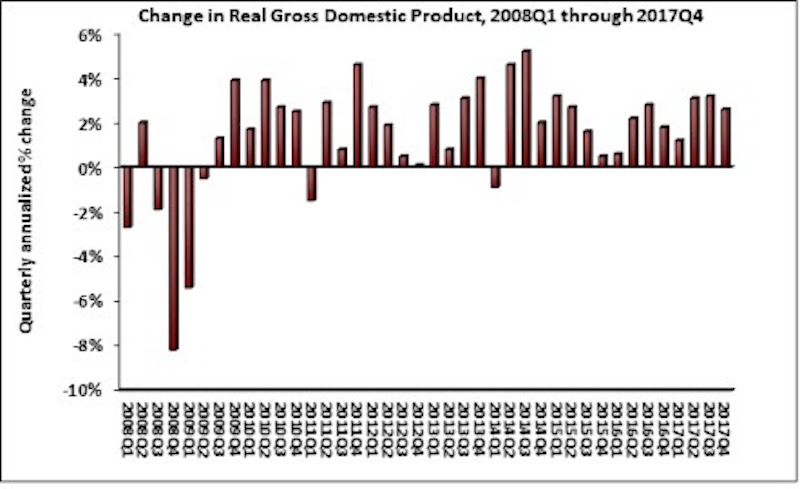

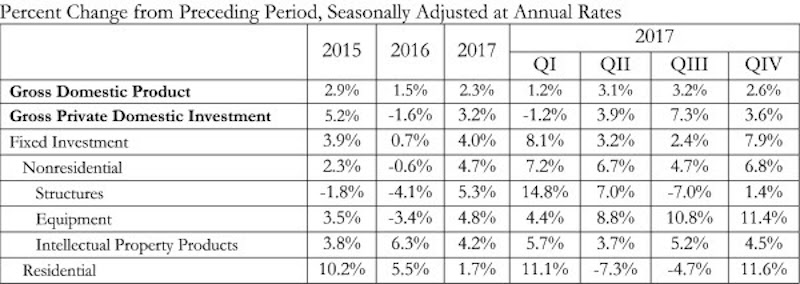

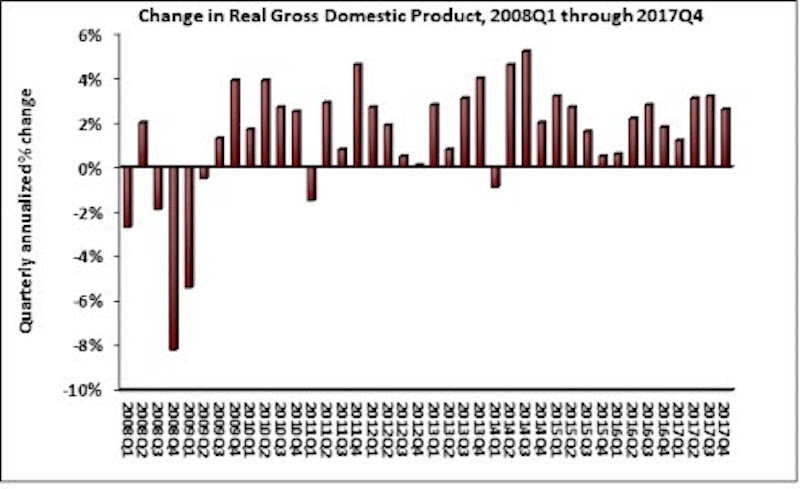

The U.S. economy grew by 2.3% in 2017, while fixed investment increased at a annual rate of 7.9%, according to an Associated Builders and Contractors (ABC) analysis of data released today by the Bureau of Economic Analysis.

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017 after expanding at a 3.2% rate during the third quarter. Nonresidential fixed investment performed similarly to overall fixed investment in the fourth quarter by increasing at a 6.8% rate. This represents the third time in the past four quarters that nonresidential fixed investment increased by at least 6.7%.

The year-end figure for GDP growth of 2.3% is up from 1.5% in 2016 but down from the 2.9% figure posted in 2015. Nonresidential fixed investment increased 4.7% in 2017, its best year since increasing 6.9% in 2014. This followed a 0.6% contraction in 2016.

“Many will look at this report and conclude that consumer spending, the largest component of the economy, drove fourth quarter growth by expanding at a 3.8% annual rate,” said ABC Chief Economist Anirban Basu. “Upon further inspection, however, the fourth quarter consumer spending missed its 3% expectation due to imports increasing at twice the rate of exports. This widening trade deficit subtracted 1.13 percentage points from fourth quarter GDP growth.

“The factors that have helped to accelerate economic growth in America remain in place, including a strengthening global economy, abundant consumer and business confidence, elevated liquidity flowing through the veins of the international financial system and deregulation,” said Basu. “Stakeholders should be aware that although many companies have announced big plans for stepped-up investment, staffing and compensation—due at least in part to the recently enacted tax cut—the plans have yet to fully manifest within the data. The implication is that the U.S. economy is set to roar in 2018.

“As always, contractors are warned to remain wary,” said Basu. “The combination of extraordinary confidence and capital can fuel excess financial leverage and spur asset price bubbles. The implication is that as contractors remain busy, there should be an ongoing stockpiling of defensive cash. That recommendation will be difficult for many contractors to implement, however, with labor shortages and materials costs rising more rapidly and slender profit margins in many construction segments.”

Related Stories

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Feb 17, 2021

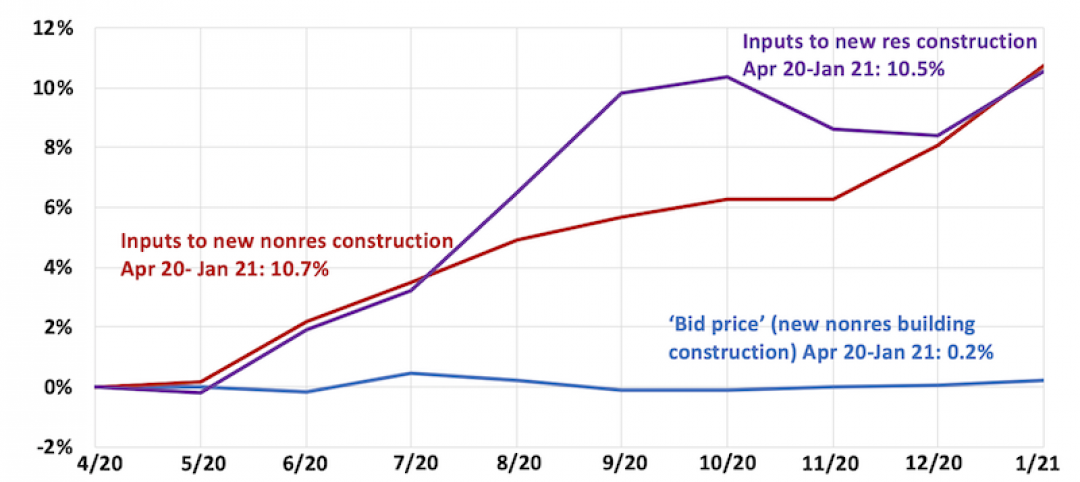

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

Market Data | Feb 9, 2021

USGBC top 10 states for LEED in 2020

The Top 10 States for LEED green building is based on gross square feet of certified space per person using 2010 U.S. Census data and includes commercial and institutional projects certified in 2020.

Market Data | Feb 8, 2021

Construction employment stalls in January with unemployment rate of 9.4%

New measures threaten to undermine recovery.

Market Data | Feb 4, 2021

Construction employment declined in 2020 in majority of metro areas

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 2020 losses, while Indianapolis-Carmel-Anderson, Ind. and Walla Walla, Wash. register largest gains in industry jobs.

Market Data | Feb 3, 2021

Construction spending diverges in December with slump in private nonresidential sector, mixed public work, and boom in homebuilding

Demand for nonresidential construction and public works will decline amid ongoing pandemic concerns.

Market Data | Feb 1, 2021

The New York City market is back on top and leads the U.S. hotel construction pipeline

New York City has the greatest number of projects under construction with 108 projects/19,439 rooms.

Market Data | Jan 29, 2021

Multifamily housing construction outlook soars in late 2020

Exceeds pre-COVID levels, reaching highest mark since 1st quarter 2018.

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.