Nonresidential fixed investment fell by 0.6% during the second quarter after expanding by 1.6% during the first quarter, according to the July 30 real gross domestic product (GDP) report by the Bureau of Economic Analysis (BEA).

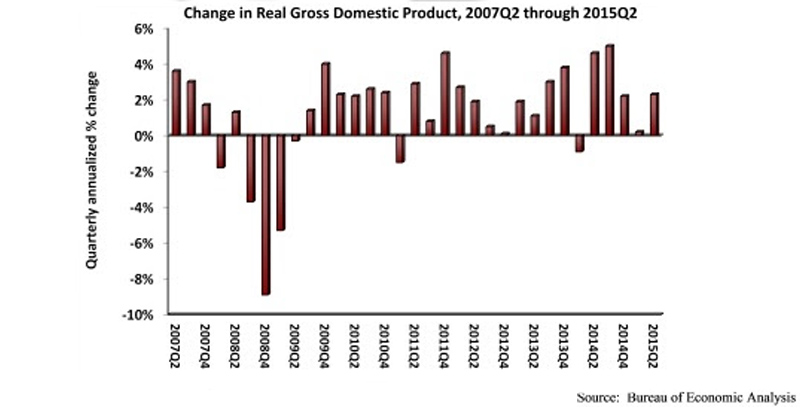

For the economy as a whole, real GDP expanded by 2.3% (seasonally adjusted annual rate) during the second quarter following a 0.6% increase during the year's first quarter. Note that the first quarter estimate for nonresidential fixed investment was revised upward from -3.4% annualized growth.

"In the first half of 2015, both the broader economy and nonresidential investment lost the momentum they had coming into the year," said Associated Builders and Contractors Chief Economist Anirban Basu. "Rather than indicating renewed progress in terms of achieving a more robust recovery, today's GDP release indicates that a variety of factors helped to stall investment in nonresidential structures. There are many viable explanations, including a weaker overall U.S. economy, a stronger U.S. dollar, decreased investment in structures related to the nation's energy sector, soft public spending, and uncertainty regarding monetary policy and other abstracts of public policy. While the expectation is that the second half of the year will be better, unfortunately not much momentum is being delivered by the year's initial six months.

"Perhaps the most salient facet of this GDP release was the revisions," said Basu. "The BEA revised the first quarter estimate upward from -0.2% to 0.6% annualized growth. This is not surprising; many economists insisted that the economy did not shrink in the first quarter. However, the BEA also downwardly revised growth figures from the fourth quarter of 2011 to the fourth quarter of 2014. Over that period, GDP increased at an average annual rate of 2.1%, 0.3 percentage points lower than previously thought. These revisions could be a function of the agency's ongoing effort to tackle residual seasonality, a pattern in which seasonal adjustments led to repeated first quarter slowdowns. It will take a few more quarters to understand the full impact of the improved seasonal adjustments."

Performance of key segments during the first quarter:

- Investment in nonresidential structures decreased at a 1.6% rate after decreasing at a 7.4% rate in the first quarter.

- Personal consumption expenditures added 1.99% to GDP after contributing 1.19% in the first quarter.

- Spending on goods grew 1.1% from the first quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 2.5% for the second quarter after a 2.5% increase in the first quarter.

- Federal government spending decreased 1.1% in the second quarter after increasing by 1.1% in the first quarter.

- Nondefense spending decreased 0.5% after expanding by 1.2% in the previous quarter.

- National defense spending fell 1.5% after growing 1% in the first quarter.

- State and local government spending grew 2% during the second quarter after a decrease of 0.8% in the first.

To view the previous GDP report, click here.

Related Stories

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.

MFPRO+ News | Feb 15, 2024

Oregon, California, Maine among states enacting policies to spur construction of missing middle housing

Although the number of new apartment building units recently reached the highest point in nearly 50 years, construction of duplexes, triplexes, and other buildings of from two to nine units made up just 1% of new housing units built in 2022. A few states have recently enacted new laws to spur more construction of these missing middle housing options.

Green | Feb 15, 2024

FEMA issues guidance on funding for net zero buildings

The Federal Emergency Management Agency (FEMA) recently unveiled new guidance on additional assistance funding for net zero buildings. The funding is available for implementing net-zero energy projects with a tie to disaster recovery or mitigation.

Hospital Design Trends | Feb 14, 2024

Plans for a massive research hospital in Dallas anticipates need for child healthcare

Children’s Health and the UT Southwestern Medical Center have unveiled their plans for a new $5 billion pediatric health campus and research hospital on more than 33 acres within Dallas’ Southwestern Medical District.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Codes | Feb 9, 2024

Illinois releases stretch energy code for building construction

Illinois is the latest jurisdiction to release a stretch energy code that provides standards for communities to mandate more efficient building construction. St. Louis, Mo., and a few states, including California, Colorado, and Massachusetts, currently have stretch codes in place.

Giants 400 | Feb 8, 2024

Top 10 Telecommunications Building Construction Firms for 2023

AECOM, LeChase Construction Services, Robins & Morton, and Salas O'Brien top BD+C's ranking of the nation's largest telecommunications building general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 20 Integrated Project Delivery (IPD) Construction Firms for 2023

Barton Malow, DPR Construction, Hensel Phelps, and Whiting-Turner top BD+C's ranking of the nation's largest integrated project delivery (IPD) construction firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 90 Design-Build Construction Firms for 2023

Hensel Phelps, Ryan Companies US, Gray Construction, Haskell, and Burns & McDonnell top BD+C's ranking of the nation's largest design-build construction firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 20 Public Library Construction Firms for 2023

Gilbane Building Company, Skanska USA, Manhattan Construction, McCownGordon Construction, and C.W. Driver Companies top BD+C's ranking of the nation's largest public library general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.