The developer TPA Residential recently selected McShane Construction to build Woodward Crossing, a Class-A, 265-unit apartment complex on 7.8 acres in Buford, Ga. The apartments would be inside two buildings, four and five stories, designed by the architecture firm Niles Bolton Associates. Its completion is scheduled for May 2022.

The Southeast is one region of the country where multifamily construction remains steady, according to construction firms active there. “Our core footprint is currently in the Southeast, [where] apartments are performing very well right now,” says Marc Padgett, president of Summit Contracting Group. Demand for multifamily isn’t cooling off, either; Summit had signed contracts for more projects through September 2020 than it had during the same nine months last year. And Padgett expects 2021 to be better for his company than either of the two prior years.

“What many don’t realize is when the economy worsens, the demand for multifamily improves,” he explains.

Last January, the general contractor Brasfield & Gorrie completed Deca Camperdown, a $48 million, 11-story building in Greenville, S.C., with 217 apartments that average 1,007 sf and feature luxury finishes. NELSON Worldwide was the architect, and Daniel Corporation the developer.

Deca Camperdown in Greenville, S.C., which was completed last January, boasts 217 homes with luxury interior finishes such as quartz countertops, stainless steel appliances, and designer light fixutres. Images: Kevin Ruck, courtesy of Brasfield & Gorrie

Opportunities for urban infill high rise construction are scarcer, acknowledges Roddy McCrory, Brasfield & Gorrie’s Vice President and Regional Business Development Director. But Alabama-based firm is encouraged by stronger demand for “affordable options”—like garden-style apartments or podium products—that support workforce renters’ needs in cities and suburbs in the Southeast.

PROJECTS PROCEED, DESPITE SOME MARKET SOFTNESS

On a national level, the multifamily sector, which over the past several years gave housing construction its wings, has been coming back to earth. The annualized rate for housing starts in buildings with five more apartments stood at 295,000 units in September, which according to Census Bureau estimates was 17.4% below starts for the same month in 2019. Multifamily permits, a barometer of future building, were also down in September, by 22.2% to 390,000 units.

Also see: Multifamily’s long-term outlook rebounds to pre-COVID levels in Q3

Multifamilybiz.com, citing Dodge Data and Analytics as its source, reported that for the 12 months ending in September, multifamily starts were off 5%, compared to a 7% gain in single-family starts over the same period.

CBRE’s economic advisers predict the multifamily market will reach its bottom in the fourth quarter of 2020 and begin recovering in the first quarter of 2021. Vacancies will rise to 7.2% by the end of 2020, a full 3.1 percentage points higher than what’s projected for the end of 2021.

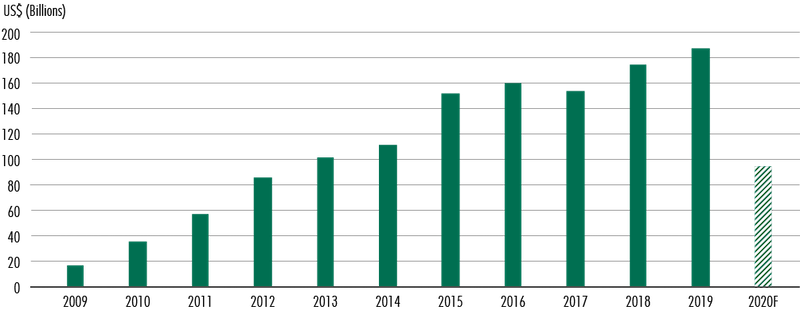

CBRE projects that investment in multifamily properties will be way off this year, but start recovering in 2021. Image: CBRE

This national pullback notwithstanding, large multifamily projects continue to get built, often as centerpieces of ambitious redevelopment plans. Last August, Brasfield & Gorrie completed The Julian, a 14-story 381,000-sf apartment complex in Orlando, Fla., designed for Ustler Development by Baker Barrios Architects, with 409 units and a 10-story 234,000-sf parking garage. The Julian is part of Creative Village, a 68-acre mixed-use transit-oriented urban infill neighborhood.

The Julian Apartments are the first housing in Orlando's Creative Village neighborhood development that are not restricted to students of the new downtown University of Central Florida campus. Image: Ben Tanner Photography, courtesy of Brasfield & Gorrie

That same month, ground broke for the $130 million AJ Railyards mixed-use building on 2.89 acres in Sacramento, Calif. (Brown Construction is the GC, LPAS Architects the design architect.) AJ Railyards will have 345 rental apartments (69 of them affordable), and 5,000 sf of ground-floor retail. This project, scheduled for completion in the winter of 2022, is a partnership between LDK Ventures and USA Properties Fund. It is part of a 244-acre urban infill redevelopment that, while still in its early stages, will eventually double the size of downtown Sacramento.

Also see: Miami’s yacht-inspired UNA Residences begins construction

On October 27, Shawmut Design and Construction broke ground on 1.16 acres in Providence, R.I., for Emblem 125, a nearly $90 million development that, when it opens in the summer of 2022, will include 248 residential units, 22,700 sf of ground-floor retail space, and an 1,800-sf rooftop space. This mixed-use building, developed by Exeter Property Group and designed by Torti Gallas + Partners and ZDS, is one of the largest to break ground within the I-195 Redevelopment District. Rhode Island’s Governor Gina Raimondo lauded Emblem 125 as “a huge step forward for the growth of the Providence Innovation and Design District.”

A rendering of Emblem 125, a $90 million multifamily project that will be part of Providence, R.I.'s Innovation and Design District. Image: Exeter Property Group.

COVID-19 RATTLES SUPPLY CHAIN

As was the case for other building types, multifamily supply and demand were hobbled by the spread of the coronavirus. In Freddie Mac’s 2020 Midyear Outlook, Steve Guggenmos, the agency’s Vice President of Research and Marketing, wrote that multifamily demand in the second quarter saw “a meaningful slowdown given the nationwide shutdown,” along with a high rate of lease renewals as tenants stayed put during the height of quarantines and lockdowns. Guggenmos also cited estimates by Reis, a leading commercial real estate data source, that multifamily completions tracked at least 30% lower than pre-pandemic levels through the first half of 2020.

Some market watchers also contend the COVID-19 pandemic drew attention to the country’s chronic housing shortage. And the virus certainly changed behaviors on multifamily jobsites.

Gilbane Building Company is using an artificial intelligence tool on some of its multifamily sites to perform checks on whether people coming to the site are wearing face coverings, and to provide temperature checks. Gilbane was also an early adopter of Proximity Trace, a wearable technology that detects social distancing.

Brasfield & Gorrie has limited the number of workers in its jobsite hoists and elevators, heightened cleaning protocols, and made changes in its break areas and food vendors, says McCrory.

The pandemic has created some supply-chain headaches, especially in the availability and pricing of lumber, says AEC sources. “The biggest impact we are seeing [on multlfamily] is the sourcing of materials for core building components,” says Sean Buck, Vice President-Operations for JE Dunn Construction. He explains that in the high-rise space, products like electrical fixtures, countertops, and casework are typically sourced from various countries. “Given the current COVID and political environment, this poses some procurement risk,” and has led JE Dunn more toward U.S.-based suppliers.

Padgett says Summit Contracting has always strove to buy American, “and right now, 100% made in the U.S.A. is most desirable” to minimize delays in availability and delivery. Padgett adds that “good planning and coordination” can overcome supply-chain blips most of the time.

Gilbane, which has been tracking the supply-chain status of critical commodities on a biweekly basis this year, saw signs of “stabilization in both price and availability” in the third quarter, according to Grant W. Gagnier, the firm’s Vice President and New York City Business Unit Leader.

LUXURY AND AFFORDABILITY IN DEMAND

590 Park in St. Paul features 92 upscale micro apartments that target local professionals. Image: UrbanWorks.

One-fifth of the homes within 19 Dutch, in Manhattan's Financial District, will be affordably priced. Image: Gilbane Building Company

Multifamily continues to address a full range of price options, and higher-end products remain attractive. In St. Paul, Minn., the GC Kraus-Anderson just completed 590 Park, a 57,982-sf building with 92 upscale micro apartments—ranging from 352 to 602 sf—designed specifically for professionals. The $20 million, six-story building—owned by Engelsma Limited Partnership and designed by UrbanWorks Architecture—is near the State Capitol, Regions Hospital, and the Green Line stop at Capitol/Rise Street Station, which provides connectivity to Minneapolis.

However, it also appears that more of what’s being developed, designed, and built targets tenants and buyers seeking affordability.

Among Gilbane’s recent multifamily projects has been 19 Dutch, a 66-story residential tower in Manhattan’s Financial District. Developed by Carmel Partners and designed jointly by Gerner Kronick + Valcarcel and SLCE Architects, the 770-ft-tall tower, which was completed last year, includes 483 furnished apartments, 97 of them affordable. The project also features two floors of retail space and three amenity levels. A rooftop terrace on the 63rd floor is accessible through an adjoining indoor lounge.

“Metrocentric markets make a lot of economic and environmental sense,” says Gagnier, “so we believe there will continue to be demand for multifamily housing—especially affordable housing—in cities and their surrounding areas.” Gilbane anticipates more developer interest in reconfiguring apartment layouts to accommodate home offices.

Summit Contracting still builds “a good bit” on the luxury end of the multifamily spectrum. “But we do see more of a push toward the mid-grade and affordable product,” says Padgett. Summit saw this trend coming a few years ago, and responded with its Summit Prototype Program, which leverages Summit’s buying power and vendor relationships, allowing buildings to be pre-priced and upgraded or downgraded depending on a developer’s budget and desired level of finishes. This program can offset rising land and labor prices and still come in 5-10% lower than a custom-designed project, says Padgett.

Related Stories

| Jun 3, 2014

Libeskind's latest skyscraper breaks ground in the Philippines

The Century Spire, Daniel Libeskind's latest project, has just broken ground in Century City, southwest of Manila. It is meant to accommodate apartments and offices.

| Jun 2, 2014

Parking structures group launches LEED-type program for parking garages

The Green Parking Council, an affiliate of the International Parking Institute, has launched the Green Garage Certification program, the parking industry equivalent of LEED certification.

| May 30, 2014

MIT researchers create 'home in a box' transformable wall system for micro apartments

Dubbed CityHome, the system integrates furniture, storage, exercise equipment, lighting, office equipment, and entertainment systems into a compact wall unit.

| May 30, 2014

Developer will convert Dallas' storied LTV Building into mixed-use residential tower

New Orleans-based HRI Properties recently completed the purchase of one of the most storied buildings in downtown Dallas. The developer will convert the LTV Building into a mixed-use complex, with 171 hotel rooms and 186 luxury apartments.

| May 29, 2014

7 cost-effective ways to make U.S. infrastructure more resilient

Moving critical elements to higher ground and designing for longer lifespans are just some of the ways cities and governments can make infrastructure more resilient to natural disasters and climate change, writes Richard Cavallaro, President of Skanska USA Civil.

| May 29, 2014

Wood advocacy groups release 'lessons learned' report on tall wood buildings

The wood-industry advocacy group reThink Wood has released "Summary Report: Survey of International Tall Wood Buildings," with informatino from 10 mid-rise projects in Europe, Australia, and Canada.

| May 28, 2014

Moshe Safdie's twin residential towers in Singapore will be connected by 'sky pool' 38 stories in the air [slideshow]

Moshe Safdie's latest project, a pair of 38-story luxury residential towers in Singapore, will be linked by three "sky garden" bridges, including a rooftop-level bridge with a lap pool running the length between the two structures.

| May 27, 2014

America's oldest federal public housing development gets a facelift

First opened in 1940, South Boston's Old Colony housing project had become a symbol of poor housing conditions. Now the revamped neighborhood serves as a national model for sustainable, affordable multifamily design.

| May 23, 2014

Big design, small package: AIA Chicago names 2014 Small Project Awards winners

Winning projects include an events center for Mies van der Rohe's landmark Farnsworth House and a new boathouse along the Chicago river.

| May 22, 2014

No time for a trip to Dubai? Team BlackSheep's drone flyover gives a bird's eye view [video]

Team BlackSheep—devotees of filmmaking with drones—has posted a fun video that takes viewers high over the city for spectacular vistas of a modern architectural showcase.