Construction material prices fell for the sixth consecutive month in December, losing 1.2% on a monthly basis and 4% on a yearly basis according to an analysis of the Bureau of Labor Statistics Producer Price Index released by Associated Builders and Contractors (ABC).

Construction input prices have fallen 7.2% since peaking in August 2014, and have fallen in 11 of the previous 16 months. Nonresidential construction input prices exhibited similar declines, falling 1.1% for the month and 4% for the year.

"Construction input prices continued to sink to the end of 2015, due in large measure to global deflationary forces that have become increasingly apparent," said ABC Chief Economist Anirban Basu. "The World Bank predicts that the global economy will expand by less than 3% in 2016, very limited growth by historic standards. Last year, the global economy expanded by just 2.4%, with significant weakness recorded in much of the emerging world. Like last year, major emerging nations like Russia and Brazil are anticipated to be in recession.

"In addition, the U.S. dollar remains strong," Basu said. "With only a couple of exceptions, the U.S. is the only major nation to increase interest rates. If interest rates rise as anticipated, the dollar will strengthen further in 2016, placing additional downward pressure on input prices. Even significant geopolitical events involving oil producing nations has not been enough to stem the decline in oil or other commodity prices."

Only four key input prices expanded in December on a monthly basis:

- Natural gas prices expanded 5.2% month-over-month but are down 46.5% year-over-year.

- Prices for prepared asphalt and tar roofing and siding products rose 1% on a monthly basis but are down 2% on a yearly basis.

- Concrete product prices ticked 0.3% higher from November and are up 3% from the same time one year ago.

- Fabricated structural metal product prices inched 0.1% higher for the month but are 0.9% lower than at the same time one year ago.

Seven key input prices fell in December on a monthly basis:

- Crude petroleum prices plunged 16% month-over-month and are 43.3% lower year-over-year.

- Crude energy materials prices fell 5.7% for the month and are down 35.8% for the year.

- Softwood lumber prices shed 2.9% from November and are 6.8% lower than at the same time one year ago.

- Steel mill product prices dipped 2.7% for the month and 19.8% for the year.

- Prices for nonferrous wire and cable fell 2.7% on a monthly basis and are down 9.9% on a yearly basis.

- Iron and steel prices are down 2.2% for the month and 23.7% for the year.

- Prices for plumbing fixtures and fittings fell 0.5% month-over-month but expanded 1.3% year-over-year.

Related Stories

Market Data | Nov 2, 2016

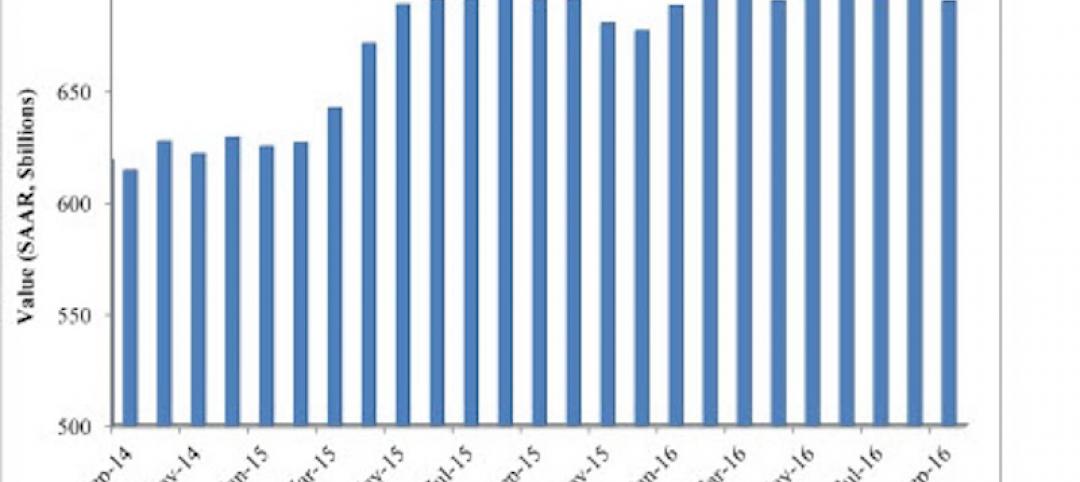

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Market Data | Oct 31, 2016

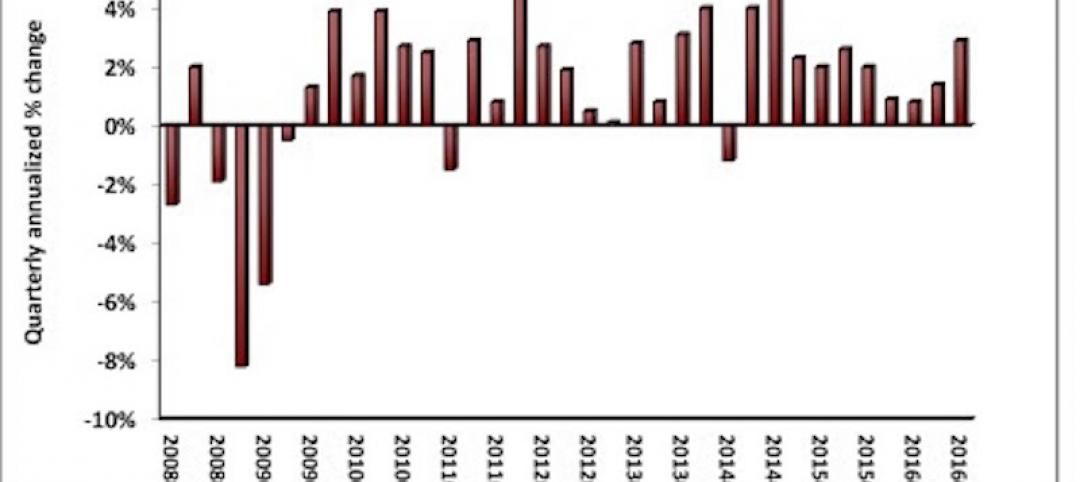

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.