Only eight states and the District of Columbia have recouped the severe pandemic-induced losses of construction jobs that occurred last spring, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials warned that job losses will become even more widespread unless lawmakers promptly renew and expand the loan program that enabled firms to temporarily retain and rehire many workers.

“New spikes in coronavirus cases, along with ongoing pandemic-related costs and revenue losses, are causing ever more private owners, developers, and public agencies to delay and cancel projects,” said Ken Simonson, the association’s chief economist. “Although single-family homebuilding is gathering steam, multifamily and nonresidential construction activity has stalled, leaving large numbers of workers at risk of losing their jobs as current projects finish up with nothing on the horizon.”

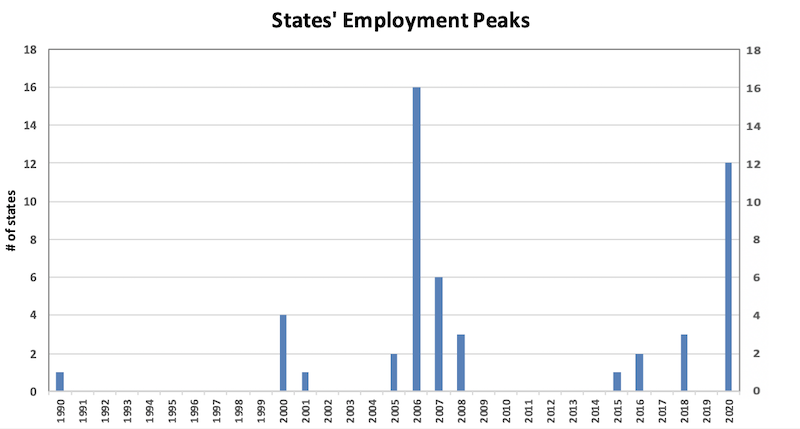

Seasonally adjusted construction employment in September was lower than in February—the last month before the pandemic forced many contractors to suspend work—in 42 states, Simonson added. California lost the most construction jobs over that span (-54,900 jobs, -6.1%), followed by Texas (51,800 jobs, -6.5%). Vermont had the largest percentage loss (-24.5%, -3,600 jobs), followed by Iowa (-14.6%, -11,400 jobs).

Of the eight states added construction jobs from February to September, Virginia added the most (4,300 jobs, 2.1%), followed by Utah (3,800 jobs, 3.3%). South Dakota posted the largest percentage gain (9.4%, 2,300 jobs), followed by Utah.

Construction employment decreased from August to September in 17 states, increased in 32 states, and was unchanged in Arkansas and D.C. Illinois shed the most construction jobs from August to September (-3,000 jobs or -1.4%), followed by Oregon (-2,600 jobs, -2.4%) and Iowa (-2,500 jobs, -3.6%). Iowa had the largest percentage decrease, followed by Oregon and New Mexico (-2.0%, -1,000 jobs).

New York added the most construction jobs over the month (5,300 jobs, 1.5%), followed by Louisiana (5,000 jobs, 4.1%) and Washington (4,200 jobs, 2.0%). Vermont had the largest percentage gain for the month (500 jobs, 4.7%), followed by Louisiana and New Hampshire (800 jobs, 3.0%).

Association officials warned that project cancellations are on the rise as new outbreaks of coronavirus across many states force many private owners and public officials to postpone or cancel planned starts. Association officials noted that the rapid adoption of Paycheck Protection Program loans last spring had enabled construction to bounce back quickly from the first round of project shutdowns and delays, and they urged lawmakers in Washington to act swiftly to extend and expand the program.

“The loans that were issued last spring saved tens of thousands of construction workers from unemployment but those funds are rapidly running out,” said Stephen E. Sandherr, the association’s chief executive officer. “Renewal of the loan program should be a top priority for any policy maker who cares about keeping the economy from backsliding.”

View state employment February-September data and rankings; August-September rankings; Highs and Lows.

Related Stories

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

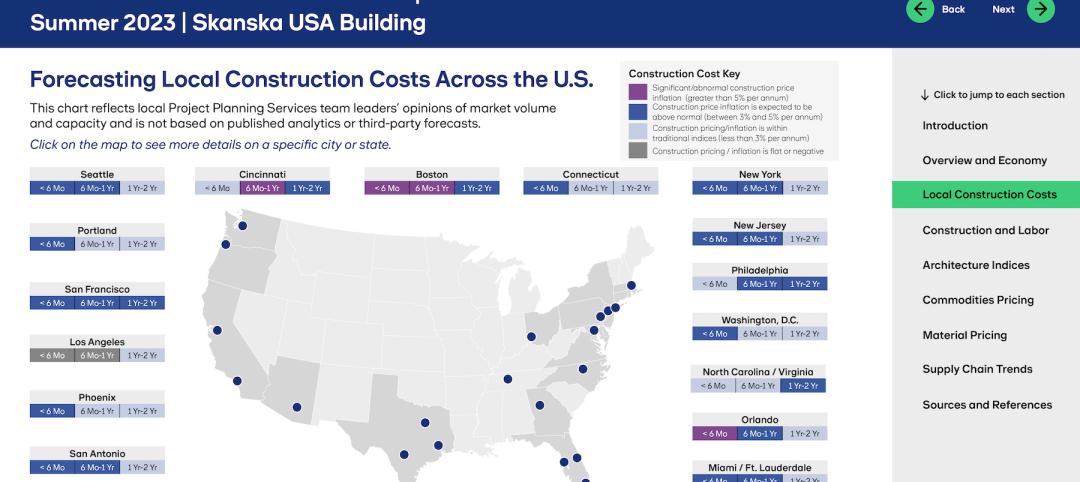

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.