Numerous impediments to completing construction projects led to declines in most categories of private construction spending in March, according to an analysis by the Associated General Contractors of America of government data released today. Association officials warn that the Treasury Department’s threats to audit or prosecute some Paycheck Protection Program loan recipients and deny loan recipients tax deductions are making it harder for construction firms already coping with declining private-sector demand to retain staff.

“Unfortunately, these numbers are only the beginning of what seems sure to be a steep decline in construction spending as current projects finish and new work is canceled or postponed indefinitely,” said Ken Simonson, the association’s chief economist. “Our latest survey found that projects as far out as June or later were being canceled last month.”

The economist noted that 10 out of 11 private nonresidential construction categories in the Census Bureau’s monthly construction spending release declined from February to March. The only exception—communication construction—probably reflected increased demand for structures to accommodate the jump in video conferencing for business, educational and personal use, Simonson added.

“In addition to the downturn in private construction, public categories were mixed,” Simonson said. “For instance, highway and street construction spending increased by 4.6 percent, which probably reflected favorable weather and the ability of highway contractors to work longer hours on nearly-deserted roads. But other major public segments, including educational construction and transportation structures such as transit projects, declined. Further declines in public construction are likely as state and local governments struggle to balance their budgets in the face of unbudgeted expenses and steep, unanticipated revenue decreases.”

Association officials said that several recent announcements by the Treasury Department are causing significant confusion about, and potentially undermining, the Paycheck Protection Program loans. They noted that recent threats by the Treasury Department to audit, or possibly even prosecute, firms that qualified for the loans was causing many firms to reconsider using the funds to protect payrolls. They added that a new IRS decision to deny tax deductions for wages and business expenses to loan recipients was also counterproductive.

“The fact that the Treasury Department continues to move the goal posts on its Paycheck Protection Program guidance is hurting construction firms that are already coping with declining private-sector demand and the prospects of significantly reduced state and local funding,” said Stephen E. Sandherr, the association’s chief executive officer. “Without further clarification from the Treasury Department, some employers may just decide it is better to return their loans and cut staff than run the risk of audit and investigation.”

Related Stories

Industry Research | Apr 25, 2023

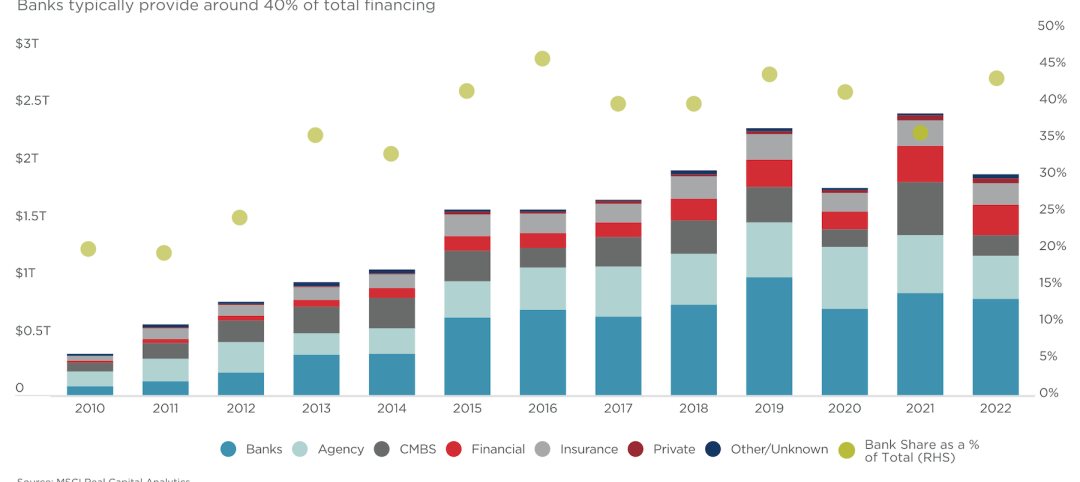

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

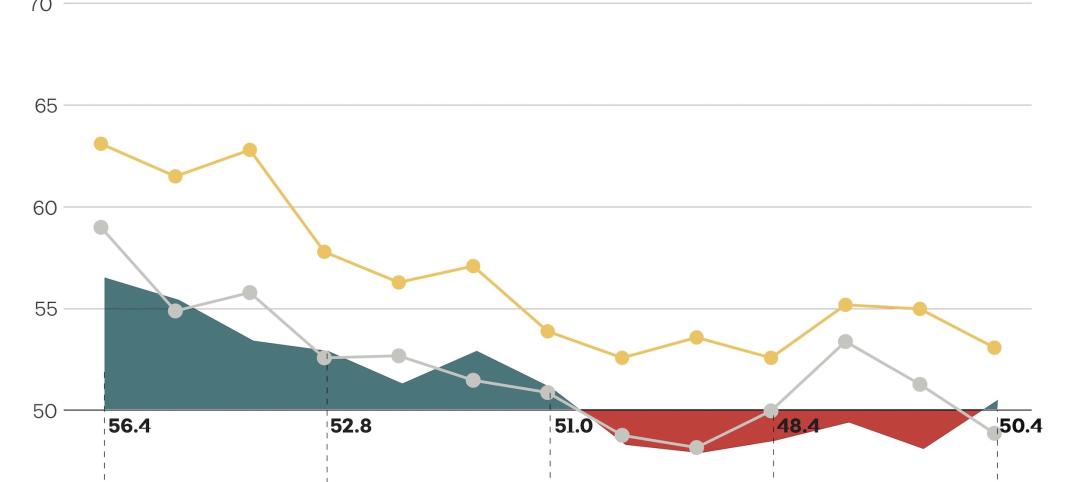

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

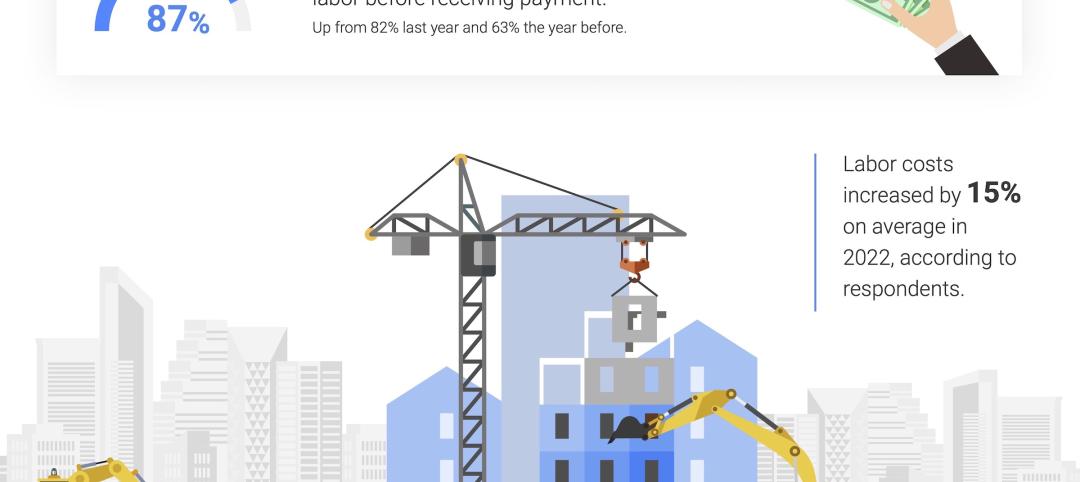

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

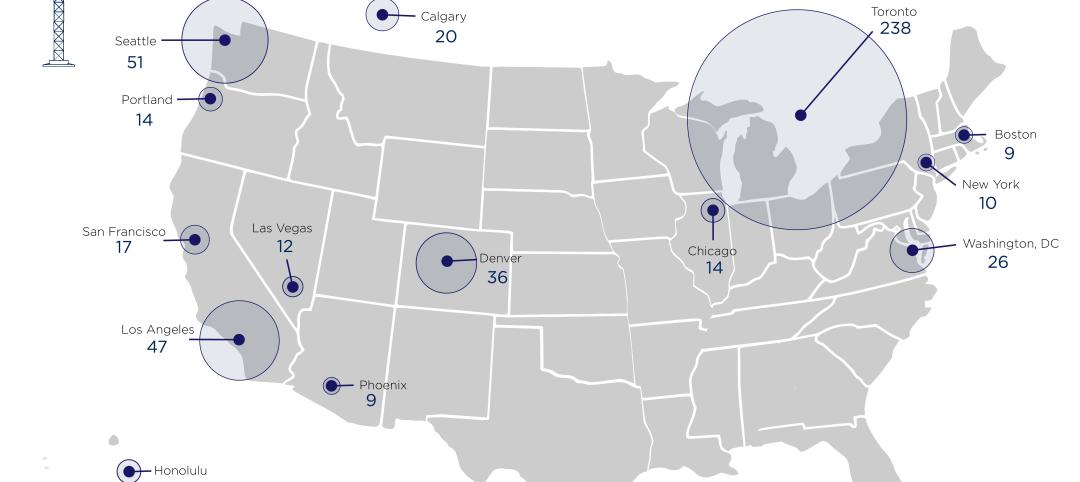

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.