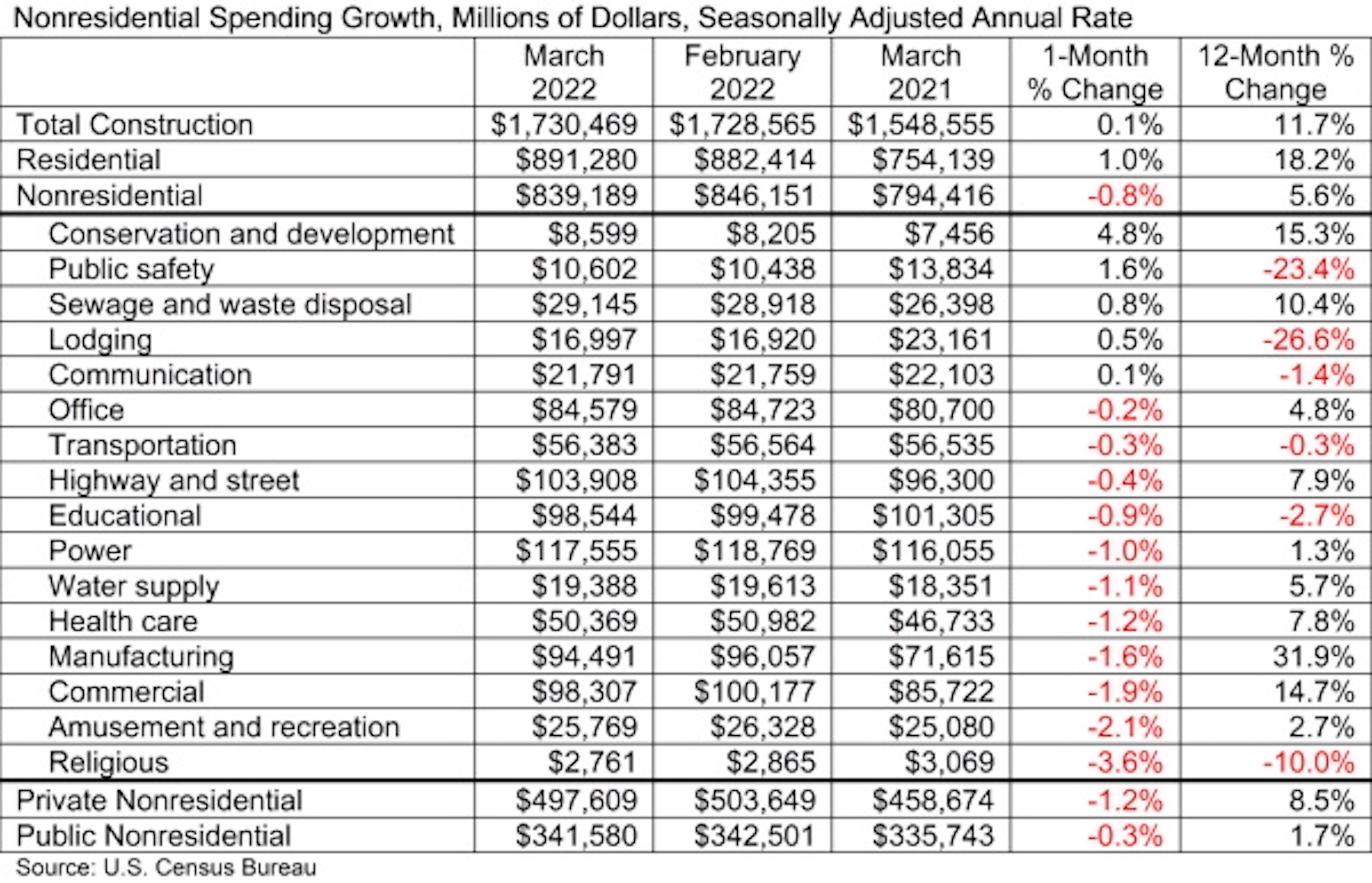

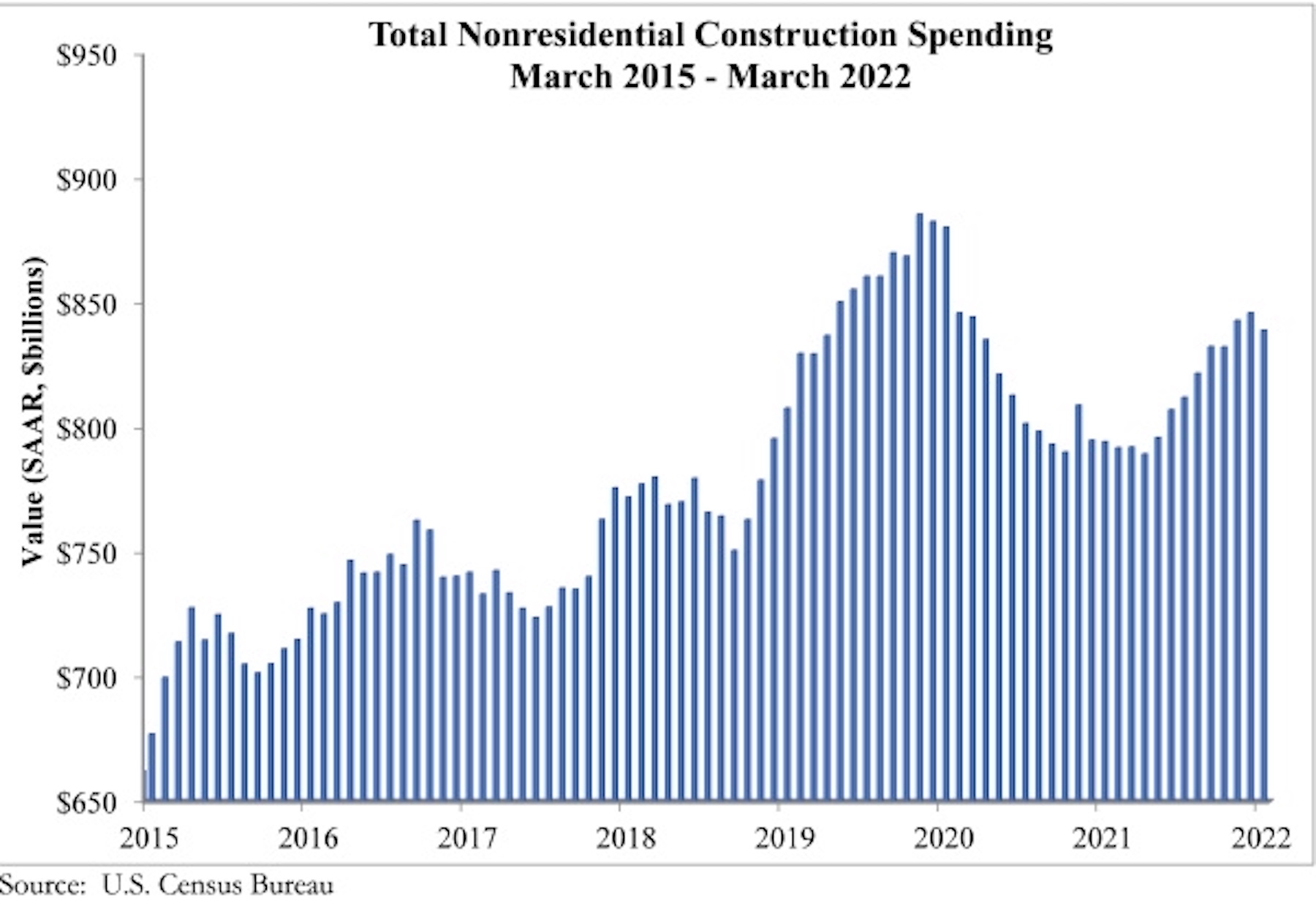

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $839.2 billion for the month.

Spending was down on a monthly basis in 11 of 16 nonresidential subcategories. Private nonresidential spending was down 1.2%, while public nonresidential construction spending was down 0.3% in March. On a year-over-year basis, nonresidential construction spending is up 5.6%, led by 31.9% growth in construction related to manufacturing.

“March’s construction spending numbers aren’t adjusted for inflation and are actually worse than they look,” said ABC Chief Economist Anirban Basu. “While overall construction spending rose 0.1% in March, largely because of the strength in multifamily residential construction, construction spending was down in real terms. Nonresidential construction performance declined because of weakness in segments like commercial (-1.9%) and amusement/recreation (-2.1%).

“Even though nonresidential construction spending levels are significantly short of what they were pre-pandemic, many contractors indicate that they are operating at capacity, according to ABC’s Construction Backlog Indicator,” said Basu. “This speaks to how challenging the economic environment is becoming, with contractors wrestling with workforce skills shortages and sky-high materials prices. The elevated cost of construction service delivery helps explain why more projects are not moving forward as project owners are forced to wait.

“Circumstances could become easier or more challenging for contractors during the months ahead,” said Basu. “The Federal Reserve’s stepped-up efforts to combat inflation will eventually translate into better pricing for key construction inputs. However, those same efforts will soften the economy. Many economists believe that a recession in America over the next 12 to 18 months has become virtually inevitable. Thus, even as delivering construction services becomes more affordable, demand for construction services, particularly private construction, may begin to fade.”

Related Stories

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.