U.S. architecture, engineering, and construction firms are being stymied by the shortage of experienced design and construction professionals and project managers, according to an exclusive Building Design+Construction survey of 133 C-suite executives and human resources directors at AEC firms.

“Finding good qualified people with experience in running projects is a challenge” is how one respondent summarized the AEC field’s shortage of so-called “seller-doers.”

Download a PDF of the survey findings (registration required)

Another industry executive worried about the AEC sector’s changing demographics, said: “There are not many young people entering the profession, and there is an extreme lack of talented people in the 10+ years’ level of experience,” said this respondent. “We have no problem hiring college graduates, but keeping them after five years is difficult, and then we start over with a new hire.”

KEY FINDINGS FROM THE SURVEY

- Four out of five respondents (81.7%) said they anticipate their firms will add at least 5% to their professional staffs over the next two years.

- “AEC professionals with 6–10 years’ experience” was cited by 24.2% of respondents as the staff category that is more than usually difficult to recruit or hire, followed by “AEC professionals with more than 10 years’ experience” (17.1%).

- Project managers were deemed the third most unusually difficult position to fill, at 16.3%.

- Bringing up the rear: “AEC professionals with 3–5 years’ experience,” at 13.3%.

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

said their firms have not had serious problems hiring qualified professionals.

- “Specialty staff (IT, BIM/VDC, Revit, CAD, etc.)” were determined to be unusually difficult to recruit by 10.0% of respondents.

- Nearly six of 10 respondents (58.1%) said it has taken their firms four months or more to place their most difficult positions to fill.

- More than six in ten respondents (61.1%) said “flexible work hours” was offered as an incentive to attract qualified AEC professionals.

- Nearly seven in ten respondents (69.4%) stated that they used “word of mouth” (not specifically defined) as a recruiting tool. Nearly a quarter of respondents (23.2%) cited “word of mouth” as their firms’ most effective recruitment tool.

- The majority of respondents (54.6%) agreed with the statement, “It’s taking us longer than ever to fill positions for qualified AEC professionals.”

- More than four in five respondents (81.5%) reported one problem or other in their firms’ efforts to recruit and hire the right professionals.

Perhaps most startling of all was the finding that one in six respondents (16.7%) said their firms had delayed or turned down projects because they could not hire qualified AEC professionals to run them.

Respondents offered possible remedies for the talent shortfall. “Competition for talent is high,” said one respondent. “Focus by the entire team, including talent recruitment professionals, hiring managers, and company leadership, is key to success.”

“Firms need to realize that to attract and retain talent you cannot keep operating your company the same way they have been for the last few decades,” said another respondent. “You need to offer more vacation time, flexible hours, good insurance, a good salary. The firms that do this well do not seem to have issues with attraction and retention. Also, we have to be cognizant that these peak times will soon enough swing downward: they always do.”

Download a PDF of the survey findings (registration required).

Related Stories

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.

High-rise Construction | Sep 8, 2017

CTBUH determines fastest elevators and longest runs in the world in new TBIN Study

When it comes to the tallest skyscrapers in the world, the vertical commute in the building becomes just as important as the horizontal commute through the city.

Multifamily Housing | Sep 5, 2017

Free WiFi, meeting rooms most popular business services amenities in multifamily developments

Complimentary, building-wide WiFi is more or less a given for marketing purposes in the multifamily arena.

Market Data | Sep 5, 2017

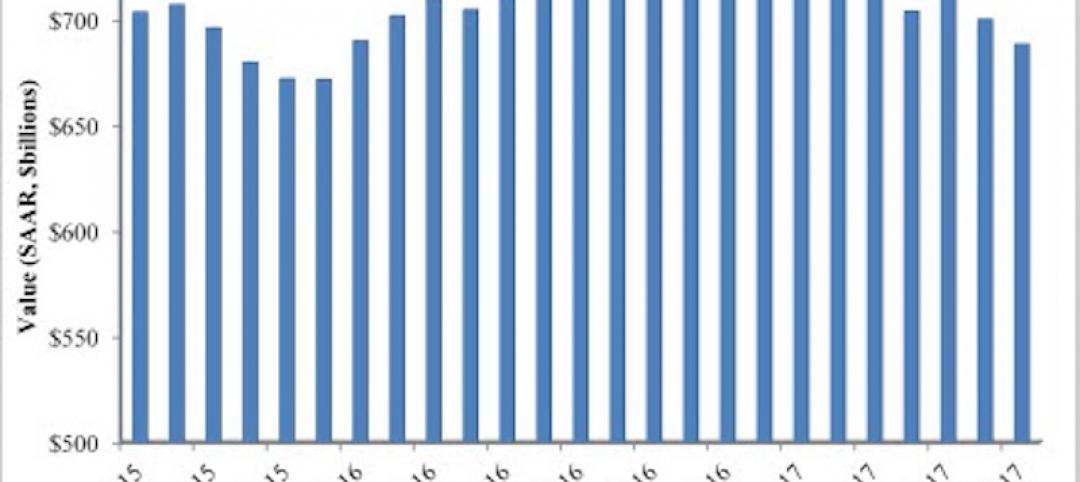

Nonresidential construction declines again, public and private sector down in July

Weakness in spending was widespread.

Market Data | Aug 29, 2017

Hidden opportunities emerge from construction industry challenges

JLL’s latest construction report shows stability ahead with tech and innovation leading the way.

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.