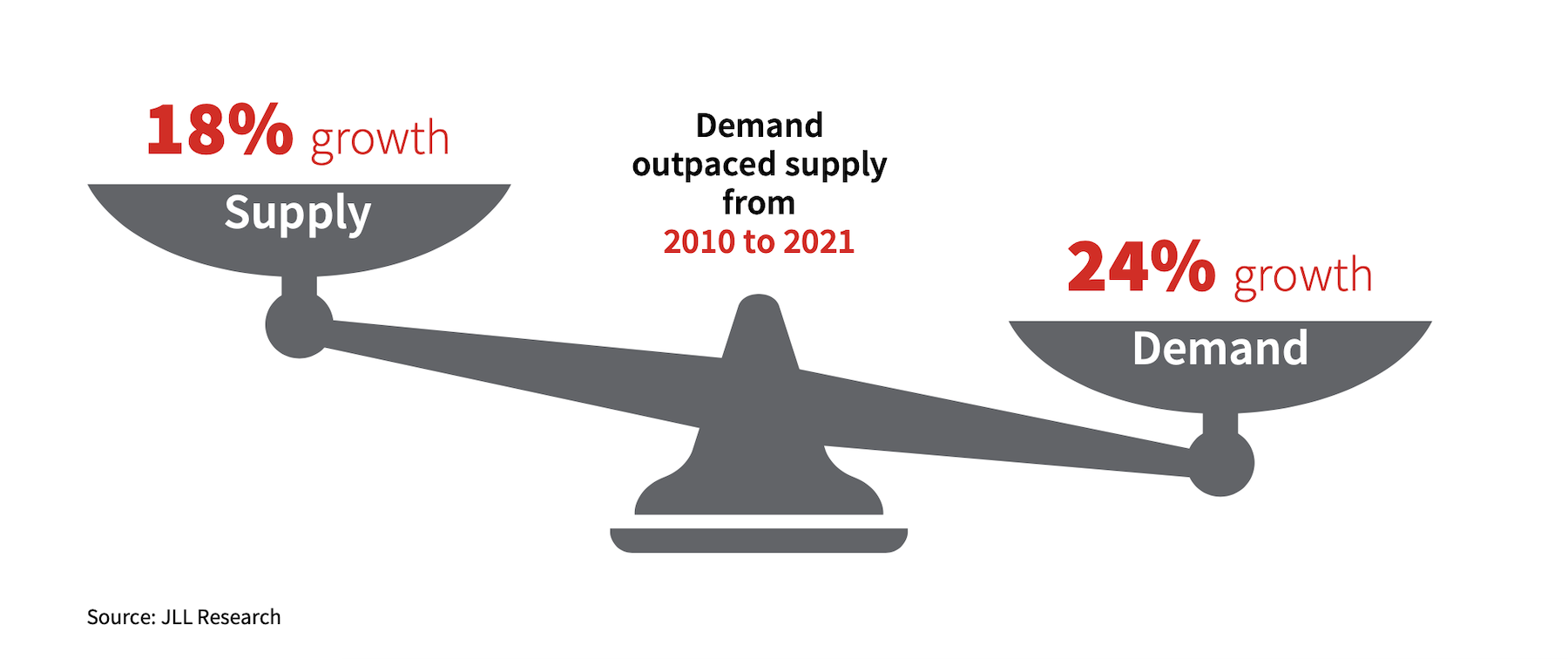

From 2010 through 2021, total U.S. industrial inventory grew by 18 percent. Over that same period, demand grew by 24 percent, driven by a surge in ecommerce that was exacerbated by the coronavirus pandemic.

“These events were defining moments that shed light on the fact that there is not enough supply to meet rapidly increasing demand in the industrial market,” states JLL in its research report “The Race for Industrial Space.”

This scarcity in industrial space has led to the sector’s lowest vacancy rate on record, from Los Angeles and Salt Lake City, to Columbus, Ohio, and New Jersey.

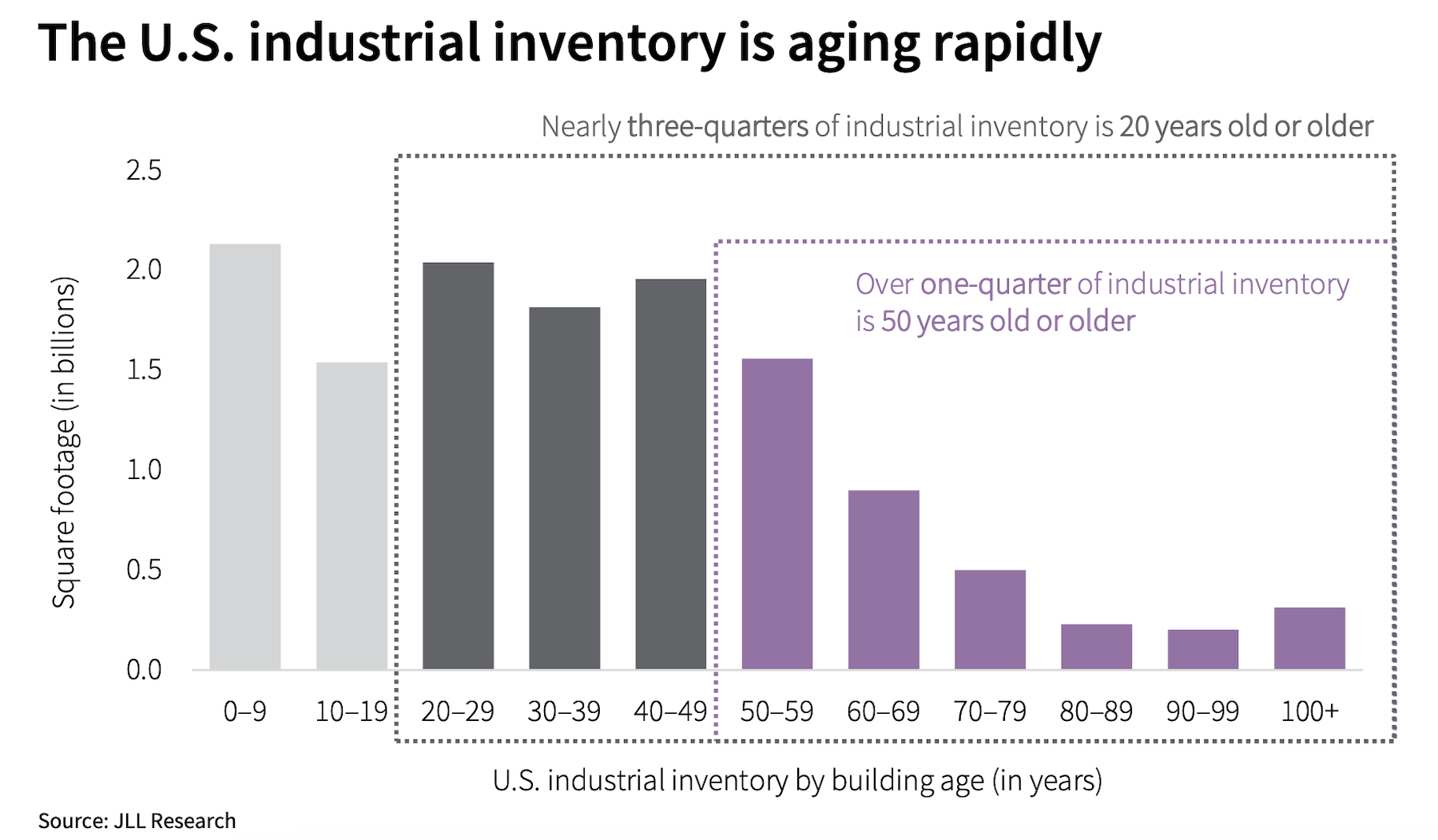

Part of the problem is the sector’s aging warehouses: nearly three-quarters of industrial inventory is 20 years old older, and more than one-quarter is 50 years or older. Owners are scrambling to adapt older, smaller, and less functionally sophisticated facilities within urban centers at a time when demand for Class A space is at its peak, with almost 70 percent of newly modernized inventory pre-leased upon delivery.

Space shortages have also led to accelerating rent growth. The average asking rents per square foot rose by 37 percent between 2016 and 2021.

BIGGER BUILDINGS IN VOGUE

JLL has identified nearly 100 proposed, under-construction, or existing adaptive reuse or replacement projects across a dozen markets. Distressed malls and vacant big-box stores are among the buildings getting industrial makeovers.

In denser urban areas where land is less available and more expensive, multistory warehouses are popular. One such example is 2505 Bruckner Boulevard, a former movie theater site on 20 acres in New York City that is being converted into a two-story, 1.1-million-sf warehouse with 28- to 32-ft clear heights. JLL states that occupiers of these multistory buildings “who value proximity to customers” are willing to pay top-of-market rents.

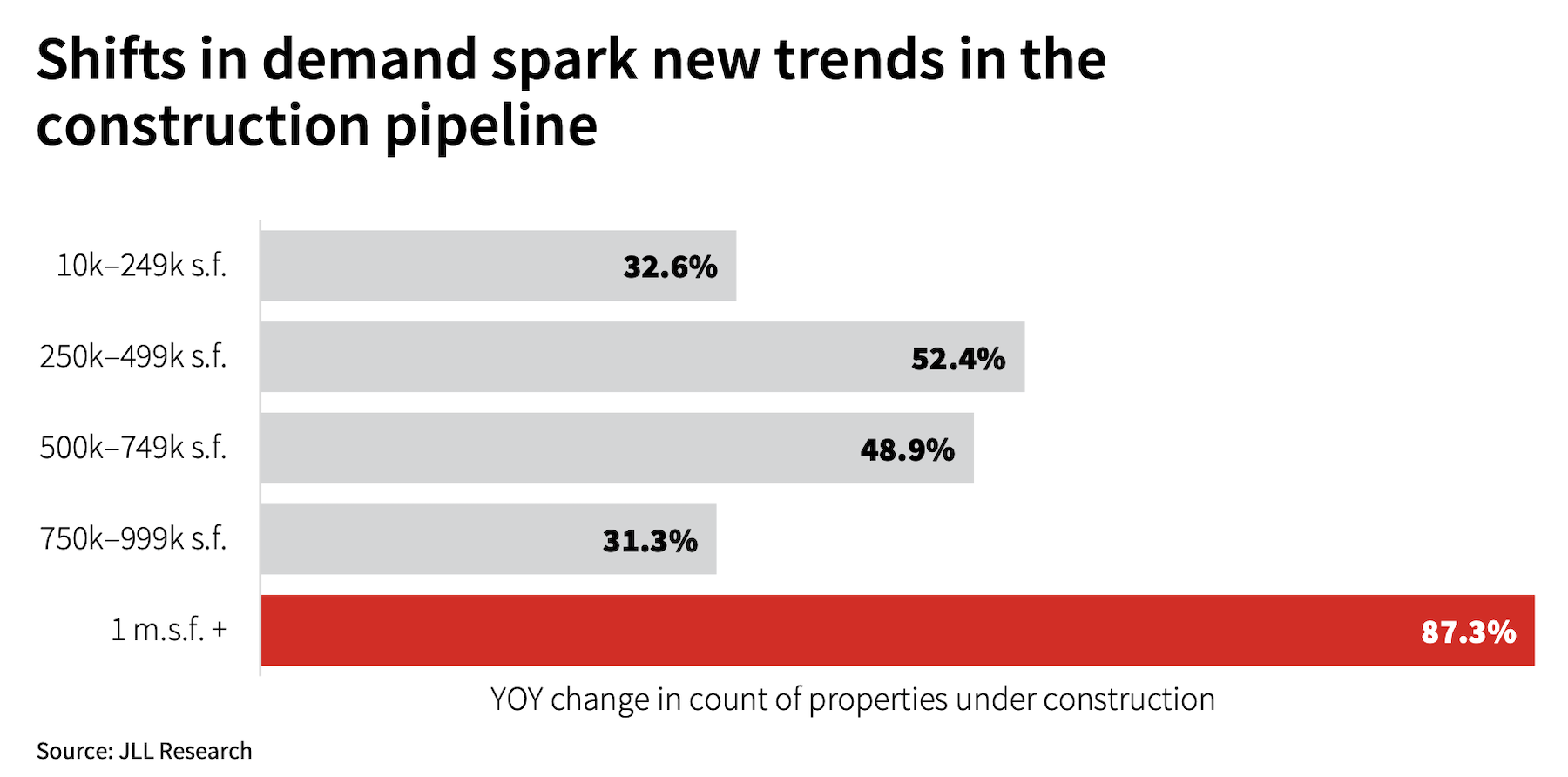

While smaller-warehouse developments still account for 60 percent of projects under construction, JLL estimates an 87 percent year-to-year increase in the number of 1-million-sf plus projects being built. “The high cost of land and the economies of scale from building larger structures make big-box facilities an easier fit,” says JLL.

The Sun Belt leads in new industrial development. Some 26 million sf have been delivered in Dallas-Fort Worth, 47 percent of which was pre-leased. More than two-thirds of the 20 million sf in industrial deliveries in Atlanta were pre-leased. Other Sun Belt markets like Houston, Memphis, and Phoenix are also seeing high levels of warehouse deliveries in their markets.

Yet, despite this construction activity, “demand and commodity pricing show no signs of slowing down in the near term,” says JLL. Last year, total costs to build a new warehouse rose 21 percent, according to JLL’s analysis of Bureau of Labor Statistics data. This dynamic “will enable general contractors to justify passing their increased costs to investors and end users.”

JLL concludes that rents for industrial space will increase more than 8 percent nationally this year, “and could be accelerated by year-end.” Vacancies will remain below the 4 percent threshold, as the imbalance of supply and demand continues through at least 2023. Projects are taking longer to build because of supply-chain delays, and land prices are peaking.

JLL predicts an “increased focus” on urban logistics sites in highly dense infill markets. JLL also foresees more adaptive reuses and conversions in urban centers.

As demand for larger buildings increases, older-generation buildings will be reimagined to accommodate end users with newer-aged features like electric vehicle parking, higher clear heights, increased truck radius maneuvering, and other reconfigurations to meet distribution needs.

Related Stories

| Aug 11, 2010

New York Mayor Bloomberg opens nation's first multi-story green industrial facility and announces new green manufacturing plant at Brooklyn Navy Yard

Mayor Michael R. Bloomberg, Deputy Mayor for Economic Development Robert C. Lieber, and Brooklyn Navy Yard Development Corporation Chairman Alan Fishman and President Andrew H. Kimball today opened the Perry Avenue Building, the nation's first multi-story green industrial facility at the Brooklyn Navy Yard. Mayor Bloomberg also announced the creation of Duggal Greenhouse, a 60,000-square-foot LEED Platinum certified facility.

| Aug 11, 2010

ASHRAE introduces building energy label prototype

Most of us know the fuel efficiency of our cars, but what about our buildings? ASHRAE is working to change that, moving one step closer today to introducing its building energy labeling program with release of a prototype label at its 2009 Annual Conference in Louisville, Ky.

| Aug 11, 2010

USGBC considering LEED for Data Centers program

In a blog post this morning on Earth2Tech, Justin Moresco writes that the U.S. Green Building Council is giving strong consideration to developing a version of its LEED green building rating system for data centers.

| Aug 11, 2010

10 tips for mitigating influenza in buildings

Adopting simple, common-sense measures and proper maintenance protocols can help mitigate the spread of influenza in buildings. In addition, there are system upgrades that can be performed to further mitigate risks. Trane Commercial Systems offers 10 tips to consider during the cold and flu season.

| Aug 11, 2010

Jacobs, Holder Construction top BD+C's ranking of the nation's 50 largest industrial building contractors

A ranking of the Top 50 Industrial Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

AECOM, Arup, Gensler most active in commercial building design, according to BD+C's Giants 300 report

A ranking of the Top 100 Commercial Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Turner Building Cost Index dips nearly 4% in second quarter 2009

Turner Construction Company announced that the second quarter 2009 Turner Building Cost Index, which measures nonresidential building construction costs in the U.S., has decreased 3.35% from the first quarter 2009 and is 8.92% lower than its peak in the second quarter of 2008. The Turner Building Cost Index number for second quarter 2009 is 837.

| Aug 11, 2010

AGC unveils comprehensive plan to revive the construction industry

The Associated General Contractors of America unveiled a new plan today designed to revive the nation’s construction industry. The plan, “Build Now for the Future: A Blueprint for Economic Growth,” is designed to reverse predictions that construction activity will continue to shrink through 2010, crippling broader economic growth.