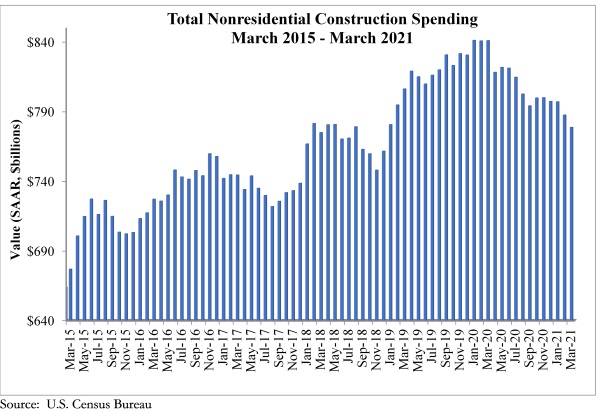

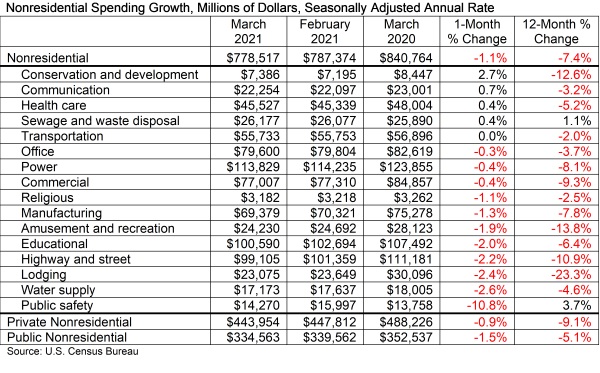

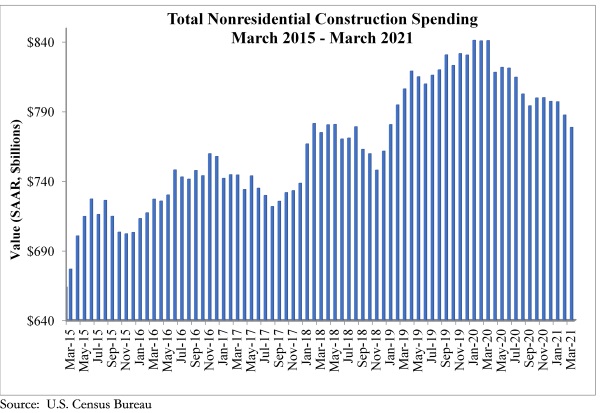

National nonresidential construction spending declined 1.1% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $778.5 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.9%, while public nonresidential construction spending fell 1.5% in March.

“While the longer-term outlook for nonresidential construction is superb, the pandemic is lingering, creating much damage to commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “The lodging, office and commercial segments experienced declines in spending in March. Office vacancy rates are elevated in many markets, and the industry experienced negative net absorption. The trials and tribulations of hotel operators, retailers and restauranteurs are also well known. Private nonresidential construction spending is down more than 9% from March 2020.

“Public construction spending was weak in March and is down more than 5% on a year-over-year basis,” said Basu. “While large-scale federal infrastructure outlays are likely in the future, that money has yet to arrive. State and local government finances have generally held up far better than many had predicted earlier in the COVID-19 crisis, but many governments have had to spend significant operational sums to countervail the public health crisis and therefore had to redirect money away from infrastructure.

“ABC’s Construction Backlog Indicator has foreshadowed this state of affairs for months,” said Basu. “The most recent readings suggest that the construction spending recovery will be slow over the near-term. However, as the broader economic recovery picks up additional speed later this year with more pervasive vaccinations and re-openings, both private and public construction spending should begin to manifest more positive momentum later this year and into 2022.”

Related Stories

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.