An unprecedented leap in the price of goods used in construction and supply-chain disruptions are wreaking hardships on contractors and slowing projects, according to an analysis by the Associated General Contractors of America of government data released today. The association posted a Construction Inflation Alert to update contractors and their clients about the latest developments. Association officials urged the Biden administration to end a variety of tariffs and quotas on imported construction inputs and to help ease domestic supply-chain problems.

“Today’s producer price index report documents just some of challenges contractors are experiencing with fast-rising materials costs, lengthening or uncertain delivery times, and rationing of key inputs,” said Ken Simonson, the association’s chief economist. “These problems threaten to drive up the cost and completion time for many vital projects and potentially set back the recovery in construction employment.”

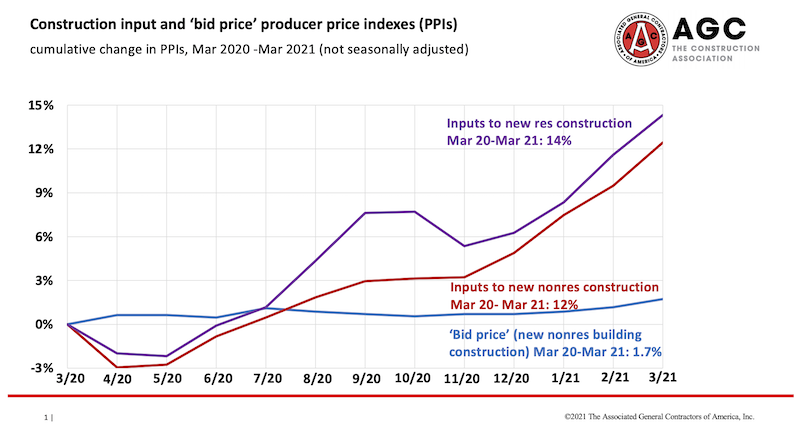

Prices for materials and services used in construction and contractors’ bid prices both declined at the beginning of the pandemic but have diverged in the past year, Simonson said. A government index that measures the selling price for goods used construction jumped 3.5% from February to March and 12.9% since March 2020. Both the monthly and yearly increases were the highest recorded in the 35-year history of the series, he noted. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—increased only 0.5% last month and 1.7% over the past 12 months.

“These material cost increases—steep as they are—tell only part of the story,” Simonson added. “They are based on prices the government collected a month ago, and they fail to capture the notices contractors are receiving daily about longer lead times, shipments held to a fraction of previous orders, and other challenges.”

Association officials said some of the supply chain problems are being caused by the pandemic, which is leaving manufacturers and shippers shorthanded amid growing demand for a host of products. But they added that federal policies, particularly tariffs and quotas on key building materials like lumber and steel, are also contributing to price spikes, supply shortages, and delivery delays. They urged the administration to remove those import barriers and explore ways to help unclog shipping backups.

“The Biden administration must address soaring lumber and steel costs and broader supply chain woes with the same energy they are putting into dealing with shortages of automotive microchips,” said Stephen E. Sandherr, the association’s chief executive officer. “Without tariff relief and other measures, construction employers will have little ability to invest in new equipment and hire new employees.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s Alert.

Related Stories

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.