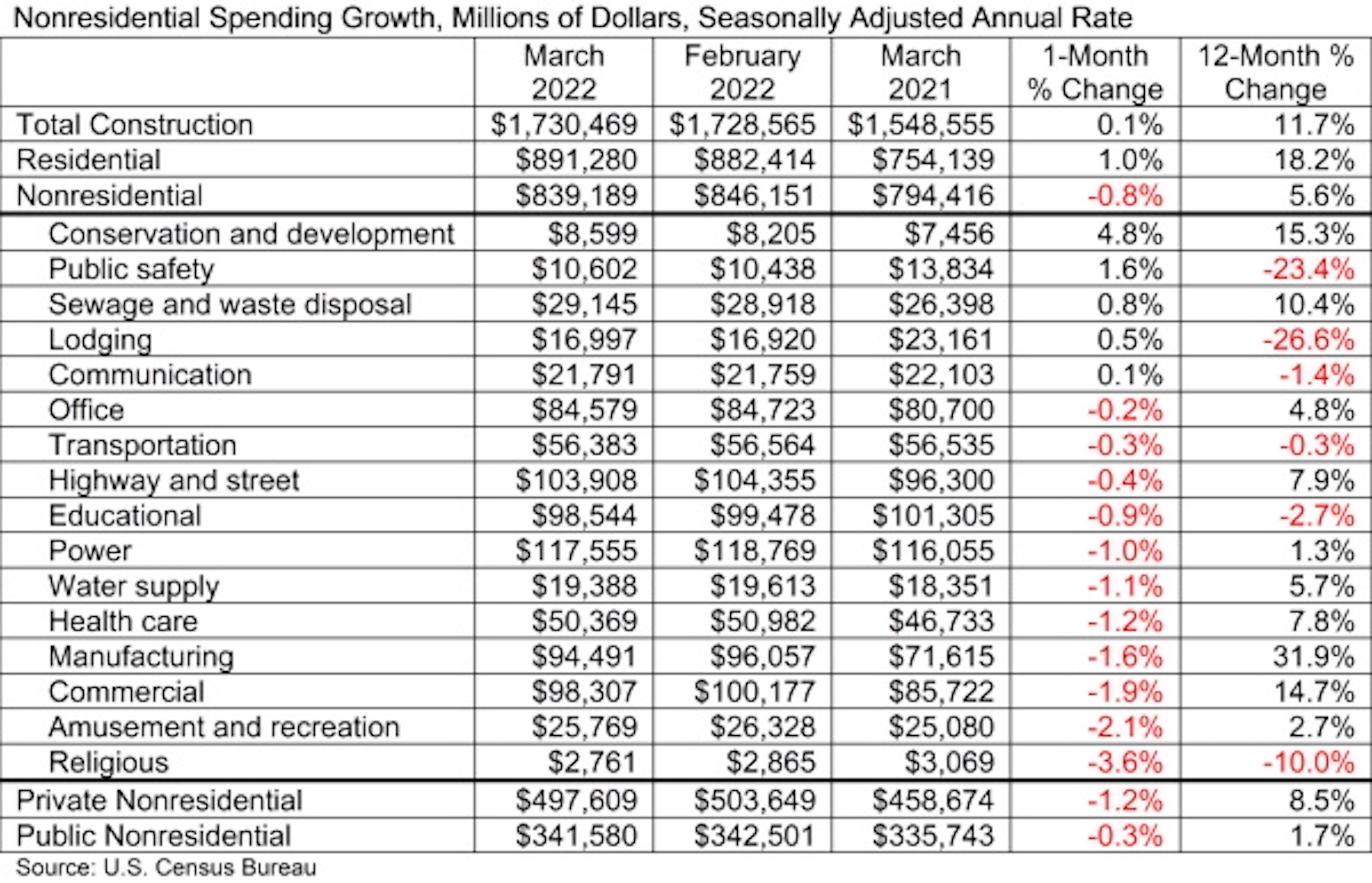

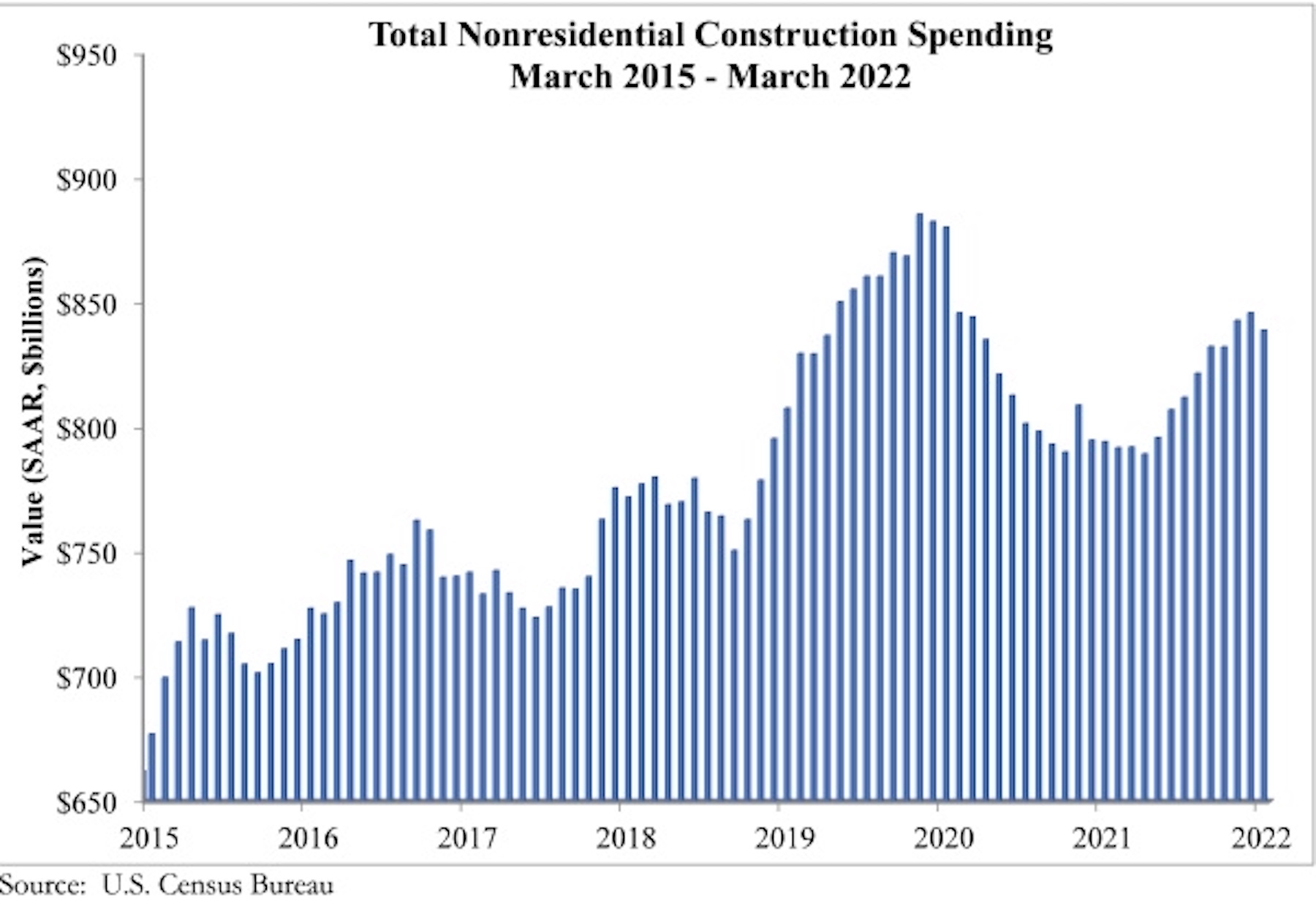

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $839.2 billion for the month.

Spending was down on a monthly basis in 11 of 16 nonresidential subcategories. Private nonresidential spending was down 1.2%, while public nonresidential construction spending was down 0.3% in March. On a year-over-year basis, nonresidential construction spending is up 5.6%, led by 31.9% growth in construction related to manufacturing.

“March’s construction spending numbers aren’t adjusted for inflation and are actually worse than they look,” said ABC Chief Economist Anirban Basu. “While overall construction spending rose 0.1% in March, largely because of the strength in multifamily residential construction, construction spending was down in real terms. Nonresidential construction performance declined because of weakness in segments like commercial (-1.9%) and amusement/recreation (-2.1%).

“Even though nonresidential construction spending levels are significantly short of what they were pre-pandemic, many contractors indicate that they are operating at capacity, according to ABC’s Construction Backlog Indicator,” said Basu. “This speaks to how challenging the economic environment is becoming, with contractors wrestling with workforce skills shortages and sky-high materials prices. The elevated cost of construction service delivery helps explain why more projects are not moving forward as project owners are forced to wait.

“Circumstances could become easier or more challenging for contractors during the months ahead,” said Basu. “The Federal Reserve’s stepped-up efforts to combat inflation will eventually translate into better pricing for key construction inputs. However, those same efforts will soften the economy. Many economists believe that a recession in America over the next 12 to 18 months has become virtually inevitable. Thus, even as delivering construction services becomes more affordable, demand for construction services, particularly private construction, may begin to fade.”

Related Stories

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.