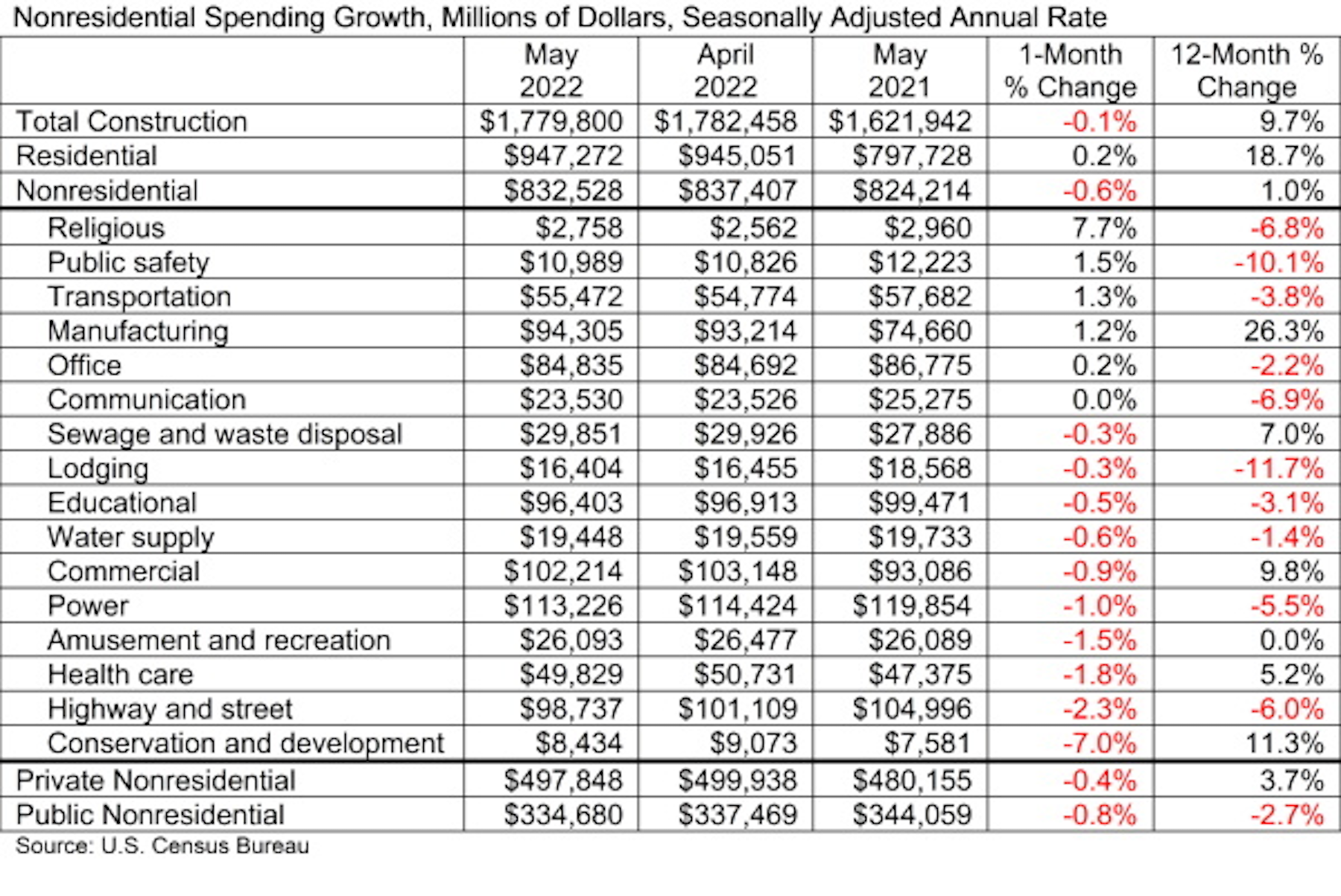

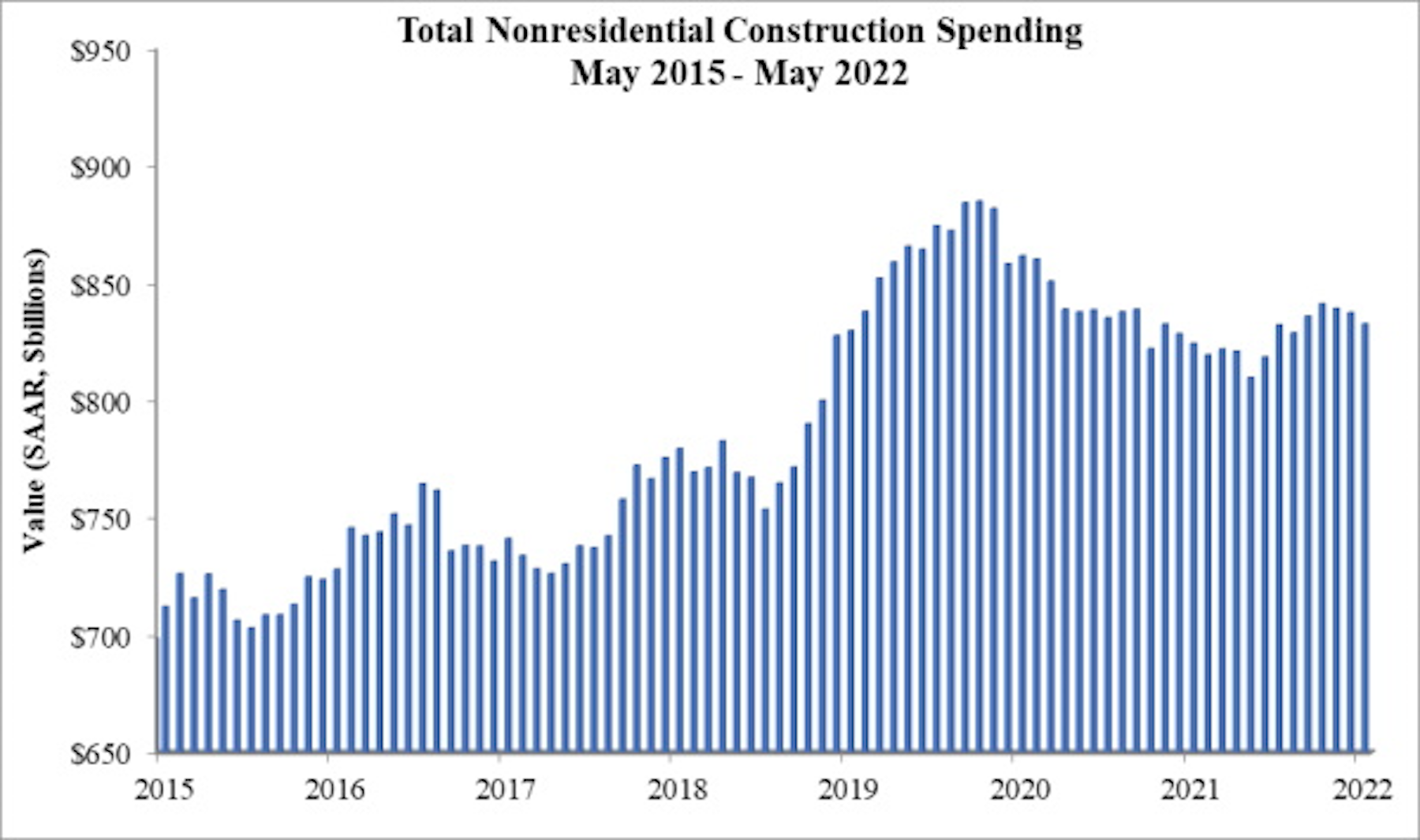

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $832.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.4%, while public nonresidential construction spending was down 0.8% in May. Nonresidential construction spending is up 1.0% over the past year, though spending is down in 10 of 16 categories over that span. The best performer is manufacturing, a segment in which construction spending is up 26.3% on a year-over-year basis.

“Many contractors continue to report that they are operating at capacity despite a lack of strong nonresidential construction spending recovery,” said ABC Chief Economist Anirban Basu. “That juxtaposition provides solid evidence that the supply side of the U.S. economy remains heavily constrained by worker shortages, domestic and global supply chain disruptions and resulting high prices.

“Since the early months of the pandemic, contractors have reported that they are able to pass along their cost increases to project owners, according to ABC’s Construction Confidence Index,” said Basu. “But there are growing concerns among industry leaders that the ability to pass along cost increases will dissipate during the months ahead as financial conditions tighten and confidence in economic performance wanes.

“A primary implication is that contractor margins may be squeezed going forward, and there is growing anecdotal evidence that this is already occurring,” said Basu. “There is also a growing risk of a significant number of project postponements in both private and public construction segments due to high materials prices and labor costs.

“The key to sustaining nonresidential construction’s recovery will be slower inflation,” said Basu. “As long as inflation remains elevated, monetary policy will continue to tighten and project owners will be less willing to move forward with projects in an effort to preserve cash. Unfortunately, ongoing efforts to limit inflation are likely to result in recession or at least further economic slowing, which will create additional issues for many contractors. However, less inflation and more favorable construction materials prices would create a foundation for renewed construction spending vigor.”

Related Stories

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.