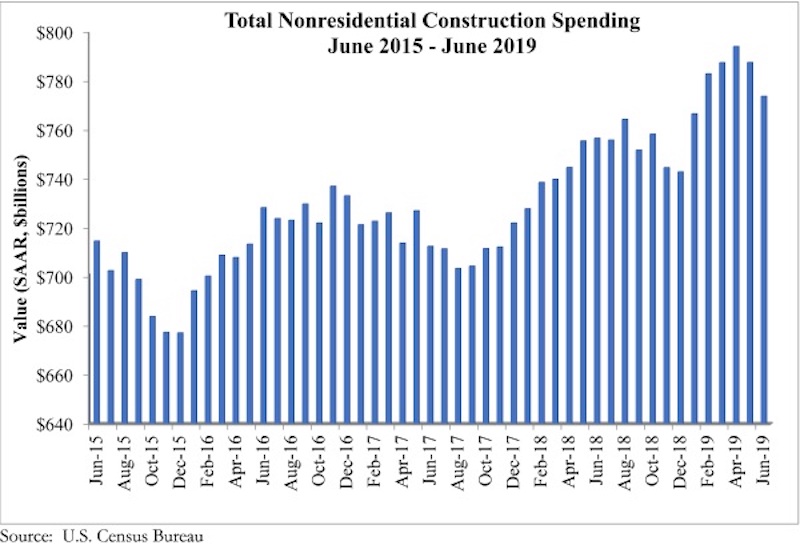

National nonresidential construction spending declined 1.8% in June, totaling $773.8 billion on a seasonally adjusted annualized basis—a 2.3% increase compared to the same time a year ago, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today. Public nonresidential spending fell 3.7% in June, but is up 6.4% year over year, while private nonresidential spending fell 0.3% on a monthly basis and is up 0.4% from June 2018.

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending, although only the conservation and development (+3.8%) and commercial (+1.3%) categories increased by more than 1%. While spending in several categories fell for the month, significant decreases in the publicly driven educational (-6.5%) and highway and street (-6.3%) categories accounted for nearly all of the monthly decline.

“Like the balance of the U.S. economy, nonresidential construction spending appears to be softening, albeit gradually,” said ABC Chief Economist Anirban Basu. “Private nonresidential construction spending has been trending lower for several months, and segments like office and lodging are no longer the drivers of construction spending growth that they had been, likely due to growing concerns about market saturation.

“The dip in public construction may have been merely temporary, which is likely the case given the ongoing strength of state and local government finances.” said Basu. “And with the economy still adding substantial numbers of jobs, wages growing at or near a decade-high pace, consumers continuing to spend and property values remaining stable, local and state governments should continue to experience solid income, retail and real estate tax collections. All things being equal, that should help fuel infrastructure outlays, especially given still very low borrowing costs.

“While many observers continue to focus on issues such as trade disputes, high levels of corporate debt and asset prices that are susceptible to sharp declines, the U.S. construction industry’s most significant source of uncertainty may be the pending insolvency of the Highway Trust Fund,” said Basu. “That insolvency is now a mere two years away, and if policymakers fail to act expeditiously, state and local policymakers may choose to postpone certain projects given the rising uncertainty of federal funding. The highway/street and transportation categories are especially vulnerable to such dynamics.”

Related Stories

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.