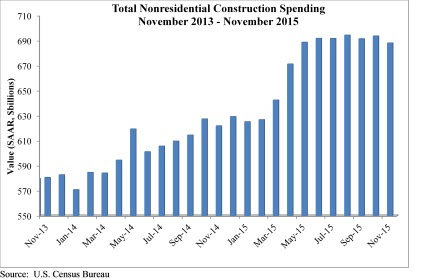

Spending for nonresidential construction, which had been on the uptick for most of 2015, stumbled in the latter months.

Related Stories

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.

Market Data | Aug 2, 2018

Nonresidential construction spending dips in June

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu.

Market Data | Aug 1, 2018

U.S. hotel construction pipeline continues moderate growth year-over-year

The hotel construction pipeline has been growing moderately and incrementally each quarter.

Market Data | Jul 30, 2018

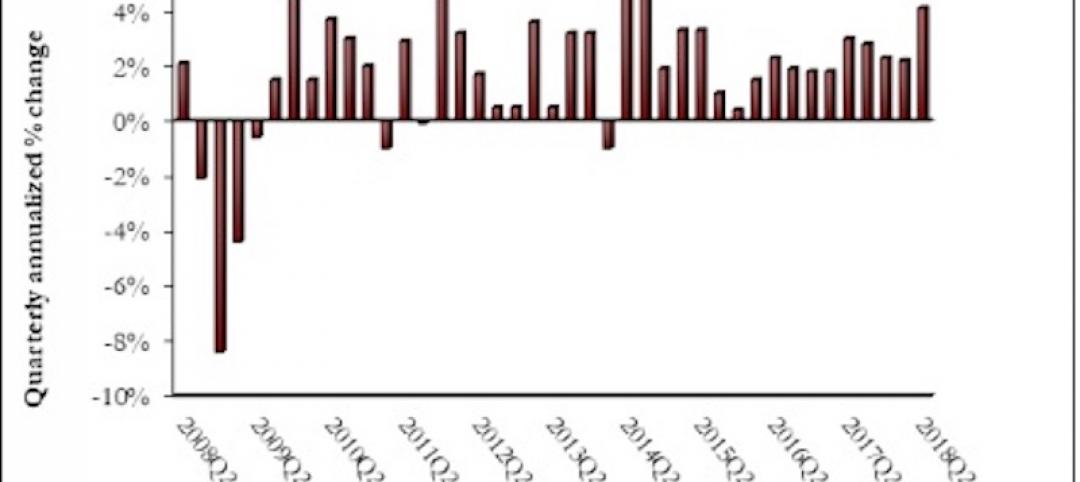

Nonresidential fixed investment surges in second quarter

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate.

Market Data | Jul 11, 2018

Construction material prices increase steadily in June

June represents the latest month associated with rapidly rising construction input prices.