A recent survey of more than 200 subcontractors and suppliers in the Northeast found that respondents have been prefabricating 20% more than they did prior to the COVID-19 pandemic. And 71% said that they had seen an increase in requests for design-assist proposals, a strong sign that speed-to-market is a priority.

Consigli Construction’s Market Outlook Report for the first and second quarters of 2021 states that the pandemic has motivated subs and vendors to turn to technology in their shops and field processes. The survey’s respondents are also more receptive to cost-saving material management software, tool upgrades, and robotics that improve efficiency and give subs the flexibility they need to manage on-site workforces at a time when skilled labor is in short supply in some markets.

While 72% of the survey’s respondents say they aren’t concerned about staffing their projects this year, Consigli suggests they need to monitor their workforce resources for 2022, based on the amount of work in the pipeline.

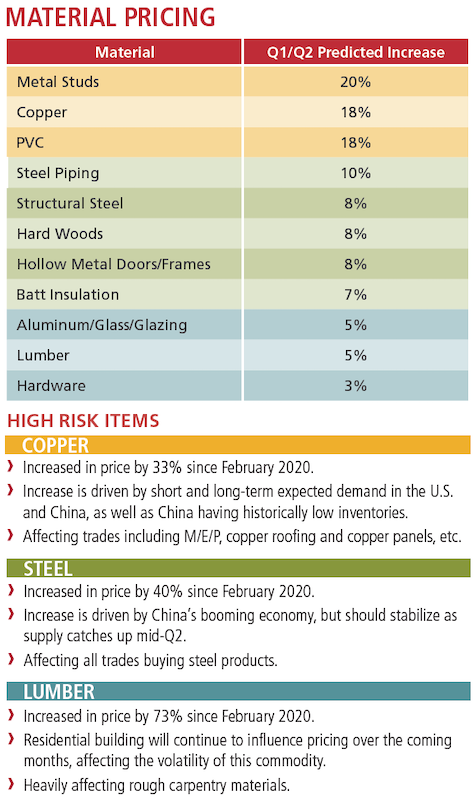

PRICING AND SUPPLY ARE ISSUES FOR SEVERAL PRODUCT

The Market Outlook expects copper and steel to manifest the greatest risk for price inflation. Chart: Consigli Construction

The Market Outlook Report also looks at materials price inflation in several product categories (see chart). Metal studs, copper, and PVC are the materials that the report expects to show the greatest price increases in the first half of the year. The report also suggests that lumber—whose pricing had jumped by 73% since February 2020—could be stabilizing, depending on residential demand.

(The Commerce Department reported last week that housing starts had surged to a nearly 15-year high in March.)

Consigli recommends that subs keep a close eye on high-risk materials, and lock in prices as soon as possible to avoid exposure to inflation. Subs should also watch for supply-chain disruptions, especially for products coming from overseas like flooring and cabinetry. Where possible, have access to alternate materials and delivery options.

Related Stories

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Market Data | Apr 19, 2017

Architecture Billings Index continues to strengthen

Balanced growth results in billings gains in all regions.

Market Data | Apr 13, 2017

2016’s top 10 states for commercial development

Three new states creep into the top 10 while first and second place remain unchanged.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

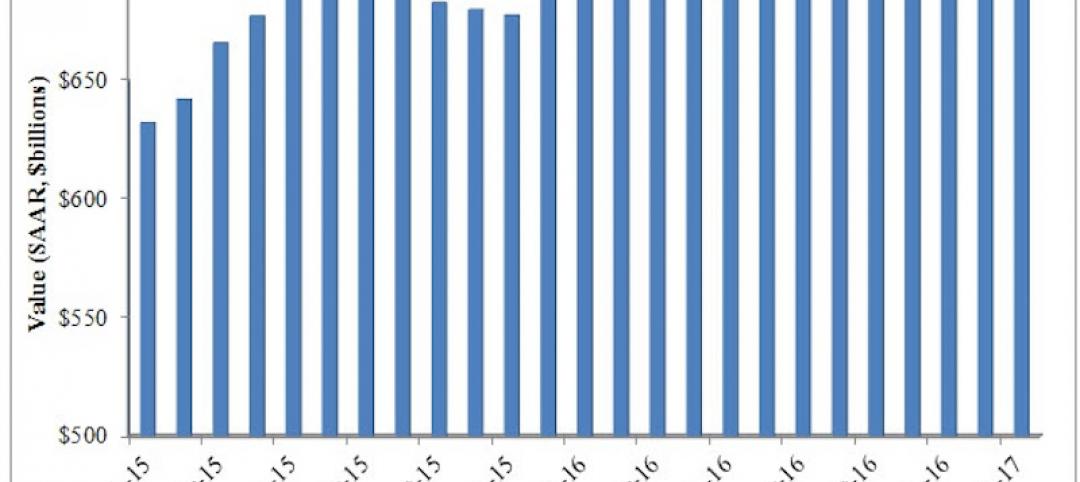

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

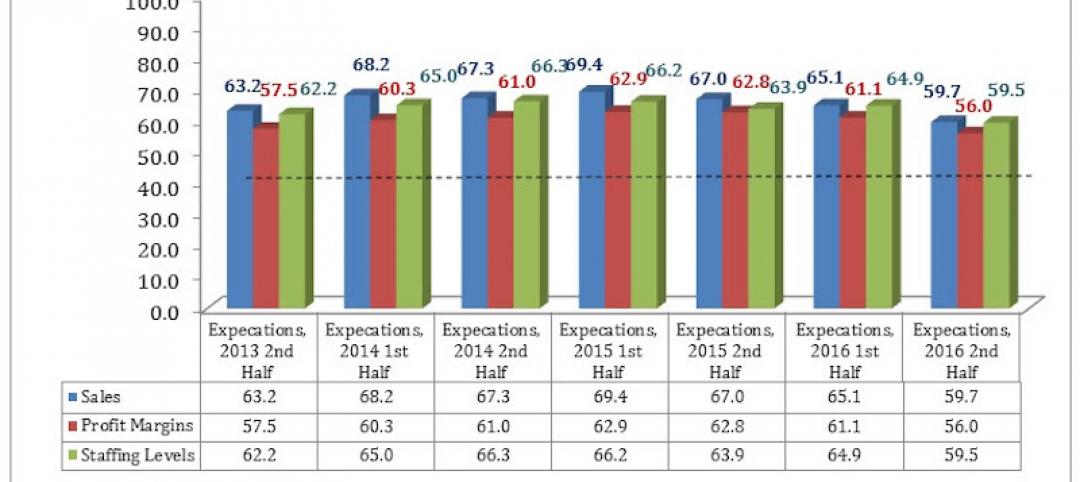

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.