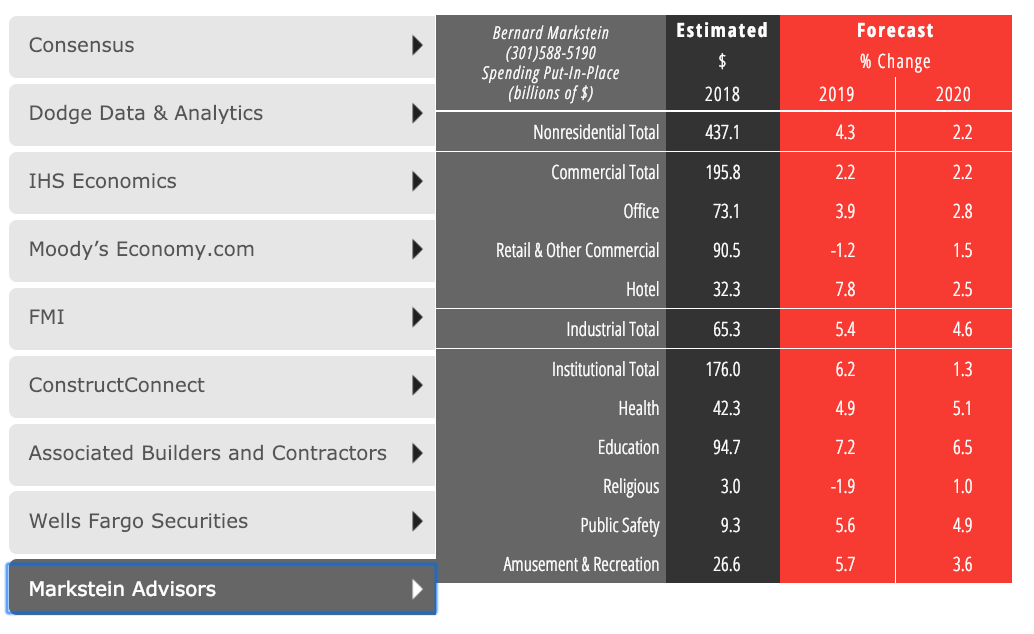

MARKSTEIN ADVISORS

Notes:

• FMI's Retail & Other Commercial category includes transportation and communication sectors.

• The AIA Consensus Forecast is computed as an average of the forecasts provided by the panelists that submit forecasts for each of the included building categories.

• There are no standard definition of some nonresidential building categories, so panelists may define a given category somewhat differently.

• Panelists may forecast only a portion of a category (e.g public buildings but not private buldings); these forecasts are treated like other forecasts in computing the consensus.

• All forecasts are presented in current (non-inflation adjusted) dollars.

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.