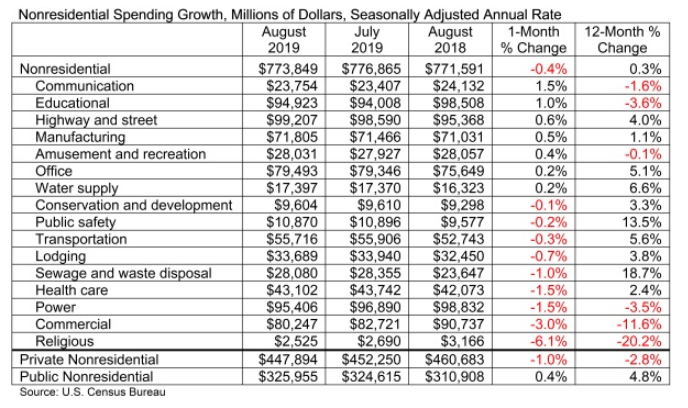

National nonresidential construction spending declined 0.4% in August, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today. On a seasonally adjusted annualized basis, spending totaled $773.8 billion, 0.3% higher than in August 2018.

Private nonresidential spending fell 1% on a monthly basis and is down 2.8% compared to the same time last year. Public nonresidential construction expanded 0.4% for the month and 4.8% for the year.

"Nonresidential construction spending is down nearly 3% from its peak in April 2019 due to declines in private construction,” said ABC Chief Economist Anirban Basu. "Construction spending in the commercial category, which encompasses retail space among other segments, is down nearly 12% on a year-over-year basis. Spending related to lodging, including new hotel construction, was down 0.7% for the month and is up less than 4% year over year. Spending in the power segment also decreased in August and is down 3.5% compared to the same time last year."

“All of this is consistent with a slowing economy, especially as measures such as industrial production and capacity utilization remain stagnant,” said Basu. “While this could be attributed to trade wars and a slowing global economy, construction dynamics are rarely so simple. Another likely explanation is that America’s growing shortage of skilled construction workers has driven up the cost of delivering construction services, even in the context of flat materials prices, resulting in more project owners delaying projects.

“On the other hand, public construction spending continues to rise,” said Basu. “Construction spending on public safety is up 13.5% on a year-over-year basis and spending in the sewage/waste disposal category is up nearly 19%. State and local governments continue to benefit from an economy that has pushed property tax, sales tax and income tax collections higher. Low borrowing costs also serve as an inducement to leverage revenues with debt, resulting in more infrastructure spending. Given the recent path of interest rates, this dynamic should continue into 2020.”

Related Stories

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.

Market Data | Aug 2, 2018

Nonresidential construction spending dips in June

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu.

Market Data | Aug 1, 2018

U.S. hotel construction pipeline continues moderate growth year-over-year

The hotel construction pipeline has been growing moderately and incrementally each quarter.

Market Data | Jul 30, 2018

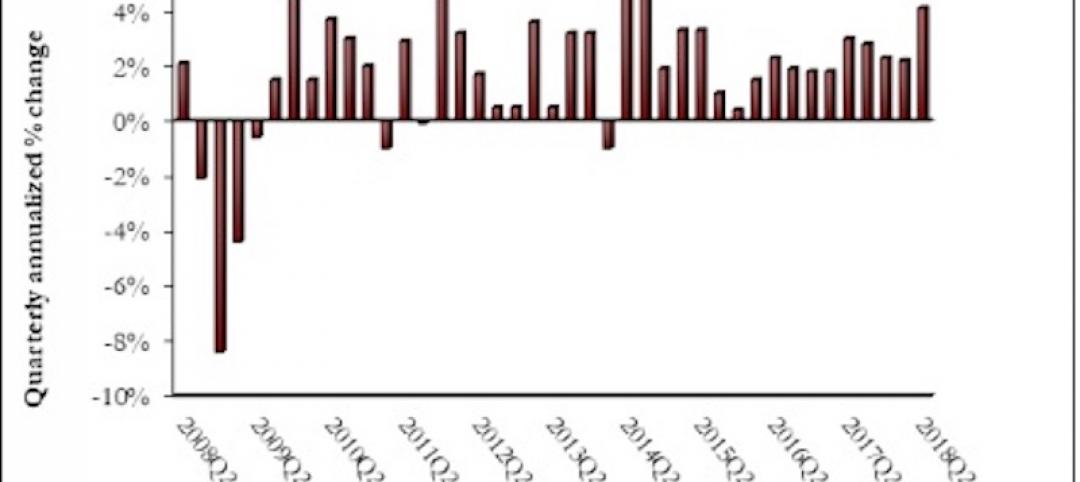

Nonresidential fixed investment surges in second quarter

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate.

Market Data | Jul 11, 2018

Construction material prices increase steadily in June

June represents the latest month associated with rapidly rising construction input prices.

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.