According to a recent report by Lodging Econometrics (LE), the U.S. Construction Pipeline stands at 4,973 Projects/598,371 Rooms, with projects up 7% Year-Over-Year (YOY).

There are 1,520 Projects/198,710 Rooms Under Construction, up 10% YOY, and are the highest counts recorded this cycle. Projects Scheduled to Start Construction in the Next 12 Months, at 2,312 Projects/264,924 Rooms, are up 5% YOY. Projects in Early Planning are at 1,141 Projects/134,737 Rooms and are up 8%, YOY. However, it’s slightly down from last quarter which, so far, is the peak level this cycle.

For the economy, the rate of growth may be low but it’s running on all cylinders. So, too, with the Total Pipeline whose growth rate is also stalling.

20% increase in new supply forecast for 2017 in the U.S.

448 Hotels/50,521 Rooms have already opened in the U.S. with another 573 Projects/64,385 Rooms forecast to open by year-end according to analysts at Lodging Econometrics (LE). The Total 2017 Forecast for 1,021 Projects/114,906 Rooms, represents a 20% increase over the actual number of Hotel Openings in 2016, which stood at 849 Hotels/99,872 Rooms. 344 of the New Openings, or 34%, will be in the Top 25 Markets.

Almost half of the hotels that are expected to open this year are Upper Midscale, at 477 Projects/46,093 Rooms and another 289 Projects/37,914 Rooms are Upscale. These two chain scales represent 75% of the 1,021 projects anticipated to open through the end of 2017. 497 of the projects will be between 100 and 200 rooms, while 464 of the projects will be Suburban locations.

LE forecasts that 1,160 Projects/133,880 Rooms will open in 2018 and another 1,193 Projects/137,393 Rooms will open in 2019, still a distance from the annualized New Openings peak of 1,316 Projects/140,227 Rooms, set in 2009.

Related Stories

Contractors | Apr 19, 2023

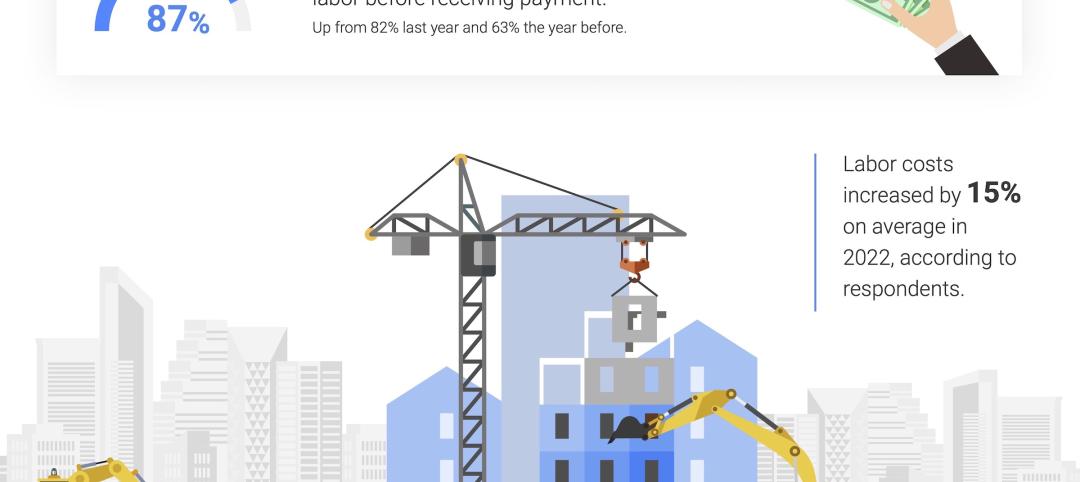

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

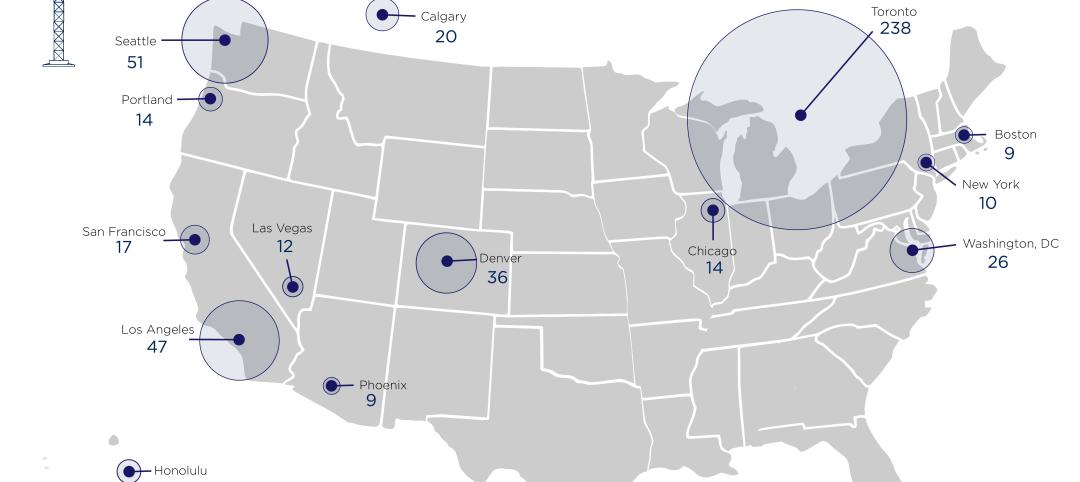

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.