Uncertainty and high risk are kryptonite to any investment community, and the healthcare real estate sector has seen a heavy dose of both since the beginning of the Great Recession.

From the economic crash of 2008-09, to the enactment of Obamacare in 2010, to the feds’ latest experiment—Ryancare, Republicare, Trumpcare, whatever you want to call it—no other major business sector has dealt with the level of chaos that healthcare owners, developers, providers, and consumers have faced.

Even as Speaker Paul Ryan’s Obamacare replacement died on the vine in Congress, President Trump and the GOP have no plans to walk away from their promise to repeal and replace the Affordable Care Act.

So, with a long road of political and financial uncertainty ahead for the healthcare sector, what does this mean for the nonresidential construction industry’s third-largest sector ($41 billion in annual construction spending)?

In the days and weeks following Trump’s historic victory, the consensus among healthcare sector analysts and AEC professionals was that the repeal and replace efforts would cause healthcare owners and developers to pump the brakes on major real estate construction and renovation plans in the pipeline. This, of course, was the case during the early days of the ACA, when many healthcare organizations halted construction projects until they could fully understand the implications of the law, especially the reimbursement structure.

More recent projections paint a slightly more positive picture for the healthcare construction market, at least in the near-term. In its latest healthcare real estate investment update, released last month (http://tinyurl.com/CBREhc17), CBRE Healthcare reported that healthcare providers “appear to be moving along with their strategy”—including their real estate plans—despite the turmoil in Washington, D.C.

“The ACA was a wake-up call for healthcare providers,” the report states. “In the last several years, healthcare providers have focused on ways to deliver care more efficiently and capture a greater market share to further their economies of scale. For developers, this means more outpatient facilities and a push to expand into new markets.”

Other real estate experts are not as upbeat. John Burns Real Estate Consulting, a respected housing market analyst based in Irvine, Calif., released a 68-page white paper last month (http://tinyurl.com/JBRChc17) that identifies healthcare as one of three major industries (the others being technology and automotive) that are “overheated and will likely be shedding jobs sometime soon.”

The most alarming indicator cited by JBRC: the sector’s rapid accumulation of debt—308% since 2009. This rate of growth far outpaces industry job and GDP growth, a circumstance that, historically, has triggered industry downturns.

Related Stories

Healthcare Facilities | Apr 14, 2022

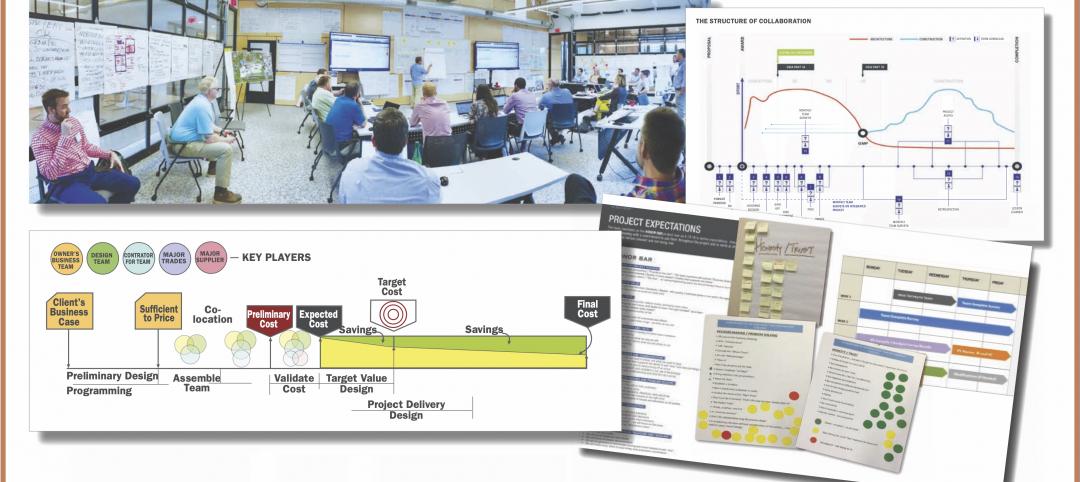

Healthcare construction veteran creates next-level IPD process for hospital projects

Can integrated project delivery work without incentives for building team members? Denton Wilson thinks so.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Laboratories | Apr 7, 2022

North Carolina's latest play for biotech real estate development

The Tar Heel State is among a growing number of markets rolling out the welcome mat for lab spaces.

Healthcare Facilities | Apr 7, 2022

Visibility breeds traffic in healthcare design

Ryan Companies has completed several healthcare projects that gain exposure by being near retail stores or office buildings.

Healthcare Facilities | Mar 25, 2022

Health group converts bank building to drive-thru clinic

Edward-Elmhurst Health and JTS Architects had to get creative when turning an American Chartered Bank into a drive-thru clinic for outpatient testing and vaccinations.

Projects | Mar 21, 2022

BIG-designed Danish Neuroscience Center will combine groundbreaking science and treatment

A first-of-its-kind facility, a new Danish Neuroscience Center in Aarhus, Denmark designed by BIG, will combine psychiatry and neuroscience under one roof.

Projects | Mar 18, 2022

Toronto suburb to build the largest hospital in Canada

A new hospital in Ontario will nearly triple the care capacity of its existing facility—becoming the largest hospital in Canada.

Projects | Mar 15, 2022

Old Sears store will become one of the largest orthopaedics outpatient facilities in the Northeast

A former Sears store in Rochester, N.Y., will be transformed into one of the largest orthopaedics outpatient facilities in the Northeast.

Projects | Mar 10, 2022

Optometrist office takes new approach to ‘doc-in-a-box’ design

In recent decades, franchises have taken over the optometry services and optical sales market. This trend has spawned a commodity-type approach to design of office and retail sales space.

Industry Research | Mar 2, 2022

31 percent of telehealth visits result in a physical office visit

With little choice but to adopt virtual care options due to pandemic restrictions and interactions, telehealth adoption soared as patients sought convenience and more efficient care options.