Analysts at Lodging Econometrics (LE) report that at the fourth quarter close of 2021, the total U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms, down 8% by projects and 10% by rooms year-over-year (YOY). While project totals have dipped slightly YOY, the number of projects in the early planning stage continues to rise. In the final quarter of 2021, projects in the early planning stage experienced an 18% increase by projects and 11% by rooms YOY, for a total of 2,021 projects/239,816 rooms.

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter. Projects under construction finished the year at 972 projects/131,247 rooms. New project announcements are down in the fourth quarter; however, developers are eager to accelerate projects long-delayed by the COVID-19 pandemic. Unfortunately, they face some development roadblocks, including escalating inflation and supply chain shortages, that are causing higher prices versus “pre-pandemic” costs for labor and materials. These factors continue to prolong hotel development timelines. We anticipate these challenges to abate throughout the year and see construction starts to moderately improve.

Nevertheless, the hotel industry has found some assurance in the recent resurgence of travel demand and the steady increase in hotel booking numbers over recent months. Pandemic exhaustion and pent-up demand for “get-aways” have led to a growing number of Americans becoming more open to travel. In addition to leisure travel, the business sector has a strong desire to travel and meet in person. LE analysts are expecting higher attendance at industry conferences and events after Q1‘22. This will help to raise hotel business demand and positively impact the industry as a whole.

Through year-end 2021, the U.S. opened 823 projects accounting for 105,705 rooms, for a growth rate of 1.9%. For 2022, LE is forecasting 783 projects/90,074 rooms to open at a supply growth rate of 1.6%. In 2023, continuing at a supply growth rate of 1.6%, another 820 projects/93,112 rooms are anticipated to open by year-end.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

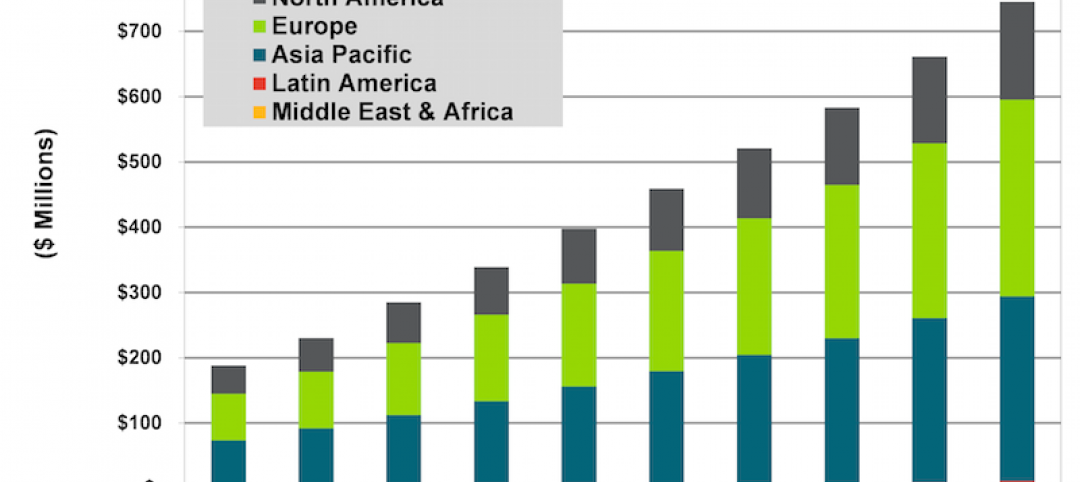

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.