Between January 2021 and February 2022, nearly 57 million people in the U.S quit their jobs. The average quit rate between August and December of last year was 4-4.1 million per month. In the construction sector alone, the quit rate during those five months ranged from 138,000 to 208,000 per month, according to Census Bureau estimates.

The so-called Great Resignation “was a wakeup call, in one sense” for America’s businesses and economy that continues to resonate. However, AEC firms have tended to respond to this phenomenon instead of measuring its impact.

That’s the assessment of Karl Feldman, a partner with Hinge Marketing, a research-based branding and marketing firm headquartered in Reston, Va. Hinge has been tracking employee satisfaction, and its latest study explores why people leave their jobs, based on responses to a poll of AEC workers at different career levels from 120 firms with combined revenue of over $8 billion. The polling was conducted between late August and late November 2022.

Forty-four percent of respondents were “mid career,” and another 28 percent were at “leadership” levels, such as directors or vice presidents. More than half of the respondents worked for firms with at least 200 employees each.

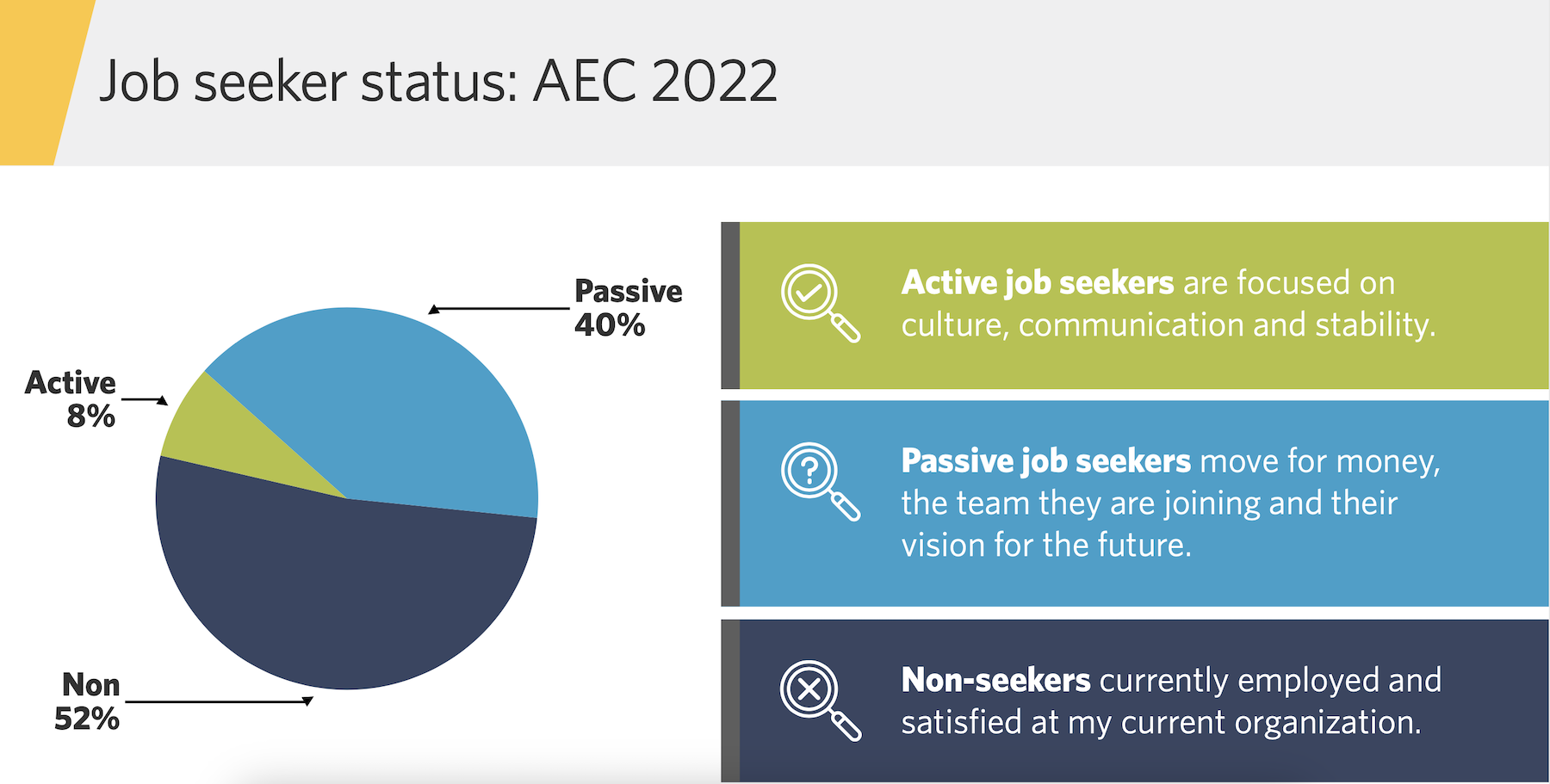

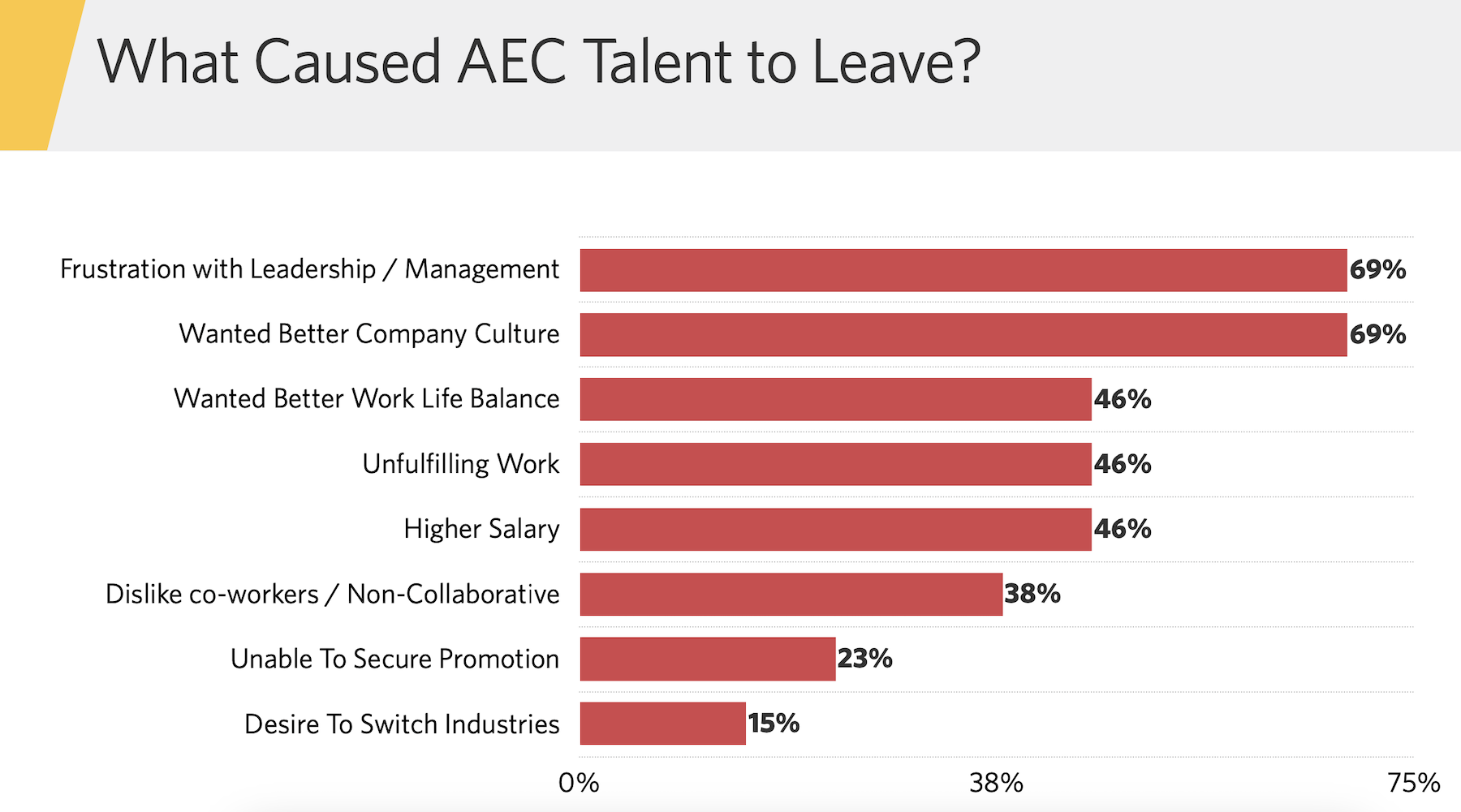

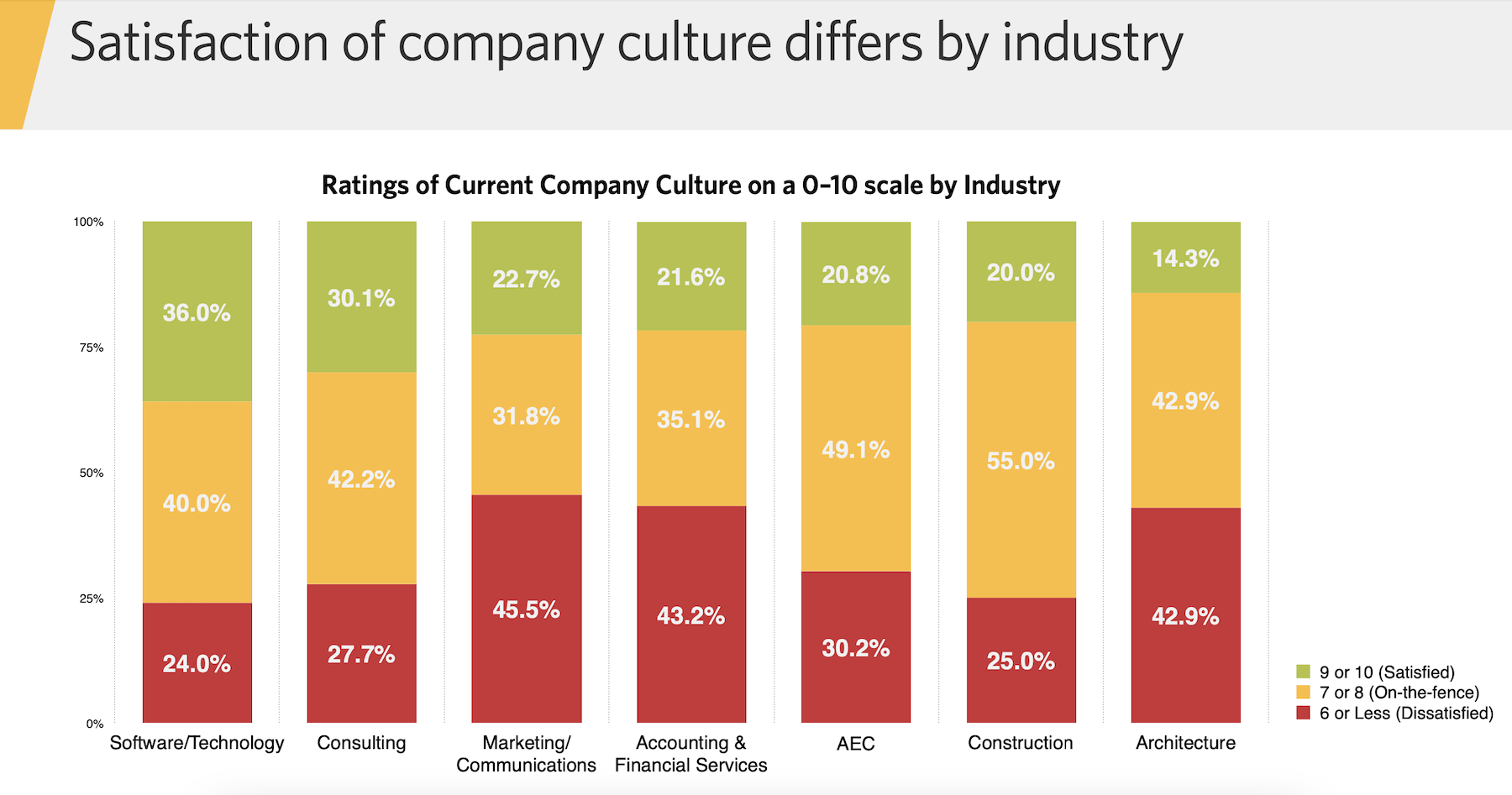

The survey found that only a relatively small percentage of workers is actively looking for a new job. But the survey also found that talent is most likely to start coveting greener pastures in mid-career, three to five years into their current jobs. Nearly half of AEC employees are on the fence about their companies, neither satisfied nor dissatisfied; however, more than half of AEC workers who had quit in the previous 12 months cited two factors—a poor company culture or frustration with its leadership—among their reasons for bolting.

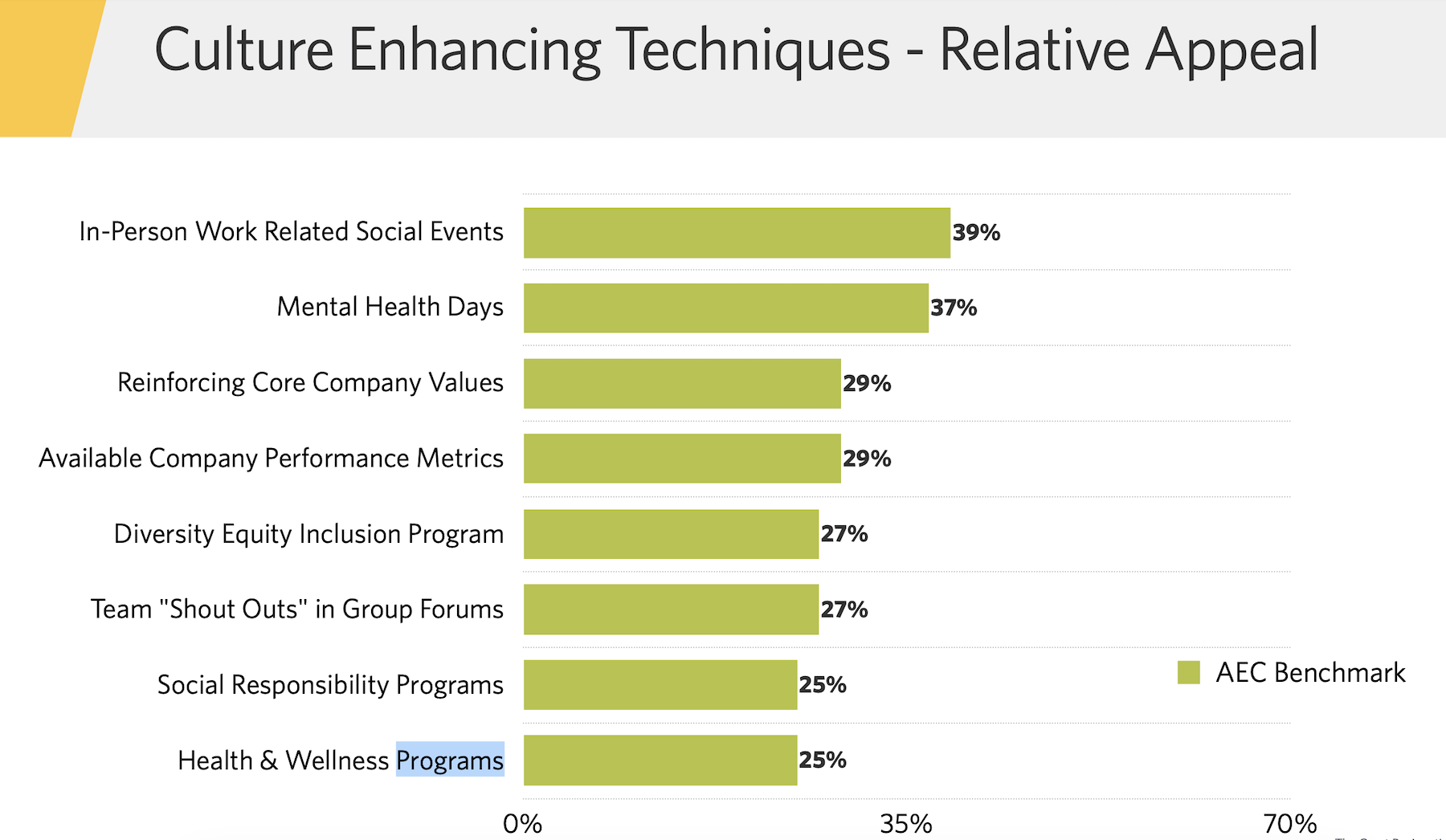

Feldman observes that many businesses still perceive “culture” as sounding “fluffy.” But, he explains, culture is essentially about how a company gets things done. “That’s the question that talent is asking about companies,” he says, and the answers better be “genuine.”

Show and tell

Feldman says that technology and organizational support are the “great equalizers” in corporate America. “The days of rainmakers are gone,” he believes. That being said, Feldman observes that employees expect their companies to invest in their “brands,” in ways that burnish their reputations and visibility. “Folks who stand out from the ‘beige’ are going to have an edge.”

The problem with the AEC sector, says Feldman, is that it’s still behind the curve using automation tools that can aggregate data to understand what employees expect and want. He wonders, for example, how many AEC firms can describe what their ideal job candidate are? Or how many firms are set up to tutor younger-generation employees who, Feldman says, are eager to learn from mentors?

The survey found that mid-career and leadership employees alike want to feel confident that their voices are being listened to. But on a range of what’s important to them, mid-career workers aren’t keen on wearing too many job hats, whereas leaders require the option and tools to work efficiently from remote locations.

Hinge’s study offers AEC firms six strategies for keeping talent corralled. The first advises them to get to know their employees better at their mid-career levels. Companies should also conduct self-assessments of their brands, “tune” and communicate their cultures, showcase their employees’ expertise, introduce job candidates to their teams, and secure whatever “accelerants” a company needs to retain and expand their talent.

“Mid-level leadership is looking for a good home, but also wants to grow,” says Feldman. What companies need to ask themselves is “will we be more visible and credible” to retain employees they want to keep?

Related Stories

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

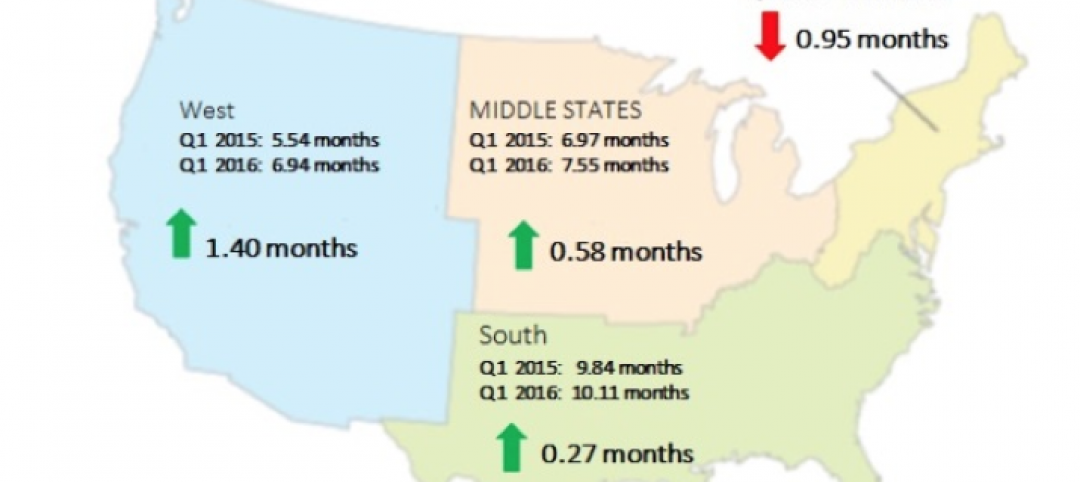

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.