As seen in the Lodging Econometrics (LE) Q4'21 United States Construction Pipeline Trend Report, the franchise companies with the largest U.S. construction pipelines at year-end 2021 are Marriott International with 1,345 projects/170,586 rooms, followed by Hilton Worldwide with 1,239 projects/141,053 rooms, and InterContinental Hotels Group (IHG) with 761 projects/76,987 rooms. These three companies combined account for 69% of the projects and 67% of the rooms in the total U.S. construction pipeline.

At the end of Q4'21, over 56% of Hilton’s projects in the pipeline are in the early planning project stage, a record-high by projects in this stage for the company, with 689 projects/76,058 rooms. Hilton has 228 projects/29,036 under construction at Q4 and 322 projects/35,959 rooms scheduled to start within the next 12 months. Marriott also hit a record high for both projects and rooms in early planning at the end of the fourth quarter, with 534 projects/63,120 rooms. Marriott has 262 projects, accounting for 38,289 rooms under construction at the end of Q4 and 549 projects/69,177 rooms are scheduled to start in the next 12 months. IHG currently has 121 projects, accounting for 11,376 rooms, in the early planning stage. 136 projects, with 16,221 rooms, in IHG’s pipeline, are in the under construction stage while 504 projects/49,390 rooms are scheduled to start within the next 12 months.

The leading brands by project count for the top three franchise companies continue to be Hilton’s Home2 Suites by Hilton with 421 projects/43,824 rooms, IHG’s Holiday Inn Express with 288 projects/27,620 rooms, and Marriott’s Fairfield Inn with 247 projects/23,344 rooms. These three brands dominate the pipeline and combined claim 20% of the projects.

Other notable brands in the pipeline for the top franchise companies at Q4 are Marriott’s TownePlace Suites with 239 projects/22,759 rooms and Residence Inn with 212 projects/25,896 rooms; Hilton’s Tru by Hilton brand with 222 projects/21,222 rooms and the Hampton by Hilton brand with 267 projects/27,577 rooms; and IHG’s Avid Hotel with 148 projects/12,885 rooms and Staybridge Suites with 124 projects/12,734 rooms.

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms. 201 of the hotels were Hilton brands, 267 were Marriott brands, and another 117 were IHG brands. The LE forecast for new hotel openings in 2022 anticipates that Marriott will open 207 projects/27,258 rooms, for a growth rate of 3.1%. Next is Hilton with 165 projects/18,764 rooms, for a growth rate of 2.5%, followed by IHG with 115 projects/12,397 rooms forecast to open for a growth rate of 2.9%. In 2023, Marriot is expected to open another 211 projects/25,056 rooms for a growth rate of 2.7%. LE predicts Hilton will open 173 projects/21,450 rooms, for a 2.8% growth rate by year-end 2023, while IHG is expected to see a 3.4% growth rate in 2023, with 148 new hotel projects, accounting for 15,146 rooms.

Related Stories

Market Data | Mar 19, 2018

ABC's Construction Backlog Indicator hits a new high: 2018 poised to be a very strong year for construction spending

CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.

Market Data | Mar 15, 2018

ABC: Construction materials prices continue to expand briskly in February

Compared to February 2017, prices are up 5.2%.

Market Data | Mar 14, 2018

AGC: Tariff increases threaten to make many project unaffordable

Construction costs escalated in February, driven by price increases for a wide range of building materials, including steel and aluminum.

Market Data | Mar 12, 2018

Construction employers add 61,000 jobs in February and 254,000 over the year

Hourly earnings rise 3.3% as sector strives to draw in new workers.

Steel Buildings | Mar 9, 2018

New steel and aluminum tariffs will hurt construction firms by raising materials costs; potential trade war will dampen demand, says AGC of America

Independent studies suggest the construction industry could lose nearly 30,000 jobs as a result of administration's new tariffs as many firms will be forced to absorb increased costs.

Market Data | Mar 8, 2018

Prioritizing your marketing initiatives

It’s time to take a comprehensive look at your plans and figure out the best way to get from Point A to Point B.

Market Data | Mar 6, 2018

Persistent workforce shortages challenge commercial construction industry as U.S. building demands continue to grow

To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions.

Market Data | Mar 2, 2018

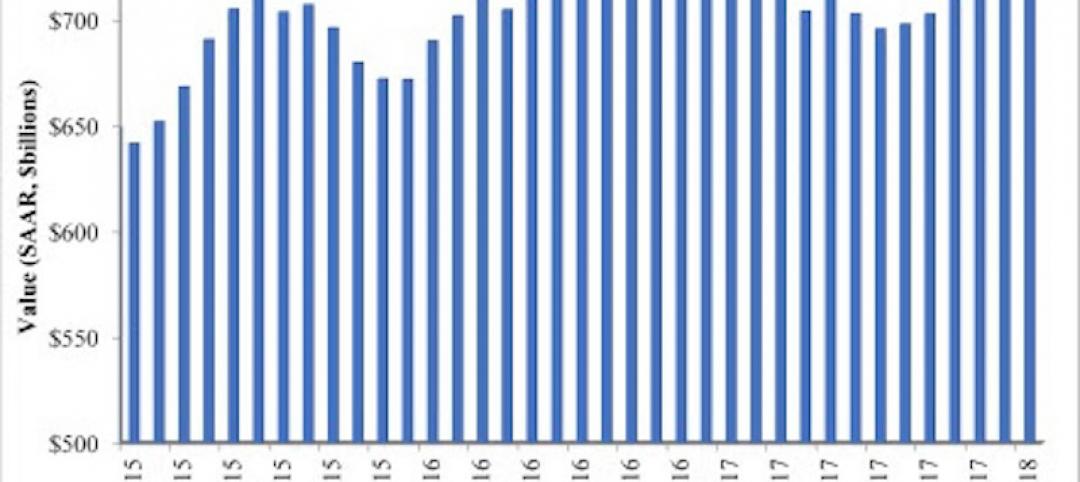

Nonresidential construction spending dips slightly in January

Private nonresidential construction fell 1.5% for the month, while public sector nonresidential spending increased 1.9%.

Market Data | Feb 27, 2018

AIA small firm report: Half of employees have ownership stake in their firm

The American Institute of Architects has released its first-ever Small Firm Compensation Report.

Market Data | Feb 21, 2018

Strong start for architecture billings in 2018

The American Institute of Architects reported the January 2018 ABI score was 54.7, up from a score of 52.8 in the previous month.